Notícias e análises diárias

Victor Camargo

Company manager

“My interest in the financial market started in mid-2013. In 2016, I started to studying Forex, where I found the possibility of having a source of income and the opportunity to mature. Today, as a trader at Win Trade Markets, I seek consistency and professional and personal fulfillment.

March 04, 2021

Approaching the 1.20 region, the euro was trading in a slight dropthis Thursday, around 1.203, while investors monitor the slow pace invaccinations in Europe and the impact of this on the economy. With respect to economic data,retail sales to the Eurozone plunged 5.9% in January, the biggest dropsince April; expectations were for a 1.1% drop. In addition, PMI researchshowed that the Eurozone construction sector contracted sharply in Februaryfor the twelfth consecutive month.

In contrast, the DXY index was up, holding above the 91 region, supported byby the increase in treasury yields .

After testing its 9-month low in the previous session, in the USD region1701 an ounce, gold was consolidated in the USD 1710 region today.

In a very volatile session, Wall Street indices fluctuated between gains andlosses, while investors awaited any comment from the Fed chairmanwith respect to bond sell-off , inflation and the Fed’s next steps.

In Europe, the indices reversed recent losses to close almost unchanged.On the corporate side, Lufthansa reported lower than expected losses for thefourth quarter while Merck KgaA increased its dividends as its earnings andtheir sales grew.

The number of Americans applying for unemployment insurance has risen to 745,000in the week ending February 27. The previous week’s number has been revised to736 thousand, while expectations for this week were 750 thousand. The requestsremained at high levels as the United States economy struggles tosustain the recovery of the labor market amid the restrictions induced by thecoronavirus and the lack of fiscal support. In addition, about 437 thousand people requestedaid from the Pandemic Unemployment Assistance scheme, which coversworkers who do not qualify for initial orders, compared to 427 thousandin the previous period

March 03, 2021

On Wednesday, the euro was trading in a slight drop after testing the1,211 region. PMI data showed that the Eurozone private sector contractedless than initially thought.

In contrast, the DXY index approached the region of 91, with an increase in treasury yieldsamid prospects for a strong economic recovery supported by stimuliand quick vaccinations in the USA. President Joe Biden said the United States will havevaccines for all Americans by the end of May.

Falling more than 1%, gold was trading around USD 1715 an ounce inamid a stronger dollar and a new high in treasury yields .

Wall Street had mixed indexes today, with the Dow Jones up slightly, the S&P 500near its opening and the Nasdaq falling almost 2%. In Europe, the indexes closedmostly in green, with the DAX 30 rising by about 0.3%.

Private companies in the U.S. hired 117,000 workers in February 2021,well below expectations for an increase of 177 thousand, and after a revised gain of195 thousand in the previous month. The service sector created 131 thousand jobs,led by commerce, transport and public services (48 thousand); education and health (35 thousand);leisure and hospitality (26 thousand); professional and business (22 thousand); other services (3 thousand);while financial activities showed no change and theinformation lost 3,000 jobs. The goods production sector eliminated 14 thousandjobs, due to manufacturing (-14 thousand) and construction (-3 thousand), while resourcesnatural resources and mining added 3 thousand.

The ISM Services PMI for the US dropped to 55.3 in February 2021 from 58.7 in January,below forecasts of 58.7. The reading pointed to the lowest growth in theservices since a contraction in May, amid supply restrictions and lower pricestall. A slowdown was seen in supplier deliveries (60.8 vs 57.8),commercial / production activity (55.5 vs 59.9), new orders (51.9 vs 61.8) and employment(52.7 vs 55.2), while price pressures intensified (71.8 vs 64.2). For anotherOn the other hand, export orders (57.6 vs 47) and inventories (58.9 vs 49.2) recovered

March 02, 2021

At the start of this Tuesday’s session, the euro extended its losses towards the level of1.20 and was trading near its lowest level since November, afterthat German retail sales data showed a decline for the second monthconsecutive and at a faster pace. In addition, the number of unemployed in theGermany and Spain grew in February amid quarantine measures. THEcommon currency, however, reversed the losses to be traded up more than 0.2%,close to 1.208.

In contrast, the DXY index was holding in the 91 region, before reversing thegains to be traded around 90.8 or -0.25%.

After reaching its lowest point in 8 months in the region of USD 1707 an ounce, thegold reversed losses and was trading at a 0.7% high, around USD1730, ending a sequence of 5 days of fall. The metal was under pressure in thelast days with the increase in bond yields which was seen as a sign of optimismeconomic. However, signs that the Fed should maintain its monetary policyextremely loose in the near future they supported gold.

After the expressive gains in the previous session, the Wall Street indices were infall on Tuesday, with technology stocks like Apple, Microsoft, and Tesla among thewith worst performance. Meanwhile, treasury yields were practicallyunchanged and remaining well below its highest point in a year reached inlast week.

In Europe, the DAX 30 closed up 0.2%, at its highest in two weeks;other important indices closed mixed, while investors are concernedwith bubbles in the global market and weak economic data from Germany. The President of theChina’s Banking and Insurance Regulatory Commission, Guo Shuqing, said thatFinancial markets in Europe, the USA and other developed countries are invery high levels and “seriously diverging” from the real economic situation.

The IBD / TIPP Economic Optimism Index in the USA rose 3.5 points to 55.4 inMarch 2021, the largest since February 2020 before quarantine measures byCovid-19 account. The six-month outlook for the US economy has increased from49.5 to 53.2, returning to positive territory for the first time since October 2020.In addition, the personal finance sub-index, a measure of how Americans feelfeel about their own finances in the next six months, rose from 56.5 to 58 and thesub-index of federal policies jumped 10.5%, from 49.7 to 54.9.

Eurozone consumer price inflation is expected to continuestable at 0.9% compared to the previous year in February 2021, unchanged fromto the 11-month high of the previous month and in line with expectations, showed apreliminary estimate. Energy prices are expected to fall at a slower pace (-1.7% vs-4.2% in January), while a slowdown in inflation was probably registeredfor services (1.2% vs 1.4%), non-energy industrial goods (1.0% vs 1.5%) and

March 01, 2021

On Monday, the euro was little changed earlier in the session, while investors awaited speeches by several ECB members, including the president Lagarde.

The DXY index recovered recent losses to be traded at a slight high in the region 91, while investors assimilate the drop in treasury yields and maintain their hopes for a rapid economic recovery, supported by fiscal stimulus. THE US House of Representatives approved coronavirus aid package Joe Biden at USD 1.9 trillion that includes checks of USD 1400 for most North Americans. Now, the bill goes to the Senate

Recovering slightly, gold was trading higher in the USD region 1745 an ounce. The metal is being benefited by a reduction in the strength of the dollar and by prospects that the US aid package will be approved, now that the project passed to the Senate.

Wall Street started the month of March in the positive with its main indexes skyrocketing more than 2% each. In Europe, the indexes were also in the green, with the DAX 30 gaining 1.4% and other important indexes between 1.5% and 1.7%. Concerning pandemic, more than 20 million people in the UK have already received their first doses of vaccine, while the US expects deliveries of single-dose vaccines from Johnson & Johnson start on Tuesday.

ISM Manufacturing PMI jumped to 60.8 in February 2021 from 58.7 in January, exceeding expectations of 58.8. The reading pointed to the strongest expansion in the manufacturing activity since February 2018. New orders (64.8 vs 61.1), production (63.2 vs 60.7), employment (54.4 vs 52.6) and new export orders (57.2 vs 54.9) increased at a faster pace. In addition, supplier deliveries decreased (72 against 68.2) and the increase in prices intensified (86 against 82.1, the highest since July 2008). “The members of the Research Committee reported that their companies and suppliers continue to operate in reconfigured factories. Problems with absenteeism, short-term stoppages to sanitize facilities and difficulties in hiring workers continue to be challenges and continue to cause tensions that limit manufacturing growth potential, “said Timothy R. Fiore, president of the ISM.

February 25, 2021

This Thursday, the euro returned above the 1.22 mark for the first time since 12 January supported by Germany’s Consumer Climate and GDP data better than than expected. Investors are also optimistic about the end of quarantine and the reopening of economies, but as concerns about the delay in the vaccinations continue.

In contrast, the DXY index returned below the 90 level, trading around 89.85 or -0.35%, with expectations of a major fiscal stimulus in the USA and a tone dovish by the Fed chairman raising the risk appetite.

