Juliana Calil

05/06/2021

Highlights

In today’s session investors traded waiting for the April US Nonfarm Payroll to be released, which takes place tomorrow atevening. This should present the largest monthly job generation in the last 8 months, around 980 thousand vacancies. The recoverylabor market support was supported by the federal government’s $ 1.9 trillion stimulus package andvaccination against COVID-19 in the country.

Investors are more confident in the Fed’s thesis that US inflationary pressures are transitory. Youhigh-ranking members of the Institution have been working hard to convince the market: Rosengren said that pressuresinflationary measures must be short-lived and must not lead to a setback in monetary policy; Mester said he hopes to bedeliberately patient, unless there is clear evidence that inflationary pressures will push inflationexceed the desired standard; and Charles Evans said he expects monetary policy to remain super-easy for some time.

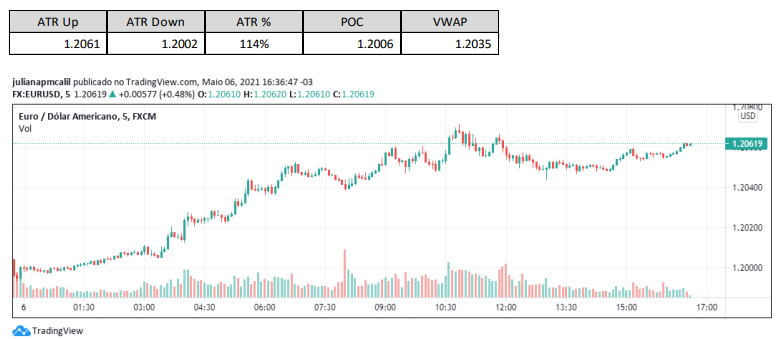

EURUSD traded higher in today’s session. In a webinar held this morning, ECB Vice President Luis de Guindos saidthat, after contracting in the first quarter of 2021, reflecting the sanitary measures to contain the pandemic, the economy of the zoneof the euro may show a rapid and intense improvement in the coming months, with the acceleration of vaccination as the maingrowth driver.

DXY is being traded at the level of 90.9 thousand points. The USDJPY is oscillating close to $ 109.0. The USDCHF of $ 0.9082.Gold is trading at $ 1,814 an ounce, and silver at $ 27.3 an ounce. Gold surpassed the $ 1,800 threshold for the first timesince February, driven by market optimism regarding the global economic recovery, which is drivingdollar investors and stimulating the purchase of gold.

The main facts observed by investors at the moment are:

COVID-19

Due to the shortage of vaccines from AstraZeneca and Moderna, Canada is considering allowingpatients receive two different types of vaccines. Canada has chosen to extend the time period between doses ofvaccine, from three to four weeks to up to four months, in order to stretch supplies

MACROECONOMY

Millions of British voters go to the polls for local and national elections, with investors payingspecial attention to the results of the Scottish parliamentary elections, since an absolute majority for theScottish national party would increase requests for another independence referendum.

The European construction sector, as measured by the IHS Markit Eurozone Construction PMI, remained stable atApril / 2021 in relation to the previous month. A further increase in the activity of housing construction and amilder reduction in commercial construction was offset by a steeper decline in constructionof civil engineering. Among the largest economies in the eurozone, German construction production contractedat a faster pace, while activity in France fell only marginally. The builders Italians have experienced the strongest pace of expansion since January 2007.

Weekly retail sales in the European Union in March / 2021 increased 2.7% in relation to the monthabove the market expectations of 1.5%. Sales of non-food products increased4.6% and food, beverages and tobacco, 1.0%. Fuel sales fell 2.9% as many countriesimposed or expanded restrictive measures to contain the spread of COVID-19. On an annual basis,retail sales increased 12%, also above the 9.6% market consensus.

The number of Americans filing unemployment insurance claims dropped to 498,000 in the weekended May 1, the lowest level since the pandemic began in the country. The pace of recovery ofThe labor market gained new impetus due to the acceleration in the pace of COVID-19 vaccinations and the packageof $ 1.9 trillion economic stimulus from the government.

Job cuts announced by US-based companies in April 2021 fell by 25% compared tothe previous month, to 22,913, the lowest level since June 2000. Throughout 2021, employersannounced plans to cut 167,599 jobs from their payrolls. The sectors responsible formost of these cuts are Aerospace / Defense (32,003 vacancies) and Telecommunications (24,639).

Speech by senior members of the EDF (Williams, Bostic, Mester, Kaplan).

ACTIONS

The European DAX index closed today’s session slightly higher, impacted by good news about earningscorporate concerns and concerns about the increase in COVID-19 cases in India and Japan.European market open, AB Inbev and several banks showed positive results for the first quarter.In addition, optimistic order entry data for Germany’s factories and better retail sales thanthan expected in the eurozone supported investor optimism.

The French CAC 40 index closed the session today at the highest level at more than 20. In April, retail salesin France fell 1% on a monthly basis, but showed a 21.3% jump compared to the yearprevious. Banco Societe Generale’s shares rose 5.5% after posting a 4 times higher profitto that estimated by the market in 1Q21. On the other hand, Air-France KLM fell 2.6% when registering another hugea quarterly loss.

The Italian FTSE MIB closed higher in today’s session. Banco Unicredit’s shares appreciated 5%, after thefinancial institution presents results 2 times better than the guidance for the first quarter.Telecom Italia led losses with a 5.5% drop after Italian media reported that the projectnetwork with Open Fiber has been archived.

The English FTSE 100 closed higher again today, at the highest level of the last 14 months, amid thecontinued optimism about a solid economic recovery in the UK and earnings disclosure fromNext and Melrose Industries.

The Dow Jones rose for the fourth consecutive session to reach a historic high on Thursday, whilethe S&P 500 and Nasdaq traded lower. Vaccine makers’ actions came under pressure afterPresident Joe Biden said that he had supported a WTO waiver of intellectual property in relation tovaccines against COVID-19. PayPal reported better than expected earnings; IBM presented what it saysbe the world’s first 2-nanometer chip manufacturing technology for faster computing; it’s theUber signaled that it would pay drivers more to put cars back on the roads and released a$ 600 million charge to provide benefits to UK drivers.

Source:https://wintrademarkets.com