Wyllian Capucci

05/31/2021

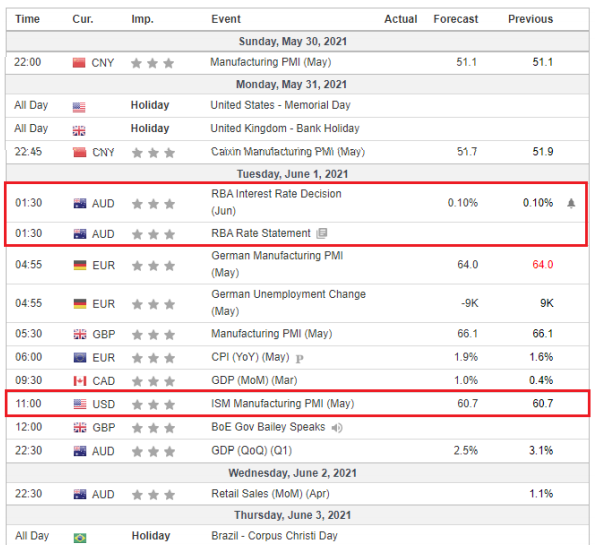

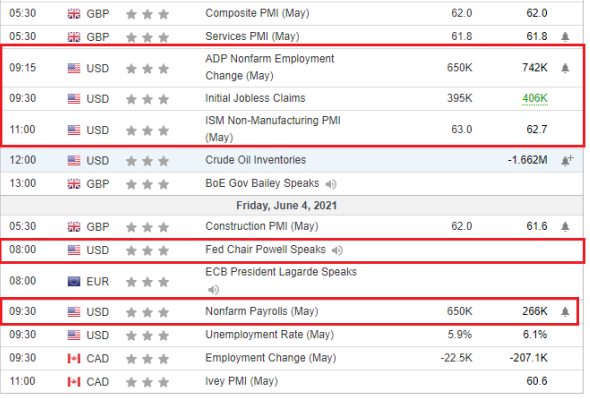

It will be a busy week with the US jobs report and manufacturing and manufacturing PMIsservices around the world providing an update on economic recovery as well.such as supply restrictions and price pressures. Other important releases include dataGDP in India, Brazil, Australia and Canada, monetary policy decisions by RBA and RBI andinflation for the Euro Area.

Trading Economics : In the US , the focus of investors turns to reporting jobs fromMay, which is likely to show an increase in payroll of 650 thousand, after aless than expected gain of 266 thousand in April; while the unemployment rate is fallingbelow the 6 percent mark for the first time since March 2020, when the pandemichit the job market for the first time. Meanwhile, ISM PMI surveys shouldsignal solid growth rates for manufacturing and services during the month of May, due tothe country’s reopening efforts, continued government support and one of themost successful vaccinations in the world. Other notable publications are factory orders;construction spending; ADP job change; IBD / TIPP economic optimism; Index ofDallas Fed manufacturing; and final readings of first quarter job productivityand Markit PMI surveys.

Elsewhere in America, the main data below includes GDP growth for theCanada’s first quarter and Markit’s current account, employment numbers and PMI surveys andIvey Business School; Mexico’s business and consumer morale and manufacturing PMI Markit; and the GDP, industrial production, foreign trade and PMI Markit figures for the firstquarter of Brazil.

In the United K the , final Markit PMIs should confirm that companies in the private sectorBritain had its best month in two decades in May, driven by growthrecord across the manufacturing sector and for the fastest growth in production sinceOctober 2013 in the service sector as a product driven by vaccines the reopening of theeconomy goes into gear. Still, the flash data showed that cost pressureswere the strongest in almost thirteen years. Meanwhile, the preliminary figures should showthat construction growth in the UK remains around the 6-1 / 2 highsyears old. Bank of England currency indicators, home prices across the country andnew car sales will also be in the spotlight.