Also falling, gold was trading below USD 1800 an ounce, extending its losses for the third consecutive session, pressured by the rise in treasury yields and prospects for a rapid economic recovery. However, the weak dollar held back a steeper drop in metal prices.

Wall Street indices were in sharp decline, driven mainly by stocks in the technology sector. The Dow Jones was down 1%; the 1.4% S&P 500 and the 2.2% Nasdaq.

In Europe, the indices reversed recent gains to close in negative territory this Thursday, with the DAX 30 leading the losses due to the sharp drop in the shares of Bayer after the drugmaker recorded a 78% drop in profits.

The US economy grew 4.1% in the fourth quarter of 2020, slightly above the anticipated growth of 4%. Still, the economy slowed a record 33.4% expansion in the third quarter, as the increase COVID-19 cases and activity restrictions moderated consumer. Considering the total for 2020, the American GDP contracted 3.5%, the same as anticipated estimate and the worst performance since 1946. The prospects for 2021 seem more encouraging than a few months ago, as the implementation of vaccination started – albeit at a slower pace than expected – and also because of the new Biden government that revealed a USD 1.9 trillion stimulus plan. However, the package has not yet been approved and current unemployment insurance benefits expire in 14th March.

The number of Americans who applied for unemployment insurance decrease from 111 thousand to 730 thousand in the week ended on February 20, the lowest number in three months; expectations were 838 thousand. It was the biggest weekly decline since the late August, with California and Ohio reporting the biggest declines as Covid-19 infections decrease and the rate of vaccinations accelerates. Even so, remained elevated in general amid the restrictions induced by the coronavirus and the lack of fiscal support. In addition, about 451 thousand people requested help from the Pandemic Unemployment Assistance, which covers workers who are not qualify for initial orders, compared to 513,000 in the previous period.

February 19, 2021

On yet another bullish day, the euro remained above the 1.21 region on Friday, while the DXY index extended its losses for the second consecutive session, reaching its lowest level in almost four weeks, below 90.3.

After testing its lowest level more than seven months earlier (USD 1759), the gold recovered today and was trading around USD 1780 an ounce, supported by for a weaker dollar. However, the metal is expected to register a weekly drop of more than two%.

Wall Street had its main indices up slightly, while investors monitor the high in treasury yields and after Treasury Secretary Yellen said that a large stimulus package is necessary. In the corporate part, shares of Applied Materials jumped 7% after the company said it expects strong results this quarter.

In Europe, indices closed slightly higher, with DAX 30 rising 0.7% and ending a sequence of three fall sessions. On the corporate side, Renault recorded its worst annual loss in history in 2020, while Allianz’s profits fell less than expected and Danone warned of a difficult first quarter. At week, the index fell by 0.4%.

The IHS Markit US Manufacturing PMI dropped to 58.5 in February 2021, from 59.2 in January, in line with expectations. Although production expansions and new orders have declined, growth rates remain high overall, as manufacturers saw stronger customer demand. New requests for exports also increased. However, the interruption of the supply chain it remained apparent as the delivery times of the suppliers lengthened. Longer delivery times have also led to declines in purchasing stocks and finished products. As a result, cost burdens have increased. The inflation rate input costs was the most pronounced since April 2011 and product inflation had the fastest pace since July 2008. The rate of job creation was the highest since December 2017. Finally, product expectations improved and were the highest since November 2020.

February 17, 2021

On Thursday, the euro extended gains towards the 1.21 level. As minutes of ECB monetary policy meeting held that officials agree that the Global information is at a very low level, remaining far from the bank’s target central bank, while the appreciation of the common currency poses a risk to monetary restatement. In addition, as concerns about the slow pace of vaccinations and the impact of that on the economy increases.

In contrast, the DXY index was down, trading around 90.5, moving away from the 91 level. Investors now await progress on the relief package against the pandemic.

Still under pressure, gold was slightly falling, being traded around its lowest level in 3 months, in the region of USD 1780 an ounce, pressured by expectations of a stronger and faster global economic recovery. On the other hand, signs that the Fed should let its monetary policy loose in the near future have encouraged metal buyers.

Wall Street indices sank today, with the Dow Jones falling more than 200 points, pulled by weak unemployment insurance claim data. In the corporate part, the Big tech stocks were among the worst performers. In addition, Walmart were down more than 5% after earnings reports came below expectations and the company reported that its sales will be moderate this year. The S&P 500 and Nasdaq were down 0.8% and 1% respectively

Wall Street indices sank today, with the Dow Jones falling more than 200 points, pulled by weak unemployment insurance claim data. In the corporate part, the Big tech stocks were among the worst performers. In addition, Walmart were down more than 5% after earnings reports came below expectations and the company reported that its sales will be moderate this year. The S&P 500 and Nasdaq were down 0.8% and 1% respectively

The number of Americans who applied for unemployment insurance rose to 861 thousand in the week ended February 13, compared to the revised number of the week previous 848 thousand; expectations were 765 thousand. It was the second consecutive increase amid the lack of fiscal support and restrictions related to COVID-19, which still weigh on companies in some states. In addition, about 516 thousand people requested help from the Pandemic Unemployment Assistance scheme, which workers who do not qualify for initial orders, compared to 342 thousand in the period previous.

February 16, 2021

The euro was trading higher earlier in Tuesday’s session in the region 1,215, its highest level since January 26, but reversed the gains to be traded down 0.17%, close to 1,211.

Still under pressure, the DXY index was falling, remaining close to 90.5, while the risk appetite increases.

Extending losses, gold was trading below USD 1800 an ounce, while investors are more optimistic about vaccination plans in the and fiscal stimuli to support the global economic recovery.

On its first trading day this week, the Wall Street indices started trading session, with the 3 main indexes renewing record highs, while the optimism over the global economic recovery remains high. Democrats of Chamber should refocus on the USD 1.9 trillion stimulus plan, as The benefits of the latest pandemic aid are due to expire on 14 March. this, earnings reports from hotels, cruise lines and other companies heavily impacted by coronavirus, including Norwegian Cruise Lines, Marriott and TripAdvisor should be released this week. The minutes of the FOMC to be released on Wednesday.

On its first trading day this week, the Wall Street indices started trading session, with the 3 main indexes renewing record highs, while the optimism over the global economic recovery remains high. Democrats of Chamber should refocus on the USD 1.9 trillion stimulus plan, as The benefits of the latest pandemic aid are due to expire on 14 March. this, earnings reports from hotels, cruise lines and other companies heavily impacted by coronavirus, including Norwegian Cruise Lines, Marriott and TripAdvisor should be released this week. The minutes of the FOMC to be released on Wednesday.

The eurozone economy shrank 0.6% in the last quarter of 2020, less than an initial drop estimate of 0.7%, amid quarantine measures on account of the pandemic. The most recent reading followed a record expansion of 12.4% in the third quarter and an unprecedented contraction of 11.7% in the second quarter due to the crisis COVID-19. Among the largest economies in the bloc, France, Italy and the Netherlands contracted in the fourth quarter, while GDP growth in Germany and Spain decelerated sharply. In the annual comparison, GDP shrank by 5.0%.

The eurozone economy shrank 0.6% in the last quarter of 2020, less than an initial drop estimate of 0.7%, amid quarantine measures on account of the pandemic. The most recent reading followed a record expansion of 12.4% in the third quarter and an unprecedented contraction of 11.7% in the second quarter due to the crisis COVID-19. Among the largest economies in the bloc, France, Italy and the Netherlands contracted in the fourth quarter, while GDP growth in Germany and Spain decelerated sharply. In the annual comparison, GDP shrank by 5.0%.

February 10, 2021

This Wednesday, the euro tested its highest point since February 1st, in the region of 1.214, before cutting some earnings gains to be traded close to your trading point opening. The sentiment has been supported by an optimism about vaccination and a rapid economic recovery in 2021. At the same time, economic data from the Germany confirms that the consumer price information rate has jumped 1% in January, recovering from a six-month period of deflation or readings stable.

In contrast, the DXY index extended its losses to test the region by 90.2 by first time in two weeks, after the release of data on inflation and falling prices treasury yields. In addition, Biden and his Democratic-controlled Congress must launch massive spending plans that include additional checks of USD 1,400 to the majority of Americans and a temporary increase in unemployment benefits.

