Juliana Calil

06/21/2021

Highlights

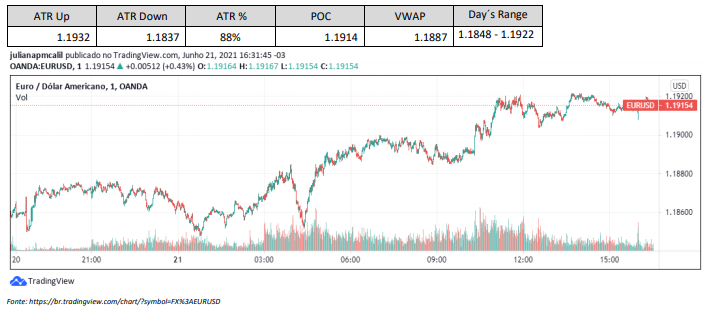

The month of June is coming to an end, with the EURUSD accumulating a devaluation of approximately 16%, alreadythat at the beginning of the month the pair oscillated close to 1.2230. Today, after reaching 1.1848, it should close around 1.1915. Overof today’s session, the EURUSD hit 88% of the ATR, on a day when the macroeconomic calendar had little to offer, butwith the reduction of investors’ anxiety about the changes that will be carried out by the Fed until 2023 in light of the recoveryof the US economy once the coronavirus pandemic is over. By the way, this week, only on Thursday and Fridaydata publications should move the market a little, regarding the revenues and spending of the North consumer.in May 2021 (which is the Fed’s favorite inflation indicator), and German consumer sentiment in July 2021.This week’s speech by Jerome Powell on the Fed’s emergency lending programs and theits current policies, to the US House Subcommittee on the Coronavirus Crisis. Investors look for clues aboutof the monetary stimulus reduction schedule and its consequent increase in the interest rate. Powell speaks Tuesday morningfair.

Across the Atlantic, ECB President Christine Lagarde told the European Parliament that it was not yet time toincrease interest rates and that a tightening in financing conditions would be premature and would pose a risk to theongoing economic recovery and for the inflation prospects of the bloc.The yield on the ten-year US Treasury bond, which monitors the flow of capital to the dollar, had ahigh day of more than 3%, closing at 1.487% today, after 3 days of declines.All three major US stock market indices, the Dow Jones Industrial Average, the S&P 500 and the Nasdaq, shouldclose higher today, of 1.77%, 1.32% and 0.7%, respectively. Analysts said this high suggests that concernswith last week’s interest rates may have been exaggerated, as any increase in rates would be marginal and hencemore than a year ago. In addition, the returns accumulated this year were high, facilitated by the Fed’s stance, with interest rateslow and an economy in full recovery. In fact, there is much more to celebrate than to regret.

DXY is trading at 91.8, down 0.4%. The USDJPY is fluctuating near $110.2. The USDCHF of $0.9178. ODeutsche Bank’s Currency Volatility Index rose today, reaching close to 40%. Gold is being tradedat $1,782 an ounce, and silver at $25.9, both up, in recovery from last week’s declines

Source:https://wintrademarkets.com/