Juliana Calil

06/15/2021

Highlights

The release of the results of the June meeting of the Fed’s monetary policy committee, the FOMC, will take place tomorrow at 3pm. Everythingindicates that policy changes should only take place from August, however, for tomorrow, the market is looking forward toknow the Institution’s updated position regarding the recovery of the US economy after the pandemic, with allmonetary incentives placed and its consequent inflationary pressure. The financial market accepted that the pressures onprices are transitory, will last as long as the economy reopens and recovers from the coronavirus pandemic, and is acceptable as long asthat wages do not increase with the same intensity. Any indications to the contrary from the Fed will change the moods of the market.

Among today’s releases, the highlight is retail sales in the US, which shrank 1.3% in May 2021 compared tolast month. Analysts estimated a drop of 0.8% with a resumption of spending on services, in particularthose related to travel. The biggest drops were observed in the construction and gardening materials segment (-5.9%), automobiles (-3.9%) and electronics stores (-3.4%), furniture (-2.1%) and sporting goods, hobby, musical instruments andbookstores (-0.8%). On the other hand, there were increases in clothing (3%), health and personal care (1.8%), food andbeverages (1%) and gas stations (0.7%).

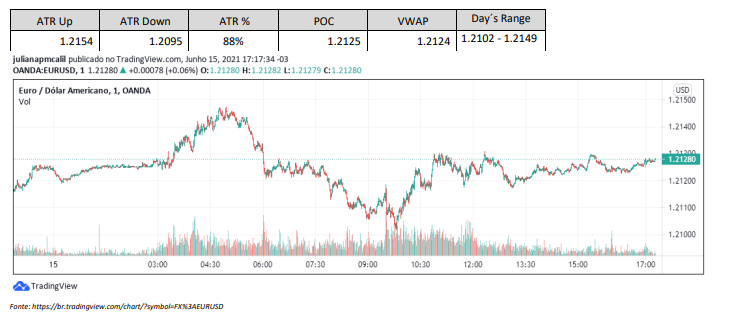

During today’s session, the EURUSD reached 88% of the ATR, and was practically stable, for the second consecutive day, closingclose to 1.2127, very close to VWAP and POC. The day’s range was as small as the last few days, but stilloffered good opportunities for scalpers

The yield on the ten-year US Treasury bond, which monitors the flow of capital to the dollar, had astability day, closing at 1.490% today

The Dow Jones Industrial Average is expected to close down today similar to yesterday’s 0.27%, while the S&P 500 and Nasdaq reversedgains obtained yesterday, down 0.20% and 0.71%, respectively. In the last 20 sessions, the S&P 500 recorded 36record high and 1 low over the past 52 weeks. In the same comparison, the Nasdaq Composite registered 87high and 21 low

DXY is trading at 90.5, stable The USDJPY is fluctuating near $110.0. The USDCHF of $0.8992. The Index ofDeutsche Bank Currency Volatility continues to decline, at a level close to 28%. Gold is trading at US$1,858the ounce, and the silver at $27.6

Source:https://wintrademarkets.com/