Extending gains, gold was trading above the USD 1850 level at ounce, supported mainly by the weakness of the dollar. However, the metal is under pressure since the beginning of the year due to the optimism surrounding the vaccination against coronavirus

US indices fell from their record highs as investors assimilate the country’s inflation data. Meanwhile, earnings from Cisco, Lyft, Mattel, Twitter, Coca-Cola, Under Armor and General Motors were better than expected; THE Uber is expected to release its balance sheets today.

In Europe, indexes closed down today, with the DAX 30 falling 0.6%, as it is Germany is expected to announce an extension of its quarantine measures until the end of March 14th. On the corporate side, Societe Generale’s profits exceeded those of forecasts and Thyssenkrupp increased its flow and profit prospects for the year; on the other hand, Heineken announced that it intends to cut 8,000 jobs due to lower sales.

The annual inflation rate in the USA was stable at 1.4% in January 2021, the same as at December and slightly below expectations of 1.5%. The main upward pressures came from food (3.8%), used cars and trucks (10%), gas (4.3%), health care services (2.9%), shelter (1.6%), electricity (1.5%) and new vehicles (1.4%). Meanwhile, clothing prices fell 2.5% and the cost of energy fell 3.6%, mainly due to gasoline (-8.6%).

Federal Reserve President Jerome Powell stressed the importance of maintaining current monetary policy to support the fragile US labor market. In comments prepared for the New York Economic Club on Wednesday, Powell warned that bringing the economy to full employment will not be an easy task and will require more than a dovish policy to achieve it. Meanwhile, the Fed chairman downplayed concerns that Biden’s huge fiscal stimulus plan might trigger undesirable inflation. The Federal Reserve left the target range for its federal funds rate unchanged at 0-0.25% and maintained its program to purchase titles intact during its first 2021 meeting.

February 09, 2021

EIA’s short-term energy outlook for the US at 9 am; job offers JOLTs to the US at 12:00. At 06:10, EURUSD 0.38% and DXY -0.35%; EUR 67%, USD 14%. 93% ATR, with an increase projection of 1.2108 and a reduction projection of 1.2042. POC in 1,20785. Strong buying trend, breaking DR2 level. High channel. Bollinger com 370 points. Overbought in H1.

At 18:01, EURUSD 0.54% and DXY -0.52%; EUR 51%, USD 17%. ATR by 117%. POC in 1.20695. Delta accumulated at +650.

February 08, 2021

On Monday, the euro was trading lower earlier in the session, while the demand for the dollar recovered due to the increase in hopes of a faster economic recovery in the USA, supported by the fiscal stimulus of the President Joe Biden, worth $ 1.9 trillion. With regard to economic data, the Germany’s industrial production stagnated in December 2020, below conversion of a gain of 0.3% MoM.

The DXY index was up slightly, being traded in the region of 91.2, but staying away from its peak in two months reached last week. The US economy performed better overall compared to other important G10 economies, which was of great importance for the dollar’s strength in the last month. In addition, the rise in US treasury yields also supported the currency. Still, the medium to long term outlook for the dollar remains bearish due to the risks posed by record debt levels.

After recovering from the test of its lowest point in two months in the region of USD 1784, gold was above the level of USD 1800 an ounce. Metal has been pressured by expectations of a stronger economic recovery due to the vaccinations and more government spending.

The three main Wall Street indices renewed record highs today, supported by hope for a new fiscal stimulus package in the US. Yellen, asked for a quick approval of the USD 1.9 trillion plan and said that the country’s labor market could fully recover in 2022 if Congress acts quickly. In addition House Speaker Nancy Pelosi said on Friday that the House plans to approve the project within two weeks. Meanwhile, the swing season continues with results from Cisco, DuPont, Twitter, Uber and Coca-Cola being released during the week.

In Europe, indices were also up, with the DAX 30 closing close to its record high in 14060, while other important indices rose from 0.1% to 1.5%, supported by the US stimulus package and reduced political uncertainties in Italy.

February 05, 2021

Earlier, awaiting the payroll data, the euro was little changed in the region of 1.20, after testing its lowest point since December 1st and on the way to register a weekly decline of 1%.

After disclosure of the payroll data, the DXY index extended its losses to be traded around 91.2. Anyway, the dollar is on its way to its biggest weekly gain since October, 0.8%

Recovering recent losses, gold returned above the region of USD 1800 an ounce this Friday, supported by a weaker dollar. Metal, however, is on the way to a weekly drop of 2%.

Wall Street indices were up, with the S&P 500 and Nasdaq extending their records from the previous session after weak payroll data raised hopes that the new stimulus is approved more quickly. In the corporate part, earnings from Gilead Sciences and Ford released after the close of the previous session were better than expected.

In Europe, indices were up slightly extending earnings from 4 sessions consecutive. Johnson & Johnson has officially asked the US FDA for authorization to use emergency treatment of your single dose coronavirus vaccine and should, within the coming weeks, also ask t

Divergent from ADP, payroll data released today showed that the US created 49 thousand new job openings in January 2021; expectations were for an increase 50 thousand. In January, notable job gains in professional services and business and public and private education were offset by losses in leisure and hospitality, retail, health and transportation and storage. At the However, it is a small gain that leaves the economy with around 10 million jobs below the peak in February 2020

The US unemployment rate in January 2021 fell to 6.3%, down 0.4% from compared to the previous month and well below expectations of 6.7%, since the number of unemployed people dropped to 10.1 million. Although both measures have been much lower than their April 2020 highs, remained well above pre-pandemic levels in February 2020 (3.5% and 5.7 million, respectively).

February 04, 2021

Initial claims for unemployment insurance in the US at 10:30. At 05:25, EURUSD -0.33% and 0.21% DXY; EUR 31%, USD 61%. 92% ATR, with a projection of up to 1.2047 and a projection down 1.1997. POC at 1.20385. Strong Selling Trend. Downtown channel. Bollinger com 146 points. Stoch below 20 in D1.

At 16:08, EURUSD -0.61% and DXY 0.40%; EUR 31%, USD 69%. ATR by 141%. POC in 1.199865. Delta accumulated at +2180.

On the eve of a payroll, the euro was trading below the 1.20 region by the first time since December 1st. Data from the Markit PMI survey showed that the construction sector in the Eurozone had the most accelerated contraction since January May of last year

In turn, the DXY index gained strength again, reaching the region of 91.5, its level highest since 30 November, after ADP data showed a strong recovery in the private employment sector and the ISM Services PMI outperformed estimates. For tomorrow, it is estimated that the USA has created 50 thousand jobs in January. In addition, the US economy managed to register growth in the fourth quarter quarter.

Trading below the level of USD 1800 an ounce for the first time in two months, gold prices were falling sharply. Positive economic data for USA combined with advances in vaccinations and more government spending hopes for a stronger and faster economic recovery have increased.

The top three Wall Street indices were up with the S&P 500 and Nasdaq approaching its historic highs supported by signs of a recovery in the North American labor market. In addition, earnings from eBay, PayPal, Philip Morris and Becton, Dicknson and Company were better than expected; for another hand, Qualcomm’s revenues disappointed

Extending gains for the fourth consecutive session, European indices were in high, with the DAX 30 adding more than 120 points or 0.9% and closing at a maximum supported by the announcement of stimulus measures in Germany to help families and companies. In the corporate part, the German Bayer company jumped more than 4%, while Deutsche Bank had better than expected results.

The number of Americans who filed for unemployment insurance dropped to 779 thousand in the week ended January 30, compared to the revised number from the previous week 812 thousand; expectations were 830 thousand. It was the third consecutive week of decline on orders and the lowest number since the last week of November; still, very above pre-pandemic levels and are likely to remain elevated for some time, although vaccination has already started. In addition, about 349 thousand people asked for help from the Pandemic Unemployment Assistance scheme, which covers workers who do not qualify for initial orders, compared to with 404 thousand in the previous period.

February 03, 2021

Extending the losses, the euro was in a slight fall this Wednesday, being negotiated below 1,203, with concerns about the pandemic still hurting the currency.

Also falling, but lower than the euro, the DXY index remains above the level of 91, slightly backing from the 91.3 test. On Tuesday, the Senate voted with result 50-49 to start the debate that could allow Democrats to approve the package USD 1.9 trillion.

Consolidated at around USD 1840 an ounce, gold recovers after testing its level lower in two weeks in the previous session, supported by the slowdown in the dollar’s strength.

