Juliana Calil

06/16/2021

Highlights

As expected, the Fed maintained its monetary policy, by keeping the interest rate at 0-0.25% pa, and the programpurchase of assets at $120 billion a month, reinforcing its commitment to the pursuit of full employment, pricesstable and moderate long-term interest rates.

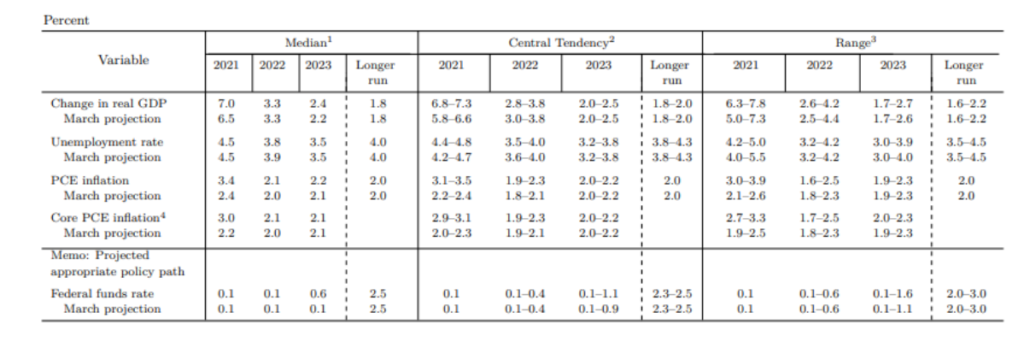

However, the Fed raised its projections for US inflation and GDP in 2021, as shown in the graph below, and anticipated theterm for raising interest rates. By 2023 the interest rate must be raised twice by 0.25%. This move suggeststhat the central bank is starting to take the pace of inflation more seriously as the market pressured it to do so

13 of the 18 FOMC members are in favor of at least an increase in interest rates by the end of 2023, compared to 7 in March.

At the press conference, Powell stressed that “The issue we are facing with this inflation (above estimates) has notnothing to do with the situation.” That’s because, according to Powell, “The question is: how to separate broad upward pressures on pricesof points outside the curve.” Powell repeated that “We believe that these factors are temporary, they will decrease, althoughmay seem uncertain at this point.” And that “We’re going to decrease (monetary stimulus) when we feel that the economyhas made substantial progress.”

Powell also pointed out that the process of “getting the US economy out of a deep hole” starts with a stimulusdemand, which has already been done, which is followed by the development of the supply chain, which should continue to happenand should appear with greater emphasis in the coming months

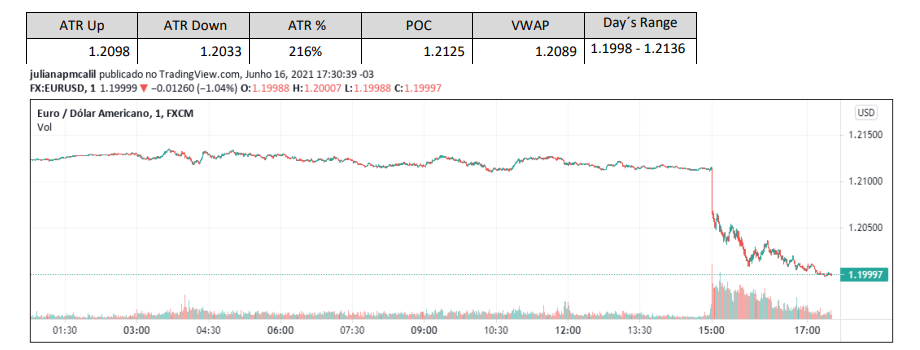

Over the course of today’s session, the EURUSD hit over 200% of the ATR, and plummeted sharply at the time of the release of thestatement from the FED, from 1.2115 to 1.2050, and from this level to close to 1.2000 while Powell led the press conferencepress

The yield on the ten-year US Treasury bond, which monitors the flow of capital to the dollar, had aday of strong high, of more than 5%, closing at 1.575% today. Rising interest rates make these bonds more interesting

All three major US stock market indices, the Dow Jones Industrial Average, the S&P 500 and the Nasdaq, shouldclose down today, of 0.77%, 0.55% and 0.25%, respectively

The DXY is trading at 91.4, up 0.92%. The USDJPY is fluctuating near $110.7. The USDCHF of $0.9082. ODeutsche Bank’s Currency Volatility Index continued to decline today, still close to 28%. The gold is beingtraded at US$ 1,821 an ounce, and silver at US$ 27.2, both falling, as capital migrated from these metals to thedollar and for treasury bonds in today’s session.

Source:https://wintrademarkets.com/