In Europe , the preliminary impression of eurozone inflation for May is expected to show aaccelerating price pressures with the main number likely to reach the target of theECB of just under 2%, although the central bank mainly attributes this to the base effect.last year’s low. Other large European countries will also release flash data frominflation, including Germany, Italy and Spain. Meanwhile, investors will also be looking forward tolook at final Markit PMI surveys for the euro area, Germany and France, while Italyand Spain will publish their preliminary estimates. Other important economic datainclude: the eurozone unemployment rate, retail sales and producer prices; DataGermany’s unemployment and retail trade; Swiss first quarter GDP data,Manufacturing and retail sales PMI; and GDP data and consumer prices from Turkey infirst quarter.

In China , traders will turn their attention to the May PMI updates from NBS andof Caixin, with forecasts pointing to a steady growth in manufacturing activity, asthat the country continues its recovery from the coronavirus. In Japan, important data to beobserved include industrial production, retail sales, consumer confidence, spendinghouseholds, housing construction and the final estimates of Jibun Bank’s PMIs.

Reserve Bank of Australia and Reserve Bank of India will hold their policy meetingsmonetary policy, but no change is expected. In front of economic data, launchesimportant to Australia include first quarter GDP, current account,manufacturing and construction of the Ai Group, trade balance, building permits and loansreal estate; while in India, GDP data from January to March, foreign trade and theMarkit PMIs will be highlighted.

COT report

COT ES: + 4.7k ; Total = -18,488 (Previous week: + 13.7k ; Total = -23.191)COT NQ: -7.2k ; Total = -13,295 (Previous week: -91 ; Total = -6,102)EURO COT: + 4.14k ; Total = 104,000 (Previous week: + 5.95k ; Total = 99,858)COT LIBRA: + 5.76k ; Total = 30,659 (Previous week: -3.28k ; Total = 24,900)COT DXY: +96 ; Total = 2,780 (Previous week: +261 ; Total = 2,684)GOLD COT: + 15.75k ; Total = 214,642 (Previous week: + 6.63k ; Total = 198.889)COT CL: -457 ; Total = 475,490 (Previous week: -20.61k ; Total = 475,947)COT ZN: + 72.74k ; Total = 104,398 (Previous week: + 30.44k ; Total = 31.654).

