Juliana Calil

05/27/2021

Highlights

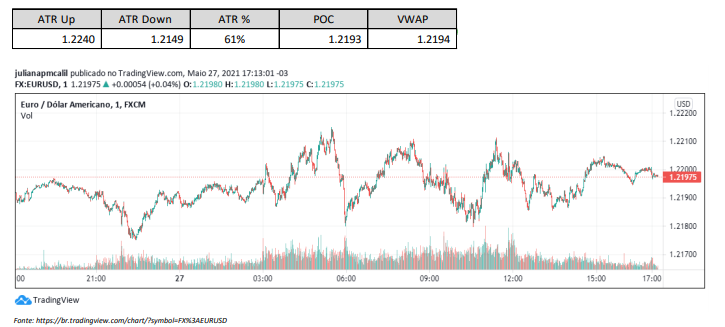

Another weak session for the EURUSD today, as the month of May draws to a close. The pair walks to close thesession at 1.2195, practically stable, very close to VWAP and POC, having today operated within the small range 1.2175- 1.2215. Demand for the pair remains low, pressured by an increase in global risk appetite, reinforced today after thedissemination of encouraging data regarding the economic recovery in the USA and the plans of the Joe Biden president, ofincrease public spending ($ 6 trillion federal spending budget in 2022)

Strategists believe that more solid data may come tomorrow, with readings on the main price indices around the world.consumer in April and a survey of purchasing managers, which would appreciate the US currency and pull theEURUSD value down. Today we learned that April durable goods orders contracted 1.3% compared to the previous monthhowever, the core reading rose to 2.3%, much better than expected in the market. 1Q21 GDP was revised upwards to 4.3%, andinitial unemployment insurance claims for the week ending May 21 fell to 406,000, the lowest weekly numbersince the pandemic hit the USA. Tomorrow, the EU will publish the May Economic Sentiment Indicator, and the US will publishPersonal Income and Personal Expenses in April and the PCE Price Index (the Fed’s favorite inflation indicator). And the market will beawaiting the Fed’s response to the inflation situation

DXY is trading at 90.0 on Thursday. Yields on US Treasury bonds convinced by 10years have now increased to 1.6045%. The USDJPY is oscillating close to $ 109.2. The USDCHF of $ 0.8967. Gold is beingtraded at $ 1,897 an ounce, and silver at $ 27.8, both up.

The main facts observed by investors at the moment are:

COVID-19

Black Americans are being hospitalized with Covid-19 at twice the rate of whites, according towith Covid-Net, a hospital surveillance network from the US Centers for Disease Control and Prevention.These disparities reflect the same inequalities in health and wealth that contributed to lower rates.of diabetes and obesity among blacks than among whites. Black and Hispanic communities wantvaccines more than white Republicans and evangelical Christians – and yet received less inComparation

Chile will turn to the bond markets to help finance the $ 10.8 billion earmarked for thefacing the pandemic. Expansion of aid to families and cash transfers to small businessescompanies will increase the country’s deficit. The measures will be paid for with the increase in copper prices, fundsgovernment sovereigns and debt issuance. Considering how crucial copper is in the transition to a worldcarbon-free, demand is expected to exceed supply this year due to the lack of investment by largemining companies.

MACROECONOMY

The number of Americans filing new claims for unemployment insurance dropped to 406,000 in the weekthe lowest level since the pandemic first hit the labor market in March2020 and below market expectations of 425 thousand. Many states have decided to withdraw from programsfederal unemployment insurance, after reports that it has been more difficult to hire, as benefits paymore than the minimum wage of most jobs.

Source:https://wintrademarkets.com/