While investors await earnings reports from Amazon, Alphabet and Amgen, Wall Street indices were up sharply, with the Dow Jones rising more than 500 points, while the S&P 500 and Nasdaq about 1.5% each. Meanwhile, better-than-expected Exxon results surprised, while Pfizer disappointed.

The Nasdaq and S&P 500 indices fluctuated between gains and losses, while the Dow Jones it was falling. Amazon’s earnings nearly doubled compared to expectations, however, Jeff Bezos announced that he would step down as CEO of the company. The Alphabet’s results were also surprising. The retail traders frenzy also continues to cool and GameStop shares recorded their biggest daily loss in history, losing more than USD 27 billion in market value. In addition, the secretary of the US Treasury asked several regulators, including the Fed, to discuss the recent volatility in the financial market.

In Europe, the indices closed, mostly, upwards, with the DAX 30 rising about 0.6%, supported by better-than-expected corporate data and hopes for a better faster economic recovery, as vaccination in Europe appears to be increasing your pace. In addition, French and Eurozone PMI data has been revised upwards, while Germany came in a slight drop.

The ISM Services PMI for the US increased to 58.7 in January 2021 from 57.7 in December; expectations were 56.8. The reading pointed to the strongest expansion in the service sector since February 2019. New orders increased more rapidly (61.8 vs 58.6) and employment recovered (55.2 vs 48.7). On the other hand, the production (59.9 vs 60.5) and suppliers’ deliveries (57.8 vs 62.8) decreased and inventories (49.2 vs 58.2) and new export orders (47 vs 57.3) returned to contract. Price pressures remained high (64.2 vs 64.4). “The respondents’ comments are more optimistic about business conditions and the economy. Several local and state restrictions on account of COVID-19 continue to negatively impact companies and sectors. Production capacity and logistics problems continue to cause challenges in the supply chain, “he said. Anthony Nieves, Chairman of the ISM Services Business Research Committee.

Private companies in the U.S. hired 174,000 workers in January 2021, easily exceeding expectations for an increase of 49 thousand, and recovering from a 78 thousand decline in the previous month. The service sector created 156 thousand jobs, led by education and health (54 thousand); professional and business (40 thousand); leisure and hospitality (35 thousand) commerce, transport and public services (16 thousand); others services (10 thousand); and financial activities (1 thousand). On the other hand, the information sector lost 2 thousand jobs. The goods production sector added 19 thousand jobs, due to construction (18 thousand) and manufacturing (1 thousand), while natural resources and mining they did not hire or fire people. Private payrolls in companies medium-sized companies increased by 84 thousand, small companies by 51 thousand and large 39 thousand.

February 02, 2021

On this Tuesday, the euro extended its losses to reach its lowest level in 8 weeks, in the region of 1.2053, amid growing concerns regarding the Eurozone economy and other consequences of the pandemic

In contrast, the DXY index broke through the resistance at 91, returning to levels seen by the last time in December. The strength of the dollar is greater against the euro, as the EU remains having problems with vaccinations. Still, the outlook remains bearish for the currency.

After testing the region at USD 1871.5 an ounce in the previous session, gold was being traded lower, below USD 1840, as risk appetite improved a little because of hopes of fiscal stimulus in the US and more vaccination fast. In January, metal had its worst month in a decade, registering a fall of almost 3%

While investors await earnings reports from Amazon, Alphabet and Amgen, Wall Street indices were up sharply, with the Dow Jones rising more than 500 points, while the S&P 500 and Nasdaq about 1.5% each. Meanwhile, better-than-expected Exxon results surprised, while Pfizer disappointed.

In Europe, indices were also up, with the DAX 30 rising more than 1% supported by optimism about the stimulus package in the US and that more vaccine doses will be available soon. Other important indexes also were up more than 1%.

After a record growth of 12.4% in the third quarter, the economy of the Euro recorded a shrinkage of 0.7% in the last quarter of 2020, but a little better than expected, -1%. The contraction was due to the restriction measures for contain the spread of COVID-19, according to preliminary estimates. Among the largest bloc economies, Italy contracted 2% and France 1.3%, while Germany (0.1%) and Spain (0.4%) managed to avoid contraction. However, the prospects for first quarter of 2021 are not encouraging, as many countries have strengthened their restrictions and imposed new quarantine measures. Considering the 2020 total, the Eurozone’s economy shrank 6.8%.

January 29, 2021

That Friday, the DXY index was up, before reverting close to the important resistance level in the region of 91. The recovery of the dollar occurred mainly in the first half of January with a significant increase in treasury yields, which encouraged investors to buy a currency. In addition, important concerns about pandemic, amid a slow pace in vaccinations and high numbers of new cases, coronavirus hospitalizations and deaths, has generated an appeal for safer assets. In anyway, a long-term outlook for the dollar to stabilize bearish on account record debt levels.

Despite trading high on the day, gold is on track to record its worst January since 2011, with a drop of 1.5% for the region of USD 1860 an ounce

In a very volatile week, the North American indices were falling today, already that a speculative retail trade movement is setting off alarms from a possible bubble in the technology sector and investors fear huge losses in investment funds hedge as a consequence. Meanwhile, the swing season continues with Caterpillar, Eli Lily and Honeywell having better than expected results; for another On the other hand, Chevron’s results were disappointing. Visa, Western Digital and Skyworks Solutions also surprised with positive reports released yesterday.

In Europe, stocks also closed down, with the DAX 30 plummeting more than 1.5%, reaching its lowest level since 22 December. The EU is, temporarily controlling exports of manufactured coronavirus vaccines in the block, which has generated an escalation in the dispute for access to millions of doses. On the other hand, the GDP figures for the fourth quarter were higher than expected for major economies, with Spain avoiding the recession and, in France, a fall smaller than expected.

In the USA, personal spending fell 0.2% MoM in December 2020, after a drop revised 0.7% in November; expectations were for a fall of 0.4%, since the increased coronavirus infections led to more business and activity restrictions, plus more job losses. The decreases in purchases of goods and services recreational vehicles, food and beverages, food services and hospitals were partially offset by an increase in expenses with motor vehicles and parts.

January 25, 2021

On this Monday, the euro was trading lower, in the region of 1.21, with investors still worried about the record numbers of new cases coronaviruses, hospitalizations and deaths, as well as travel restrictions, because Biden is expected to reinstate travel bans arriving in the country Europe and the UK.

In contrast, the DXY index was trading higher amid a drop in the risk appetite, reaching the region of 90.5, after reaching a two-week low early. The Merck laboratory has stopped its development of vaccines against coronavirus due to the low immune response, while both AstraZeneca / Oxford regarding Pfizer / BioNTech reported delays in their deliveries to Europe in the week last. On the other hand, renewed hopes for Joe Biden’s stimulus package limited earnings to the dollar.

Due to the prospects for fiscal stimulus in the USA, gold, used as protection against inflation, was trading higher in the USD 1860 region. also benefited from the rate of vaccination in the US that has been slower than expected.

In a week full of news of economic data, Fed monetary policy and report balance sheet, the Dow Jones was trading lower, while the S&P 500 reversed recent gains to also be traded in the red; Nasdaq retreated from its historic high reached today, but it was still being traded upwards. At corporate part, results from Apple, Microsoft, Facebook and Tesla to be released this week

In Europe, indices closed down, with DAX falling around 1.7%, after disappointing data from Germany’s business climate has raised concerns with the pandemic. Travel and leisure activities were among those with the worst performance, as new travel restrictions are expected from the US and UK, while in France, negotiations on a third quarantine take place.

The Ifo Business Climate indicator for Germany dropped to 90.1 in January 2021, from a revised 92.2 in the previous month and below expectations of 91.8. It is the most down in seven months, as companies have become less optimistic about their current conditions (89.2 vs 91.3) and expectations (91.1 vs 93). Many service providers services were affected by quarantine measures, including transport and logistics, and the retail has collapsed while the industry remains well positioned, said the Ifo economist, Wohlrabe. Economic uncertainty has grown and German GDP is stagnate in the first quarter, he added.

