Juliana Calil

07/07/2021

Highlights

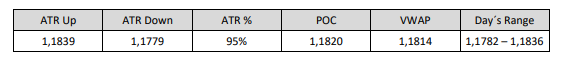

Given the expectation that the minutes of the FOMC meeting held on June 16 would confirm the anti-inflationary stanceadopted in the speech of some of the high-ranking members of the Fed, in today’s session, the EURUSD dropped 0.3%,closing at a level close to 1.179, below both the POC and the VWAP, reaching 95% of the ATR. the pair becametraded at 1.1782, before the release of the minutes, but soon returned to levels above 1.18. The USD remains valued, toas investors expect the US economy to continue to progress

In the minutes released today, the Fed reiterated its intention to give notice well in advance of the reduction in the pace of asset purchases.According to the minutes, “substantial further progress” has not yet been achieved, therefore, the Institution has reasons tokeep monetary stimulus at current pace. The minutes did not make it clear when the FED will begin to change monthly purchases ofbonds and interest rates, currently close to zero. But it showed that the debate on these policies started for real, withsome members presenting a widely divergent set of views on the risks facing the US economy.faces, the level of uncertainty and even investigating details such as restricting the purchase of mortgage-linked securities morefaster than US Treasury bonds

The FOMC meets eight times a year, with the next two meetings scheduled for July 27-28 and September 21-22.In the meantime, the Fed will hold its annual research conference in Jackson Hole, Wyoming, an occasion used to signalpolicy changes. Economists polled by Reuters expect the Fed to announce a strategy to reduce its purchases ofassets in August or September 2021, with the first cut occurring early next year

The yield on the ten-year US Treasury bond, which monitors the flow of capital into the dollar, shouldclose today with another sharp drop, of 3.8%, at 1.318, after reaching 1.2960 earlier, the lowest value in more thanfour months, and an important technical plateau as investors are looking for the safety of the USD.

Earlier in the day, Germany published the Industrial Production for the month of May, which fell 0.3% from the previous month, downexpectations of investors. In the year, production grew 17.3%, below the 34.5% expected. Unexciting dataon the European economy like this has also helped the USD appreciate

Among the top three US stock market indices, the Dow Jones Industrial Average, the S&P 500 and the Nasdaq closedtoday on the rise, by 0.30%, 0.34% and 0.05%, respectively.

The DXY is trading at 92.7, up 0.2%. The USDJPY is fluctuating near the $110.6. The USDCHF of $0.9255. The goldis trading at $1,803 an ounce, and silver at $26.1.After the publication of the FOMC minutes, the market’s attention turns to the release of the minutes of the monetary policy meeting of theECB, which happens tomorrow.

This week, high-ranking members of the European Central Bank will be meeting to discussthe biggest revision of the Institution’s strategy in almost 20 years, including a new formulation of the inflation target.Tomorrow, as every Thursday, the United States will publish the weekly unemployment insurance claims figures.