Juliana Calil 06/30/2021

Highlights

In this June 2021 Payroll release week, in which economists expect 683,000 jobs have beencreated, according to a Dow Jones survey, the USD has strengthened.

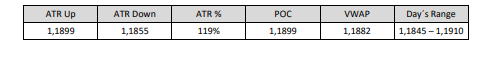

In today’s session, the EURUSD had another session of decline, of 0.32%, closing the month of June at 1.1859, well below bothof the POC and VWAP, reaching 119% of the ATR. The pair traded at 1.1844, the lowest level of tradingsince early April 2021, under pressure, struggling to stay above 1.1845. During the session, they favored the USD oADP employment report, which showed the creation of 692,000 jobs in the US private sector in June (best of the year).than the expectation of 600,000) and comments from an important high-ranking member of the EDF, stating that “it is ready todecrease (monetary stimulus) earlier because of questions about efficacy and side effects.” The USD caught up on thisJune its highest monthly appreciation since November 2016, of 2.6%. In the first half of this year, the USD advances 2.5%,best half-yearly performance since 2019.

In the early hours of the morning, the inflation rate for June/2021 in the European Union was released. The annual rate decreased to 1.9%,in line with market projections. Prices decelerated for energy (12.5% vs 13.1% in May) and services (0.7% vs1.1%), but inflation accelerated for non-energy industrial goods (1.2% vs 0.7%) and food, alcohol and tobacco (0.6% vs 0.5%).The monthly rate was stable at 0.3%.

The yield on the ten-year US Treasury bond, which monitors the flow of capital into the dollar, shouldclose today with a drop of 1.04%, at 1.465.

Among the top three US stock market indices, the Dow Jones Industrial Average is expected to close with a rise of0.61%, followed by the S&P 500, which increased by 0.21%. The Nasdaq showed a mild devaluation of 0.17%. OS&P 500 is up 14.4% for the year to date, while the Nasdaq Composite and Dow have gained more than 12% each. In the quarter,the S&P 500 rose 8.2%. And the future perspectives are great. Whenever there was a double-digit gain in the first half, theDow and the S&P 500 never ended that year with an annual decline, according to Refinitiv data dating back to 1950.

In Europe, the STOXX 600 index managed to rise more than 2% in June, its fifth consecutive month of gains. DAX closedJune on the rise, ending this quarter with more than 3% appreciation.ATR UpATR DownATR %POCVWAPDay’s Range1.18991.1855119%1.18991.18821.1845 – 1.1910

the spread of the highly infectious Delta variant of COVID-19 has worried investors for itsimpact on the global economic recovery, the dollar has provided the necessary security. DXY is trading at 92.3,with an increase of 0.32%, at its highest value in the last 3 months. The USDJPY is fluctuating near $111.1. The USDCHF of $0.9251.Gold is trading at $1,769 an ounce, and silver at $26.1.

Source:https://wintrademarkets.com/