January 22, 2021

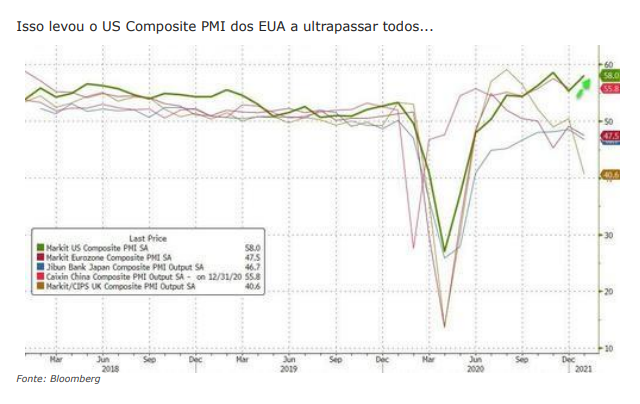

SERVICE AND MANUFACTURING PMI’S REPORT – USA

After a ‘mixed’ picture in December (services falling, but manufacturing up – due to the fallacy of interrupted supply chains being a sign of strength?), analysts had expected coordinated weakness in January’s preliminary data, recovering from the drop in “hard” economic data in the past three months. At the However, amid drastic blockades across the country and daily headlines about how bad is life in the United States, US Services and Manufacturing exploded in January

- Markit US Manufacturing PMI 59.1 vs 56.5 exp vs 57.1 previous – record!

- Markit US Services PMI 57.5 vs 53.4 exp vs 54.8 previous

All driven by high inflation:

Meanwhile, inflationary pressures have intensified as delays and shortages of suppliers have increased input prices. THE input cost inflation rate was the fastest ever recorded (since October 2009), since the growing transport costs and PPE. However, several companies have partially pass on higher cost burdens, as the pace charge inflation accelerated to a sharp rate. The impact was less pronounced in the service sector, since companies sought to increase sales, but manufacturers registered the sharpest increase in sales prices since July 2008.

The rate of input price inflation rose further in January, in higher transport costs and fixed assets. The rate of increase was the fastest ever recorded (since the beginning of data collection in October 2009)

However, the overall growth rate decreased compared to that observed in December, since service providers have indicated a slower expansion in new orders after an increase in virus cases and greater restrictions on operations commercial. Even so, the recovery among manufacturers accelerated and was the accentuated since September 2014.

Commenting on PMI data, Chris Williamson, Chief Business Economist at IHS Markit said:

“US companies reported a strong start in 2021, driven by hope that vaccine development means the worst of the pandemic is behind us and that the new administration will provide a stable and favorable environment for a stronger economic growth. Production growth accelerated in January the second fastest in almost six years, and business optimism in compared to next year increased. In the past three months, business sentiment reached its highest level since the beginning of 2015.

“However, capacity constraints are easing amid the outbreak of growth. In the past two months, the scarcity of supply has not only developed at a pace never seen before in the history of research, but the prices also rose due to the imbalance between supply and demand. Consequently, input cost inflation also hit research and exerted further upward pressure on average selling prices of goods and services.

“There was also disappointing news in the job market, as short-term concerns about the impact of the pandemic, particularly on the demand for consumer-oriented services, and rising costs have led to weakest employment rate since July. ”

Therefore, employment is weaker, inflation is skyrocketing and impressions of headlines are hampered by a record increase in delivery times for suppliers (caused by supply chain disruptions driven by blocking … not exactly positive) … it’s all an illusion!

January 21, 2021

On an ECB monetary policy day remaining unchanged, as expected, the euro it was trading higher, above 1,215 this Thursday; however, the possibility of further stimulus for the bloc since the Eurozone economy continues to deteriorate due to the covid-19 case record numbers and new quarantine measures, still exists. In addition, consumer prices keep in deflationary territory for the fifth month.

Because of widespread optimism that the new Biden administration should increase spending to support the economic recovery, the DXY index extended its losses for the fourth consecutive session and was trading below 90.2.

Supported by expectations of fiscal stimulus in the USA, gold prices were in high earlier in the session, staying close to its highest point in 2 weeks, in the region of USD 1869 an ounce.

Extending gains after renewing historic highs in the previous session, North American futures indices were up. The swing season continues, with disappointing earnings from Baker Hughes, while Union Pacific coming above the expected. Intel, IBM and CSX are expected to release their results after the close.

In Europe, the main indices were up earlier, supported by shares of technology that extended yesterday’s gains to reach nearly 20-year highs, while the automotive sector rose 14 months.

The ECB maintained, as expected, its monetary policy unchanged, with the main rate interest rate at 0.0%, while maintaining its PEPP quota at EUR 1.85 trillion, maintaining purchases at least until March 2022.

The construction of new homes in the USA increased by 5.8% MoM to a rate annualized 1669 thousand in December 2020; expectations were 1560 thousand. It was the highest reading since September 2006, supported by the increase in the number of families who move out of big cities due to the pandemic. The construction of new houses increased 32.1% to 251000 in the Midwest, 10.2% to 453,000 in the West and 5.5% to 858 thousand in the South. In contrast, there was a drop of 34.8%, to 107 thousand in the Northeast.

Still on the rise, the number of Americans who filed for unemployment insurance dropped from the previous week to 900,000 in the week closed on 16 January; expectations were 910 thousand. Orders remain well above the numbers prior to the pandemic and should continue for some time, as the number of covid-19 infections remains at record rates. On a non seasonally adjusted, the number of orders fell to 961 thousand, compared to 1.11 million the previous week. In addition, about 424 thousand people asked for help under the Pandemic Unemployment Assistance regime, which covers workers who do not qualify for initial orders, compared to 285,000 in the previous period.

January 19, 2021

Recovering this Tuesday after testing its lowest point since 2 December, the euro was trading in the 1.21 region, supported by a weakness make dollar. However, it is expected to be announced today by Chancellor Angela Merkel and other European leaders an extension of their partial quarantine measures to the mid-February. Regarding economic data, new car sales in the EU has shrunk to a record pace in 2020.

While investors await the speech by former Fed chairman Janet Yellen, appointed by Biden as secretary of the Treasury, the DXY index was falling, with traded around 90.6. She is expected to say that the US does not seek a dollar weak, in addition to urging Congress to do more to help the economic recovery of the parents. However, doubts about whether Congress will approve the USD 1.9 relief plan trillion and the increase in coronavirus infections, put pressure on the dollar.

Reaching its peak in almost a week, gold was being traded on around USD 1844 an ounce, supported by the weakness of the dollar.

On the return from the holiday, the North American indices were up, with the Dow coming to rise more than 200 points. The balance sheet season continues with Bank of America and Goldman Sachs reporting higher than expected earnings; Netflix should disclose its after closing. In addition, the S&P 500 and Nasdaq were up 0.5% and 0.9% respectively.

In Europe, the main indices reversed recent gains and were being traded in a slight drop, with the DAX 30 falling about 0.15%; CAC 40 -0.4%; FTSE MIB – 0.1%; and the IBEX 35 -0.5%. With regard to economic data, Germany remained in deflationary territory in December for the fourth consecutive month.

The Zew Indicator of Economic was up 6.8 points in January 2021 from the previous month, reaching 61.8 points, slightly above expectations. At prospects for the German economy have improved amid rising expectations exports, despite the uncertainty about the future of quarantine measures. About 71% of analysts surveyed predicted an improvement in economic activity in months, while 9% of them expected it to get worse and 20% did not expect changes

January 18, 2021

On a public holiday in the USA, the euro was little changed compared to the closing of Friday, trading around 1,207 this Monday. As concerns with the pandemic and its consequences and with the political turmoil in Italy to continue and the common currency touched its lowest point since 2 December earlier.

Extending gains for the ninth consecutive session, the DXY index was being traded in the region of 90.9, its highest level since 11 December, after record your biggest weekly gain in 11 weeks. Investors remain concerned with the coronavirus pandemic and doubts are growing about whether Congress will approve the $ 1.9 trillion President-elect Joe Biden stimulus package. Biden should take office on Wednesday, the 20th, amid risks of violence and concerns with safety.

Being traded at a slight high, in the region of USD 1835 an ounce, gold tries to recover from the 1% drop on Friday, however the stronger dollar prevented further gains for metal. In addition, doubts about whether Congress will approve the plan Joe Biden’s encouragement diminished the appeal for gold.

Little changed, North American futures indices were mixed on Monday, with the Dow Jones slightly down, while the S&P 500 and Nasdaq slightly up. Coronavirus deaths in the country continue to rise, approaching 400,000; that number is expected to reach the 500,000 mark next month, according to the director of the CDC.

In Europe, the indices reversed recent losses and were trading higher, with the DAX 30 rising around 0.3%, trading around 13815.

