Juliana Calil

06/07/2021

Highlights

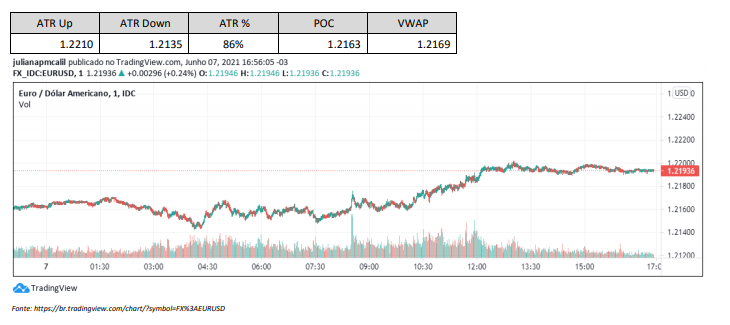

With the Dollar under pressure, the session was quite weak, reaching 86% of the ATR. US Treasury bond yield withten-year maturity, which monitors the flow of capital to the dollar, was 1.569% this afternoon, falling whencompared to 1.628% at Friday’s close. Dow Jones dropped 0.36%, the S&P 500 practically closedstable with a small drop of 0.07% and the Nasdaq gained 0.49%. The stock market closely monitors thediscussions of the G7, which seeks to increase the tax levied on large corporations, to at least 15% of profits. the mainGlobal stock indices remain very close to the all-time highs achieved recently, as even with this“bad” perspective on taxes, company profits should generate great returns, considering the economy inacceleration, an accommodative FED and fiscal stimulus.

The second week of June begins with investors digesting the May Payroll , released last Friday, and theexpect the US inflation data (CPI, which is expected to jump to 4.7%, the highest rate since September 2008) and the nextEuropean Central Bank monetary policy meeting, both on Thursday

Although 559,000 jobs were created in the US in May, this volume was below economists’ forecast.consulted by Reuters, of 650 thousand. Hirings as well as salaries increased. This “frustrating” result decreased theinflationary pressure on the US economy, as well as investor discomfort regarding the decisions of theFed to keep the dovish policy for a few more months. Therefore, for the EURUSD, the result of this Payroll tends to be neutralor possibly positive

In today’s session, the EURUSD appreciated by 0.21%, closing close to 1.2192, above the VWAP and POC,mainly influenced by the USD weakness, as investors were more optimistic today and therefore morelikely to take risk

DXY is trading at 89.9, down. The USDJPY is fluctuating near $109.2. The USDCHF of $0.8975. the gold istrading at US$1,899 an ounce, and silver at US$27.9

The main facts observed by investors at the moment are:

COVID-19

Signaling the end of the critical period of the pandemic for both nations, UK airlines andof the US issued a joint appeal for the resumption of travel between the two countries. Leisure travel andbusiness can resume without jeopardizing efforts to fight COVID-19, US chiefs said.Delta, United Airlines., American Airlines and JetBlue as well as British Airways and VirginAtlantic

The COVID-19 vaccination campaign in India remains very confused. The country has already administered 232million doses since January 16, 2021, immunizing 3.4% of its population. At this rate, it will take more22 months to cover 75% of the population, according to Bloomberg Vaccination Tracker.

Moderna, whose vaccine is proven to be effective for teenagers, requested a conditional authorizationin the European Union, allowing the bloc to also immunize its population aged 12 to 17 years.

TAX POLICYUS

lawmakers must submit a $4 bipartisan bill to the votetrillions in infrastructure spending over the next 10 years this Wednesday

Source:https://wintrademarkets.com/