Juliana Calil

06/07/2021

Highlights

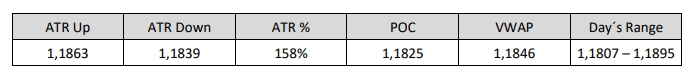

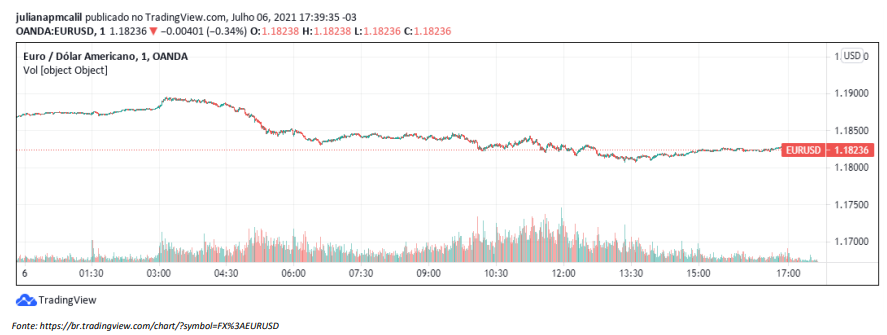

Today’s session was influenced by June’s Payroll , released late last week, pointing to a scenariostrange that the number of vacancies went up as did the unemployment rate, and that was followed by a weekendprolonged, because of Independence Day in the United States. In today’s session, the EURUSD dropped 0.34%,closing at a level close to 1.1825, below both the POC and the VWAP, reaching 158% of the ATR. the pair becametraded at 1.1807, the lowest level of trading since the beginning of April 2021. In June, the EUR lost 3.1% againstthe USD, with the ECB’s dovish stance contrasting with the Fed’s hawkish stance . The prospects for an economic recoverysolid growth in Europe and the US were supported by upbeat economic data, however, the spread of the Delta variant of COVID-19 and the shortage of labor and raw materials continue to bother investors

Awaiting the minutes of the FOMC meeting, held on June 16, which will take place tomorrow afternoon, the market’s risk appetiteis decreasing, favoring the USD. The yield on the ten-year US Treasury bond, which monitors thecapital flow to the dollar is expected to close today with a sharp drop of 5.74% at 1,350, its lowest value since February 24,2021. A month ago, yields were expected to increase in the second half, possibly reaching 2% by the end of2021. After the last FOMC meeting, the consensus believes that yields may have already reached this year’s high. OThe market expects that, in the minutes to be released tomorrow, the Fed will confirm the anti-inflationary stance adopted in the speech of someof the institution’s high-ranking members, which would trigger a demand for the USD.

Among the top three US stock market indices, the Dow Jones Industrial Average and the S&P 500 are expected to close atfall, of 0.6% and 0.2%, respectively. Nasdaq, on the other hand, has a mild 0.17% appreciation. The search for actions oftechnology companies, to the detriment of the finance and energy sectors (closely linked to economic growth),were the main responsible for this scenario. Or, it may be that investors have realized that the economy may notto be as heated as the stock market was showing, with successive highs, and that it is a good idea to carry outthe profits obtained in the quarter that ended with the month of June.

Released today, the IHS Markit US Composite PMI , an indicator that assesses the US private sector, from June2021, at 63.7, falling from the historic high of 68.7 reached in the previous month, May 2021, was the secondbiggest monthly increase on record as new business and export orders continued to increase ina solid rhythm. The pace of job creation has slowed amid the challenges of hiring new employees. The companiespassed on higher costs to customers through the second sharpest increase in average selling prices for goods andservices since the beginning of data collection in 2009

The DXY is trading at 92.5, up 0.35%, back to the level it last reached on April 5, 2021.USDJPY is fluctuating near $110.6. The USDCHF of $0.9244. Gold is trading at $1,797 an ounce, and silver at$26.1

After the publication of the FOMC minutes, the market’s attention turns to the release of the minutes of the monetary policy meeting of theECB, which takes place on Thursday. This week, the high-ranking members of the European Central Bank will gather todiscuss the biggest revision of the Institution’s strategy in almost 20 years, including a new formulation of the inflation target

The ZEW Economic Sentiment Indicator for the Eurozone, released today, fell 20.1 points to 61.2 in July 2021.the lowest reading since January. In July, 4.4% of interviewed analysts expected a deterioration in activityeconomic, 30% did not expect change, while 65.6% predicted an improvement. The current economic situation indicatorrose 30.4 points to 6, while inflation expectations dropped 10 points to 69.6