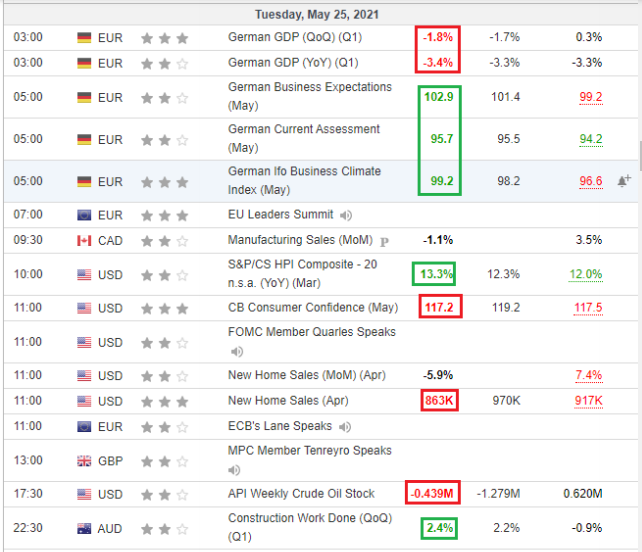

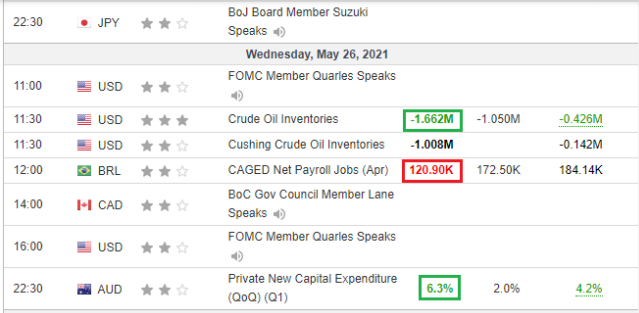

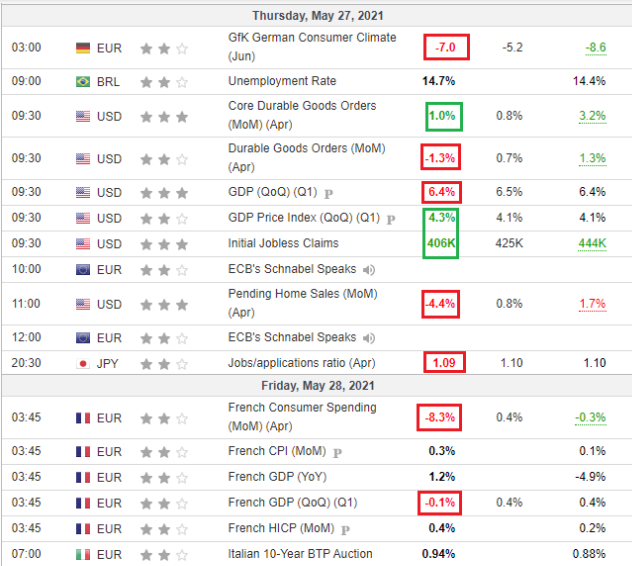

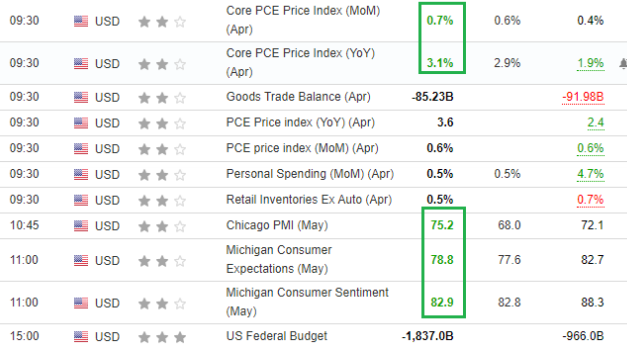

ECONOMIC CALENDAR (KEY EVENTS) – PREVIOUS WEEK

Highlights of the week:

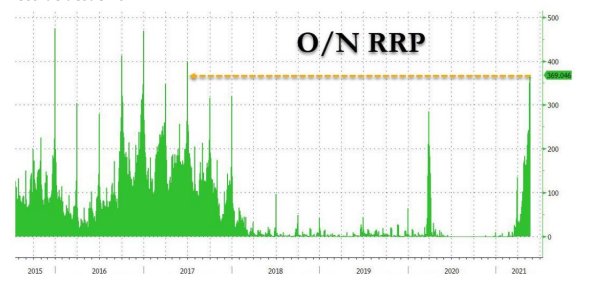

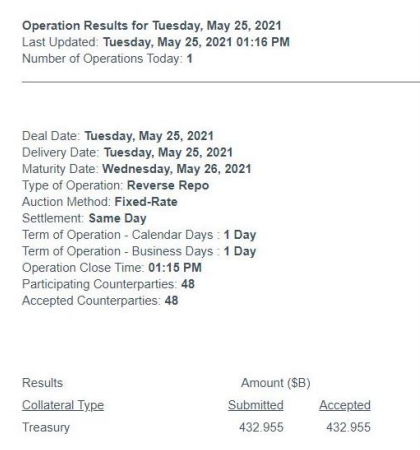

The biggest highlight of the last week was not related to the macro economic calendar, but to theaccumulation of Fed reverse overnight repurchase operations, which broke the historic high rising dayafter day, as well as the beginning of the “taper talking”, even if indirectly:

5/20/2021: Reverse overnight repo reached cumulative value of $ 351 billion, rising $ 58bi in one day.

5/21/2021: Reverse repo up $ 18 billion to $ 369 billion, new highrecord since 2017

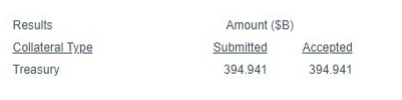

5/24/2021: Reverse repo rising to $ 394.94 billion

05/25/2021: $432.955 billion

05/27/2021: Reverse overnight repo reaches historic high: $ 485,329

Below, comments from the past few weeks by FOMC members and American officials regarding themonetary policy

BARKIN (RICHMOND FED):

“WHEN WE MAKE SUBSTANTIAL PROGRESS WE WILLSTART TAPERING ”

