Juliana Calil

06/14/2021

Highlights

The third week of June will have a big and main event, which is the meeting of the Fed’s monetary policy committee, theFOMC, whose results will be released at 3pm on Wednesday. Apparently, no one will change their positions until then. Perhapsnor afterward, since everything indicates that, at this meeting, the Fed will not make any changes in policy. Not next time. Onlyafter the Jackson Hole Economic Symposium at the end of August

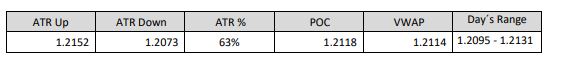

Over the course of today’s session, the EURUSD hit 63% of the ATR, and was virtually stable, closing near 1.2120 as well.close to VWAP and POC. The day’s range was even smaller than the last few days, but it offered good opportunities for themore patient scalpers

Since the release of the US inflation report for May/2021 last week, investors seem to have entered intoaccording to the direction of the FED and calmed down, maintaining this stability seen today as well as some days of the weeklast. The deal is: price pressures are transitory, they will last as long as the economy reopens and recovers from thecoronavirus pandemic, and is acceptable as long as wages do not increase at the same rate

The yield on the ten-year US Treasury bond, which monitors the flow of capital to the dollar, is atrecovery path, to 1.496% this afternoon, which represents an appreciation of 2.42%

The Dow Jones Industrial Average is expected to close down 0.25% today, while the S&P 500 is up 0.19%, reachinganother record level. The Nasdaq should close with an appreciation of 0.74%

High-growth technology-related stocks that lost value amid fears of rising yieldsUS Treasury bonds rebounded, to the detriment of industrial and financial companies

DXY is trading at 90.5, stable USDJPY is fluctuating near $110.1. The USDCHF of $0.8997. The Index ofDeutsche Bank Currency Volatility continues to decline, at a level close to 30%. Gold is trading at US$1,865an ounce, and a silver at $27.8

Source:https://wintrademarkets.com/