In the fourth quarter, China’s economy advanced 6.5%, after a growth of 4.9% in the third quarter; expectations were for a 6.1% growth. The last reading showed that growth returned to pre-pandemic levels, with the industrial production having its biggest growth more than 3 ½ years in the month of December. In the year 2020, the country’s GDP grew by 2.3%, the fastest pace slow over 4 decades. In any case, the country should be the only one among the great economies to avoid a contraction in the year. In 2020, the primary sector rose 3%, with the stock of live pigs increasing 31%. The industry advanced 2.6%, with manufacturing growing 3.4%, public services 2% and mining 0.5%. The tertiary sector has grown 2.1%. In addition, real estate investment grew 7%, with the residential sector growing 7.6% and that of office buildings 5.4%.

January 15, 2021

While investors monitor a coronavirus pandemic and its full impact on economy, the euro was trading lower this Friday, reaching its peak lowest point in 1 month, in the region of 1.21. In addition, the $ 1.9 trillion by President Joe Biden.

Staying above 90.5, the DXY index was trading higher, still supported by high treasury yields and a flight into the US currency by coronavirus and political turmoil. Joe Biden announced the stimulus package in USD 1.9 trillion, called American Rescue Plan, which includes checks of USD 1400 for most Americans, a temporary increase in unemployment insurance and a increase in the federal minimum wage of USD 15 per hour. The day before, statements dovish on the part of the president of the Federal Reserve pressed the dollar. Besides that, Powell dismissed the idea that the Fed could reduce its asset purchases by while, reinforcing the central bank’s commitment to supporting the North American economy.

Pressured by the strength of the dollar, gold was down about 1%, with traded around USD 1825 an ounce.

Amid concerns about the increase in covid-19 cases and the stimulus package announced by Biden from USD 1.9 trillion, US indices were falling this Friday. On the other hand, earnings from JPMorgan, PNC, Wells Fargo and Citigroup were above expectations. The top three North American indices are on track for a negative week.

In Europe, rates were also falling. Pfizer announced that it would reduce temporarily deliveries of their vaccines to Europe while improving their production capacity. Added to that, there was already concern about the slow pace in vaccinations in several countries in the bloc that have received less products than the expected.

With an increase of 1.6% in relation to November 2020, US industrial production exceeded expectations of 0.5% growth. Manufacturing production grew 0.9%, marking the eighth consecutive monthly increase, also exceeding expectations for an increase of 0.5%. The production of durable goods, excluding motor vehicles and pieces, grew 1.5%, and the production of non-durable goods, 0.9%. Inside the goods primary metals recorded their seventh consecutive monthly increase. In between non-durable ones, plastics and rubber products registered the greatest gain. To At the same time, the production of public services increased 6.2% due to a recovery in heating demand after an exceptionally hot climate in November; while mining production advanced 1.6%, due to gains in the oil and gas sector. In the fourth quarter as a whole, production Total industrial growth grew at an annual rate of 8.4%.

Following a 1.4% drop in November 2020, US retail trade recorded a further drop in December, of 0.7% in relation to the previous month; the expectations were down 0.2%. Amid record increases in numbers of infected by covid-19, high levels of unemployment and lack of government support, this was the third consecutive month of decline. Falls were recorded in electronics stores and household appliances (-4.9% vs -8.3% in November), restaurants and bars (-4.5% vs -3.6%), food and beverage stores (-1.4% vs 1.5%), merchandise stores in general (- 1.2% vs – 1.3%), sporting goods stores, hobbies, musical instruments and books (-0.8% vs -1.7%) and furniture stores (-0,% vs -2.1%). In addition, online commerce fell 5.8% against -1.6% in the previous month.

January 07, 2021

Euro zone annual CPI and retail sales data at 07:00; Policy statement ECB monetary policy at 09:30. Initial claims for unemployment insurance and trade balance in the US at 10:30; PMI ISM non-manufacturing at 12:00 in the USA. At 06:57, EURUSD – 0.56% and DXY 0.26%; EUR 34%, USD 76%. ATR at 116%, after reaching low1, with projection upwards 1,2333 and projection downwards 1,2275. POC at 1.23255. Trend in Strong Sell. Low channel, almost lateral. Survive in M5, M15, M30 and H1; Overbought in W1.

Strong fall for the euro. At 14:03, EURUSD -0.59% and DXY 0.38%; EUR 46%, USD 69%. ATR by 138%. POC at 1.22705.

After reaching its highest point in more than two years, the euro was falling this Thursday of about 0.6%, being traded in the region of 1.227, pulled by concerns about the increase in the number of covid-19 cases and quarantine resulting from this increase, as well as the slow pace in vaccinations against the virus. In addition, an economic contraction was shown by the ECB in the Euro in the fourth semester. It was also mentioned by the central bank that, despite the optimism about the coronavirus vaccine, it would still take time for immunity to widespread was achieved so that the economy could return to normal. With respect to economic data, consumer prices in the Eurozone remained in deflationary territory and retail trade fell more than the expected.

In turn, the DXY index recovered some of its recent losses after reaching the region of 89.2 that week and was trading around 89.9. The risk investor appetite decreased due to the outcome of the Senate elections in Georgia, with Democratic victory, which increases the prospects for more stimulus and also because of the US Capitol riots yesterday, when Biden was formally recognized by Congress as President of the country. With the victory in Georgia, Democrats secured control of the two chambers of Congress.

Retreating from the two-month high reached on Monday in the USD 1950 region to ounce, gold was trading lower. Anyway, the fundamentals for metal remain the same, which means a high demand on account of the gold’s role as protection against inflation.

Wall Street was up, with the Dow Jones and the S&P 500 renewing again record highs, extending the gains from the previous session after Congress certified Joe Biden as the 46th president of the USA. The Dow was up 0.8%; O 1.5% S&P; and the Nasdaq of approximately 2.5%.

In Europe, indexes closed higher, with the DAX 30 also renewing a record high, reaching the region of 13995. CAC 40 was up 0.65%; and the IBEX 35 of 0.3%.

The non-manufacturing PMM (USA) increased to 57.2 in December 2020 from 55.9 in November, exceeding market forecasts of 54.6. The reading pointed to the greater growth in the service sector in 3 months. Business activity (59.4 vs 58) and new orders (58.5 vs 57.2) increased more quickly and inventories were recovered (58.2 vs 49.3), while price pressure eased (64.8 vs 66.1) and employment fell again (48.2 vs 51.5). “The interviewees’ comments are mixed on business conditions and the economy. Several COVID-19 shutdowns in local and state level continue to negatively impact companies and sectors. The human resources, production capacity and applicable logistics were more limited than than in the previous month. Most respondents are cautiously optimistic about the business conditions with the recent approval and imminent distribution of vaccines ”, said Anthony Nieves, ISM president.

In Germany, new orders for manufactured products increased unexpectedly 2.3% MoM in November 2020, after a revised 3.3% jump in October and exceeding expectations for a 1.2% drop. It is the 7th consecutive month of increase in orders to factories, mainly due to intermediate goods (4.9%), capital (1.1%) and consumer goods (0.5%). Domestic orders increased 1.6% and foreign ones 2.9%, with those in the Eurozone increasing 6.1% and those from other countries 0.9%. Compared to February, a month before the coronavirus pandemic, factory orders were 4% higher.

The number of Americans who applied for unemployment insurance decreased to 787 thousand in the week ended January 2, from 790 thousand revised in the week previous; expectations were 800 thousand. Still, orders remained well above pre-pandemic levels and are likely to remain elevated for some time, as the number of COVID-19 infections continues to increase at a rapid pace record, prompting many US states to impose restrictive measures to respond to the outbreak. In addition, approximately 161 thousand people have requested assistance from the Pandemic Unemployment, which covers workers who do not qualify for initial orders, compared with 310,000 in the previous period.

January 06, 2021

PMI data from Italy at 5:45 am, France at 5:50 am, Germany at 5:55 am and Zone Euro at 06:00. Change in private ADP jobs in the US at 10:15 am and stocks of crude at 12:30. Minutes of the FOMC meeting at 16:00. At 06:12, EURUSD 0.27% and DXY -0.14%; EUR 57%, US $ 26%. ATR at 106% after reaching high1. Upward projection 1,2341 and projection of 1,2279. POC at 1.22985. Strong Buy trend. Channel high.

After finding a resistance zone in the region of 1,234, euro plummets with unexpected ADP data finding support in a zone of high accumulation of volume. At 13:50, EURUSD -0.13% and DXY 0.25%. ATR by 124%. POC at 1.23375.