– BULLARD : “WE MAY BE “APPROACHING” THE POINT WHERE THE PANDEMIC ENDED,THEN ATTENTION COULD TURN TO THE POST-PANDEMIC MONETARY POLICY ”

– Lael Brainard : “The vulnerabilities associated with high risk appetite are increasing. THEcombination of extended assessments with very high levels of corporate indebtedness deservesattention due to the potential to amplify the effects of a repricing event. ”

– Robert Kaplan : “The Fed should start talking about reducing bond buying soon.” &“I’m starting to feel different about the advantages and disadvantages of QE purchasesfrom the Fed. ”

– Eric Rosengren : “The mortgage market probably doesn’t need as much support right now.”

– Yellen : “It may be that interest rates have to go up a little bit to ensure that oureconomy does not overheat, ”he said in an interview to Atlantic taped on Monday that it wasbroadcast on the web on Tuesday. “This could cause some very modest increases in the rates offees.

“In addition to tips from Fed members and robust economic data, banks and currency marketsare encountering problems related to EQ. First, banks are struggling to digestreserves they receive when the Fed buys assets from them (this is what Quantitative Easing is in practice, thepurchase of bonds, MBS and other assets by the banks’ Fed, injecting money into the banking system). LikeAs a result, its continued ability to facilitate additional amounts of QE is becoming increasinglyproblematic.Zoltan Pozsar, credit analyst and Fed specialist at Credit Suisse, summarized the situation as followsform.

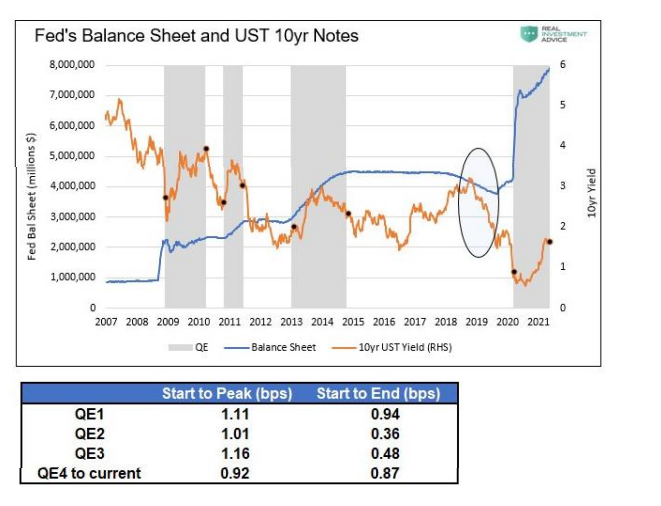

The graph shows that ten-year yields went up during each QE period and fell after their completion. At thecirculated stretch, yields fell even more aggressively when the Fed reversed QE by tighteningquantitative (QT) in 2019.

Strategies and plays for the beginning of tapering with possible movement of falling 10-year yields?

Gold, T-Notes, T-Bonds, financial sector and interest sensitive assets (Theme next classAmerican Market course).

ECONOMIC CALENDAR (KEY EVENTS) – NEXT WEEK

EARNINGS / BALANCE SHEET CALENDAR

Profiles (Friday closing)

ES : Short distribution in P pattern (Pullback in POC of Thursday)

NQ : Simple distribution

EURO : Long distribution in P pattern (“V” reversal)

LIBRA : Long distribution in P pattern (“V” reversal)

DX : Short distribution in P pattern (“V” reversal)

GOLD : Long distribution in L pattern

CL : Short distribution in P pattern

COPYRIGHT © 2021 Capital Builder

ALL RIGHTS RESERVED.This material is intended solely and exclusively for subscribers of the Capital Builder . No part of this material may be reproduced, transcribedor transmitted by any means or by any means, whether electronic, mechanical, photographic, magnetic or similar, without prior authorization andin writing by the copyright holder, pursuant to Law 5,988, of December 14, 1973, articles 120 – 130.

The ideas presented here reflect the author’s opinion, and should therefore not be confused with investment recommendations. Each reader isresponsible for its own investment decision