Highlights

Throughout today’s session, investors sought to prepare for the decisions of the April FOMC meeting , a meeting thathappens between today and tomorrow, and digest the quarterly results presented by the Companies.

This meeting should be the last one in which the FED will maintain its policies or perspectives, since the North American economy has alreadyshows signs of being in full economic recovery after the pandemic. Investors will want to know when and how theInstitution will reduce the pace of monetary stimulus. The concern is that transitory inflation becomes inflationpersistent, when it will be too late for the EDF to change course. Many analysts believe that the program to purchaseFED assets of $ 120 billion monthly ($ 80 billion in Treasury bonds and $ 40 billion in bonds backed bymortgages), no longer delivers returns that justify the huge tax expenditures it causes. In the past year, the EDF has taken actionnecessary to prevent the pandemic from causing a worse economic collapse and managed to keep markets functioningfinancial resources. As a result, its balance sheet increased significantly, to $ 7.9 trillion.

Before the opening of the markets, BP, UBS, ABB, Schneider Electric, Novartis and Whitbread reported results. Afterclosing we will know the results of Alphabet, Microsoft, Starbucks and AMD. The results in general reinforced the optimismof investors in relation to the post-pandemic world economy recovery.

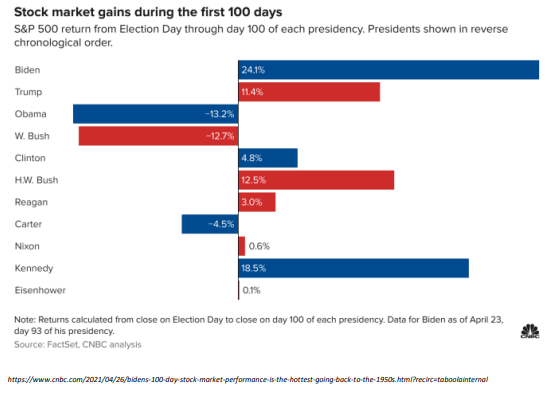

Tonight, US President Joe Biden will make a televised address to the nation, where he intends to talk about hisfirst 100 days in office. No other American president has seen such a positive moment for the marketshares, as shown in the chart below, published by CNBC:

DXY is being traded at the level of 90.9 thousand points. The USDJPY is oscillating close to $ 108.6. The USDCHF of $ 0.9134.Gold is trading at $ 1,778 an ounce, and silver at $ 26.4 an ounce.

The main facts observed by investors at the moment are:

COVID-19:

India, which continues to fight the spread of the coronavirus, reported today the sixth consecutive day with more300,000 diagnoses. In the country, more than 197 thousand people died of COVID-19, but more than 145 milliondoses of vaccines were administered. India is preparing to open its vaccination program for allover 18 years old from May 1st.

MONETARY POLICY:

The disclosure of the minutes of the April FOMC meeting should sour the market’s mood.The Institution will probably maintain an optimistic tone, providing security to investors from all over the world. However,assets are already highly valued, and more and more analysts believe that the possibility of inflation getting out of controlof the Institution, when it reaches 3 or 4%, it is real.

MACROECONOMY:

In the week ended April 24, 2021, same-store sales (representing more than 9 thousand stores andmore than 80% of the series collected and published by the United States Department of Commerce), compiledby the Johnson Redbook Index, from the USA showed that retail revenue in the country grew 13.9% in relation tothe same period in the previous year.

the February / 2021 US house price index. house prices rose 12%, a new highsince February 2006. “These data remain consistent with the hypothesis that COVID encouragedpotential buyers to move from urban apartments to suburban homes. This demandcan represent buyers who accelerated purchases that would have occurred in any way in thenext years. Alternatively, a secular change in preferences may have occurred, leading to apermanent change in the housing demand curve

The US first quarter GDP will be released on Thursday, which should show that the economy has grown6.5%. Growth in the second quarter is expected to be close to 10%.

SHARES

The markets closed in a slight drop in both Asia and Europe today. Optimism remains high, however,EURUSD is already quite high, close to 1.2100. The highlight, among the quarterly results, wasfor HSBC, whose pre-tax profits exceeded estimates, even with a drop in revenue. HSBC is,European banks, which has the largest volume of creditors in relation to assets. Last year, the Institutionprovisioned $ 3 billion for non-performing loans due to the pandemic, and the reality was better thanand the impact of the reversal of this provision improved the results achieved in this quarter. Dow and the S&P 500closed a busy session in stability, with Tesla dropping more than 4% after mediocre quarterly results