In a day full of news, the euro continued its rise this Wednesday, reaching its peak highest point since April 2018 in the region of 1.2345, before reversing gains to be traded in the fall. Democrat Raphael Warnock won the race for first Senate seat against Republican Kelly Loeffler; the dispute for the second vacancy remained undecided. In Europe, the increase in covid-19 cases and with new quarantine measures continue to worry investors. In addition, PMI showed that the economy contracted more than expected in December.

In turn, the DXY index remained under heavy pressure at the start of the session, falling below the 89.5 region, but recovered losses to be traded higher about 0.3%.

Supported by the weakness of the dollar, gold was bullish, trading above USD 1950 the ounce earlier to later reverse the gains and fall sharply to the next of USD 1900 or -2.1%.

Wall Street had the Dow Jones and the S&P 500 recovering recent losses to hit new record highs, with the Dow rising almost 500 points and the S&P about 1.3%. In contrast, the Nasdaq was trading down.

In Europe, the indices registered significant gains, with the DAX 30 rising more than 1.5% and other important indices rising between 1.5% and more than 3%. The European Agency of Medicines recommended the use of Moderna’s coronavirus vaccine in European Union; the Pfizer / BioNTech vaccine was the only one authorized for emergency use in the block, but recent concerns have emerged that new variants of the virus discoveries in the UK and Africa could make vaccines ineffective.

Unexpectedly, the US private sector cut 123,000 jobs in December 2020; expectations were for an increase of 88 thousand vacancies. It was the first fall registered in the private sector since April of last year, with the market of work being strongly affected by the increase in covid-19 cases in the country, as well as like all restraint measures. The service sector cut 105 thousand jobs led by leisure and hospitality (-58 thousand), commerce, transport and services (-50 thousand), other services (-12 thousand) and information (-6 thousand). In contrast, professional and commercial companies added 12 thousand jobs, education and health 8 thousand and financial activities 2 thousand. The goods production sector lost 18 thousand jobs, due to manufacturing (-21 thousand), natural resources and mining did not contract or laid off, while the construction sector added 3,000 jobs. Considering 2020, private sector employment fell by 9.49 million, compared with a gain of 1.79 million in 2019.

January 04, 2021

On the first blood day of the year 2021, the euro was up on Monday, testing the region again at 1.23. One currency recorded an annual gain of almost 10% in 2020, supported by hopes of a rapid economic recovery with the approval of the largest stimulus package ever financed by the European Union budget, vaccination program against coronavirus in the block and post-Brexit trade agreement.

In turn, the DXY index follows its strong downward trend, having tested the region of 89.5, as the increase in risk appetite decreases the demand for the dollar. In addition, unprecedented spending raised US debt levels, generating huge budget deficits, which make money even less attractive as a way of investment. It is expected that the weakness of the dollar, which recorded a devaluation of around 7% in 2020, continue in 2021, with investors turning to higher risk investments.

In a significant increase of more than 2%, gold broke the resistance of the important level of USD 1900 an ounce, supported by the weakness of the dollar and expectations of rising inflation. The demand for metal as a protection against inflation is expected to continue in 2021. Even thus, the increasing number of countries starting their vaccinations against coronavirus, increases the hope of a quick economic recovery and removes safe asset investors. Gold registered an expressive appreciation of 25% in the last year.

Wall Street saw its main indices sink on that first day of trading 2021. Dow Jones dropped more than 500 points after opening the session in a new record high; Coca-Cola and Boeing shares were among the worst performance. The S&P 500 and Nasdaq also fell 2% and 1%, respectively, after to open high. In contrast, Tesla’s shares were up almost 4% after the weekend’s release of better-than-expected data in December. The numbers related to coronavirus in the USA are still on the rise, having registered in a single day over the weekend 300 thousand new infections, totaling more than 20.5 million cases. In 2020, the main North American indices had its best year since 2009, with the Dow Jones gaining 7.3%, the S & P500 16.3% and the Nasdaq 43.6%.

Meanwhile, in Europe the indices were up, with the DAX 30 rising more than 1% and reaching a new record high of 13923 and other important indices rising between 0.8% and 2.7%. With regard to economic data, PMI surveys have shown that the Eurozone manufacturing sector had the biggest growth in December since May 2018.

The IHS Markit US Manufacturing PMI was revised to 57.1 in December 2020 from a preliminary 56.5 and 56.7 in November. The reading pointed to the strongest growth of manufacturing activity since September 2014, as the economy continues to grow recovering from the pandemic. Production growth was the strongest since March 2015, despite having slightly decreased compared to the recent high of November. Gives Likewise, new orders decreased due to delays from suppliers and reduced capacity as additional restriction measures have led to the cancellation of requests. In addition, in the midst of a significant deterioration in the performance of the supplier, cost burdens and sales prices have skyrocketed as companies sought to partially pass on higher input prices.

December 18, 2020

After reaching the level level of 1,227 on Thursday, the euro lost strength on that Friday and was trading lower, below 1,225. However, the common currency moves for a weekly gain of around 1.1% with the demand for riskier assets being driven by vaccine news, hopes of a post-Brexit trade deal and prospects for fiscal stimulus in the U.S.

The DXY index rebounded slightly after falling below the 90 level in the session previous. American policymakers appear to be approaching an agreement in the USD 900 billion in aid against the pandemic. This unprecedented expense, however, it has led to large budget deficits; the dollar has also become less and less attractive. A less dovish stance by the Fed was also not enough attract investors, after the central bank did not change the terms of its asset purchase program and outlined an optimistic growth outlook for 2021; rates, however, are expected to remain close to zero until 2023, at least.

In a slight decline, gold was being traded in the region of USD 1880 an ounce today. In Anyway, metal is on track to record a weekly gain of around 2.3%.

Retreating from high records set in the previous session, Wall Street was in decline, while investors await any progress on US stimulus. The leader of the majority in the Senate, Mitch McConnell, said a bipartisan agreement “appears to be next ”and House Speaker Nancy Pelosi also said that Democrats are approaching consensus. In addition, the emergency use of the vaccine against Coronavirus da Moderna was supported by the FDA. On Monday, Tesla will join officially to the S&P 500, which can generate great volatility in the trading of today.

In Europe, the stock markets were also falling, with the DAX 30 falling about 0.1% after reaching a 10-month high in the previous session. The President of the Commission European Union, Ursula Von der Leyen said yesterday that “big differences remain” with relation to the post-Brexit trade agreement, mainly in the fisheries sector and that “overcoming them will be very difficult”. Today, European Union negotiator Michel Barnier said there was a chance for an agreement, but that the path to it is very narrow. In addition, the record increase in covid-19 cases in Europe and possibilities for new quarantine concerns investors.

Germany’s Ifo Business Climate Indicator rose to 92.1 from 90.9 in December previous month and above the forecasts of 90. Companies were more optimistic about the current conditions (91.3 vs 90) and expectations (92.8 vs 91.8). “Companies are satisfied with their business situation. They are looking at the first semester of the year with less skepticism. But quarantine measures are strongly affecting some branches. The German economy in general is showing its resilience “, said the president of Ifo, Clemens Fuest. Still, reading remains below levels prior to the pandemic.

December 16, 2020

EURUSD – 15/12/2020 GMT -3 – TF M5. London e NY sessions.

Supported by better-than-expected PMI data, as well as signs of progress in Agreed with the post-Brexit trade agreement the euro was being traded above 1.22 earlier that Wednesday. The bloc’s private sector economy has come a long way close to stabilizing in December, as there was an acceleration in the growth in industrial production coupled with a slowdown in the contraction of the sector services.

Supported by better-than-expected PMI data, as well as signs of progress in Agreed with the post-Brexit trade agreement the euro was being traded above 1.22 earlier that Wednesday. The bloc’s private sector economy has come a long way close to stabilizing in December, as there was an acceleration in the growth in industrial production coupled with a slowdown in the contraction of the sector services.

At a slight high, gold prices held just above USD 1850 an ounce, supported by the prospect of additional fiscal stimulus in the USA.

In the USA, the main indices were little changed compared to the previous session, while investors assimilate worse-than-expected retail sales data. Any progress on additional stimuli in the US is also expected, as well as the Fed’s monetary policy decision. The Fed is expected to maintain its stable target rate at 0-0.25%, but investors will look for any changes in the bond purchase program. Meanwhile, the FDA said the Covid-19 vaccine from Modern was “highly effective”, setting the stage for an authorization to emergency at the end of this week, after Pfizer / BioNTech obtained authorization at last Friday.

