Juliana Calil

05/19/2021

Highlights

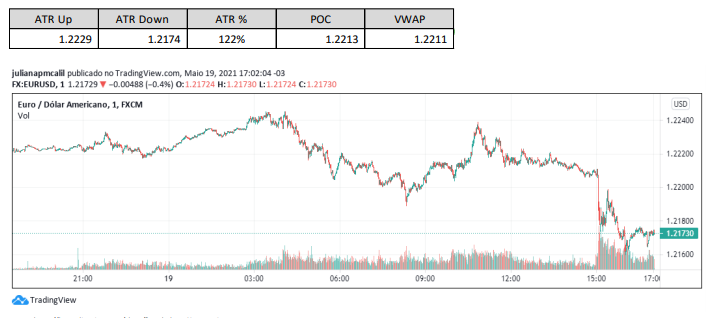

In today’s session, until 3 pm, when the FED published the minutes of the last meeting of the monetary policy committee, the EUSUSD wasmaintaining the bullish movement. As commented yesterday, the more the FED ignores the rise in inflation, the greater the trend ofEURUSD high. In the minutes published today, the FED demonstrated to be very attentive, and not ignoring, all the movements of theinflation, stating that he understands that inflation should be above 2% as long as the comparative periods reflect lowcaused by the effects of the pandemic. After the disappearance of these transient effects, inflation is expected to return toless than 2%. A strong recovery in economic activity that pressures inflation in the US would justify a tightening of policymonetary policy. According to the minutes, “if the economy progresses rapidly towards the goals of the Committee, it could be appropriate inat some point in the next meetings to start discussing a plan to adjust the pace of asset purchases ”.

It is important to note that these minutes published today refer to the April FOMC meeting, held before the disclosure of theinflation and Payroll figures for the month. April inflation was 4.3%, well above the committee’s target, and it did not have an effect, as theThe Fed said it was a weak benchmark and not a lack of supply or a decrease in the purchasing power of the currency. When thetime to tighten monetary policy, the Fed will reduce its bond purchases, which are currently at least $ 120billion a month.

In today’s session, the EURUSD rose to 1.2146, from where it started a correction, until the EDF minutes came out, when the USD gained strength,pulling the currency value down, and parking close to 1.2065, well below the VWAP and POC.

The next most significant publications on the European market come on Friday, with preliminary indexes of managersMarkit’s shopping cart for May.

The DXY is trading at 90.2, higher. The USDJPY is oscillating close to $ 109.2. The USDCHF of $ 0.9034. Gold isbeing traded at $ 1,871 an ounce, and silver at $ 27.7

The main facts observed by investors at the moment are:

COVID-19

France hopes to “turn the page on COVID-19” in November or December 2021, when a large part ofof the population is vaccinated, and if there are no new variants of the virus, said Health Minister Olivier Veran.Although he is optimistic, “we will remain vigilant and the French people must remain vigilant” toprevent a fourth wave of the pandemic, he said. The health crisis is not over yet, but the French “do notshould live in fear “until then, added Veran. French cafe and restaurant terraces, as welllike museums and cinemas, they opened on Wednesday after a months-long lockdown. A campaign ofaccelerated vaccination and a third round of restrictions on public life began to slow the spreadof the virus, with a noticeable drop in the occupation of intensive care units. If the situation gets worseagain, the easing of restrictions will be called into question, said President Emmanuel Macron tojournalists while he and Prime Minister Jean Castex sat in a cafe to celebrate the day.

Dr. Anthony Fauci, chief medical advisor to the White House, said on Wednesday that Covid-19 are decreasing in all US states, suggesting that widespread declines will make it moresafe for Americans to resume activities. The USA reported an average of about 31,200 newcases a day last week, down 18% from the previous week.

MACROECONOMY

Earlier today, Eurostat published the final reading of the April inflation figures. The Consumer Price Indexrose 1.6% pa as expected. Inflation was mainly driven by the increase in the cost of energy(10.4%). Prices increased at a smoother pace for food, alcohol and tobacco (0.6%) and services(0.9%). The ECB has already said that it expects an increase in inflation due to the base effects and temporary factors,warning that it may even exceed the central bank’s target by the end of the year. Meanwhile, the core of theannual inflation, which excludes volatile energy, food, alcohol and tobacco prices, fell to 0.7 percent from0.9 percent in March. On a monthly basis, consumer prices rose 0.6% in April

ACTIONS

US stock indices today had the third consecutive day of losses. The Dow Jones lost about165 points, led by a fall at Chevron Corp. The S&P 500 fell 0.7% with all 11 sectors endingin red. Meanwhile, the high-tech Nasdaq ended up virtually stable, after falling almost2% during the session

In Europe, markets closed down in today’s session.

OTHERS

Cryptocurrency settlement intensified on Wednesday, with Bitcoin falling more than 20% down$ 31,000 after Chinese authorities banned financial institutions and payment companiesto provide cryptocurrency-related services. Cryptocurrencies were already under pressure after Teslasuspended purchases of vehicles using Bitcoin on May 12, mentioning the growing use of fuelsfossils for mining and Bitcoin transactions. Bitcoin fell almost 50% from its $ 64,895 record setin mid-April, and erased all the gains it accumulated after the announcement of Musk by Elon on February 8that Tesla would accept it as a form of payment and use corporate money to buy the digital asset.

Source: https://wintrademarkets.com