In the USA, the main indices were little changed compared to the previous session, while investors assimilate worse-than-expected retail sales data. Any progress on additional stimuli in the US is also expected, as well as the Fed’s monetary policy decision. The Fed is expected to maintain its stable target rate at 0-0.25%, but investors will look for any changes in the bond purchase program. Meanwhile, the FDA said the Covid-19 vaccine from Modern was “highly effective”, setting the stage for an authorization to emergency at the end of this week, after Pfizer / BioNTech obtained authorization at last Friday.

IHS Markit Germany Manufacturing PMI increased to 58.6 in December from 57.8 in November, exceeding forecasts of 56.4. It is the highest reading in 34 months, showing little impact of coronavirus containment measures. Orders increased strongly supported by the increase in export sales, amid greater demand for China. Notably, the backlog of order manufacturing does not completed showed a record increase during the month. On the other hand, employment had a bigger drop and the producers of goods increased the factory prices in the largest measure since March 2019, due to the growing tension in the supply chains supply and raw material shortages. Finally, manufacturers remained optimistic, as well as businessmen’s confidence in the prospects for the activity in the following year.

US retail sales fell 1.1% month-on-month in November 2020, after a revised 0.1% drop in October and worse than forecasts for a fall of 0.3%. It is the second consecutive drop in retail sales amid a increase in coronavirus cases and a drop in income, as the benefits of unemployment are about to expire. Sales in clothing stores were the most fell (-6.8%), followed by food and beverage services (-4%); stores of electronics and home appliances (-3.5%); gas stations (-2.4%) and concessionaires of motor vehicles and parts (-1.7%). Other falls were also observed in the sales in furniture stores (-1.1%); general merchandise stores (-1%); health and personal care (-0.7%); sporting goods, hobby, musical instrument and book (-0.6%); and several (-0.5%). In contrast, the increases occurred in food and beverage stores (1.6%) and in construction material resellers (1.1%). Retail sales that exclude automobiles, gasoline, building materials and food services fell 0.5%.

December 15, 2020

EURUSD – 15/12/2020 GMT -3 – TF M5. Sessões de Londres e NY.

Day without high volatility news expected. Price data for exported goods and imported into the US at 10:30 am; industrial production at 11:15, also in the USA. At 06:13, EURUSD -0.01% and DXY 0.01%; EUR 50%, USD 54%. ATR by 56%, with an upward projection 1.2187 and projection down 1.2107; POC at 1.21485. Strong Selling Trend. Channel high. Bollinger with 160 points. At 17:23, after a volatile session, EURUSD 0.06% and DXY -0.26%; EUR 17%, USD 13%. ATR by 81%. POC at 1.21580.

Amid a record increase in covid-19 cases in Europe, which is generating stricter restrictive measures on the continent, the euro was largely unchanged in relation to its opening point this Tuesday. This week, Germany and Netherlands will start a new quarantine; Italy also considers a partial quarantine from December 24th to at least January 2nd. In addition, negotiations for a post-Brexit trade agreement remains the center of attention.

The DXY index continues to be pressured by optimism regarding the vaccine against coronavirus and the USD 900 billion stimulus package. The dollar was falling 0.25%, being traded below the 90.5 level.

Gaining some strength, gold was trading higher, passing above from the level of USD 1850 an ounce, supported by the prospects for a stimulus package for the US economy. Giving even more support to the metal was the dollar even weaker, which makes gold more accessible.

Wall Street had its main indexes up at the end of the session amid expectations more fiscal stimulus to support the economy. A bipartisan group of lawmakers proposed a new package, which would divide the previous value of USD 908 billion in two to increase your chances of approval. The new plan includes USD 748 billion in spending popular programs for both sides, including unemployment insurance and Small business. A second USD 160 billion package comprises the two provisions that divided legislators, state and local government aid and liability protection for companies. Development should encourage economy in general to recover and boost the cyclical and other sectors affected.

In Europe, exchanges were also on the rise, amid optimism about the deal post-Brexit trade, vaccines and US stimulus negotiations. The DAX 30 was discharged from about 1.5%, as well as the FTSE MIB; CAC 40 and IBEX 35 were up about 0.6% and 0.3% each.

In Europe, exchanges were also on the rise, amid optimism about the deal post-Brexit trade, vaccines and US stimulus negotiations. The DAX 30 was discharged from about 1.5%, as well as the FTSE MIB; CAC 40 and IBEX 35 were up about 0.6% and 0.3% each, while the production of public services fell 4.3%, as higher temperatures that normal have been reducing the demand for heating.

December 14, 2020

Still strongly supported by progress in coronavirus vaccines worldwide, with the USA also authorizing the emergency use of Pfizer / BioNTech, the euro started to bullish week and was being traded in the 1.2145 region earlier in that Monday. In addition, investors still believe in a post -rexit trade agreement between the EU and the UK after they have been extended beyond Sunday’s deadline. On the other hand, Germany has announced that it will tighten its measures quarantine starting on Wednesday, will affect non-essential stores, schools and hairdressers, which must close. Such measures should remain in effect until the the 10th of January.

Pressured by the increase in risk appetite after the US announced the use emergency use of Pfizer / BioNTech vaccines, the DXY index was being traded below 90.5, this being its lowest level since April 2018. In addition, the possibility of an additional stimulus agreement in the United States with Democrats and Republicans confident that Congress will agree on a value of approximately USD 900 billion before the holiday season, is expected to put pressure on the dollar even more, since investors are concerned about the increase in the debts of the government.

The appeal for gold is also waning, as progress in vaccines against covid-19 raises hopes for a faster global economic recovery; O metal was trading below USD 1850 an ounce today. However, working support for gold are the stimulus measures by governments and central banks as the metal tends to be used as protection against inflation.

With the USA starting the national vaccination campaign against coronavirus this week, Wall Street was on the rise, with travel and leisure companies among those with better performance. Other companies that performed well were Alexion Pharmaceuticals, which rose more than 30%, to a four and a half year high, after the AstraZeneca said it would buy the US biotech company for USD 39 billion in one of this year’s biggest mergers. The Dow Jones advanced more than 200 points to a historic record of 30,325. The S&P 500 rose 30 points or 0.9% and the Nasdaq rose 150 points or 1.3%.

In Europe, exchanges were also up after the EU and the UK extended the post-Brexit trade agreement negotiations beyond the deadline for Sunday. The Dax 30 was up about 1%, as was the IBEX 35; the CAC 40 and the FTSE MIB were up 0.5% each.

Eurozone industrial production increased by 2.1% in relation to the previous month, in October 2020, the sixth consecutive month of growth; expectations were of a 2.0% increase. The production of durable consumer goods, such as televisions and washing machines, recovered 1.5% after registering a sharp fall in September; energy production also grew 1.8%. In addition, there were increases in production capital (2.6%) and intermediate goods (2.1%). The production of consumer goods does not durable has remained unchanged. Among the largest economies in the bloc, Germany, France, Italy and Spain registered gains in production.

December 11, 2020

After the ECB revised the outlook for economic activity in the Eurozone with GDP growth of 3.9% in 2021, the euro was trading lower this Friday. European leaders finally got a budget without EUR 1.8 trillion to help the regions most affected by the pandemic, after Hungary and Poland withdrew their objections. Investors now come back as to considerations for Brexit solutions.

The DXY index started the session down, but reversed the losses to return to the 91. The United States continues to be severely affected by the pandemic, reaching record numbers in coronavirus infections and deaths, which meant that requests for initial unemployment benefits reached a high of about 2 and a half months; beyond In addition, the stimuli announced for the Eurozone may put further pressure on the dollar.

Despite the high, gold continues to trade below the USD 1850 an ounce region. Experts formally recommended that the FDA authorize the emergency use of vaccines from Pfizer / BioNTech in the USA, the day after Canada authorized use in their territory.

Wall Street was down, with the Dow Jones and S&P 500 falling for the third session consecutive (-0.4% and -0.75% respectively) and the Nasdaq falling more than 1%. In Europe, the stock markets were also in the red, with the DAX 30 falling more than 1.5% and reaching its lowest point in 3 weeks, since the possibility of further measures restrictions and the lack of progress in Brexit negotiations worried investors. Other important indices also registered sharp drops of more than 1%.