COT report

ES COT: + 54.5k ; Total = 23,189 (Previous week: + 48.6k ; Total = -31,287)

COT NQ: -18.1k ; Total = -23,493 (Previous week: -26.5k ; Total = -5,388)

EURO COT: -12.4k ; Total = 125,988 (Previous week: -1.4k ; Total = 138,365)

COT LIBRA: + 5.1k ; Total = 36,082 (Previous week: + 8.8k ; Total = 30,978)

COT DXY: + 3.75k ; Total = -10,103 (Previous week: +436 ; Total = -13,851)

GOLD COT: -26.1k ; Total = 189,638 (Previous week: -18.96k ; Total = 215,733)

Profiles (Friday closing)ES:

Long distribution in P pattern NQ:

Long distribution in L pattern EURO:

Short distribution in L pattern LIBRA:

Short distribution in L pattern with rejectionGOLD: Simple distribution.ZN: Simple Distribution

Weekend HEADLINES:– BIDEN $ 1.9TRI PANDEMIC STIMULUS DRAFT LAW APPROVED ON SATURDAY FROMMADRUGADA ON THE SENATE. RETURN NOW TO THE CHAMBER FOR APPROVAL, THAT WILL BE ON TUESDAYMARKET.

– An official spokesman for the Ministry of Energy said that one of the oil tank farms in theRas Tanura Port in the Eastern Region, one of the largest sea oil ports in the world, wasattacked this morning by a drone, coming from the sea.

The spokesman added that another deliberate attempt was also made tonight to attack theSaudi Aramco facilities. Shrapnel from a ballistic missile fell near the residential area ofSaudi Aramco, in the city of Dhahran, where thousands of company employees and their families liveof different nationalities.

The spokesman said that both attacks did not result in any injury or loss of life orassets.In his statement, the spokesman stressed that the Kingdom condemns and criminalizes these repeated acts ofsabotage and hostility. The Kingdom invites the nations and organizations of the world to unite againstthese attacks, which target civilian objects and vital installations.

These acts of sabotage are aimed not only at the Kingdom of Saudi Arabia, but also at security andstability of the energy supply to the world and, therefore, the global economy.

They affect thesecurity of oil exports, freedom of world trade and maritime traffic.They also expose the coasts and territorial waters to serious environmental catastrophes due to thepotential oil spill or oil products.

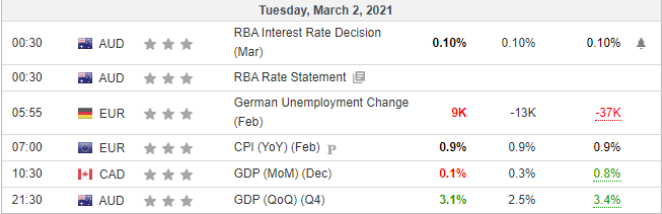

ECONOMIC CALENDAR (KEY EVENTS) – PREVIOUS WEEK

Highlights

-Payroll well above expectations, crushing expectations.

-PMI’s showed expansion, but most of them lost expectations (below expectations).

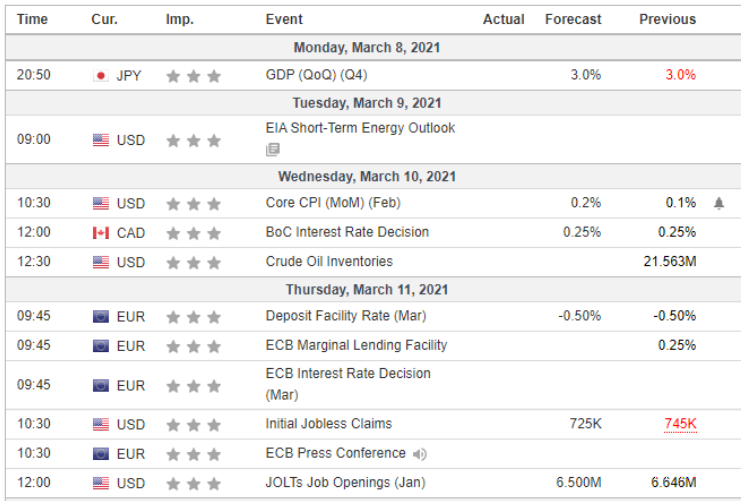

ECONOMIC CALENDAR (KEY EVENTS) – NEXT WEEK

BALANCE SHEET CALENDAR

Trading Economics:

In the US, the February consumer price report probablywill show the inflation rate rising to its highest one-year high, at 1.7 percent, approaching theUS Federal Reserve target of about 2 percent and raising concerns forinvestors about an increase in borrowing costs. At the same time, the preliminary estimate Michigan consumer sentiment for March is likely to show a slight improvement inmorale, helped by the acceleration of vaccination rates and the prospect of further stimulus of thegovernment. Other notable publications include producer prices, job openings at JOLTs,statement of the government’s monthly budget and the final reading of wholesale stocks.

Elsewhere in America, Canada’s central bank is likely to leave interest rates atrecord low levels when it meets on Wednesday. Important data to follow includes data fromemployment in Canada; Mexico’s inflation rate, consumer morale and industrial production; and traderetailer in Brazil, consumer confidence and consumer prices.

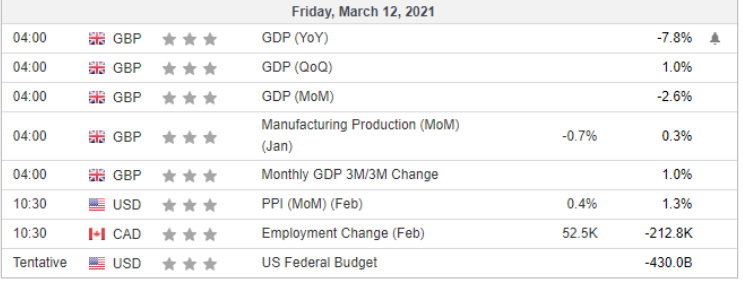

In the UK, investors will turn their attention to monthly GDP figures, along withindustrial production, construction production and the trade balance. ONS numbers shouldshow that Britain’s economy returned to contraction in January, with industrial productionfalling for the first time since April’s record drop. Elsewhere, the governor of the Bank ofEngland, Andrew Bailey, is expected to speak at the Resolution Foundation on Monday.

In Europe, the European Central Bank will decide on monetary policy and disclose its projectionsrecent macroeconomic conditions, with investors looking for any signs of changes inpolicies to support the economy amid rising bond yields. In front of diceeconomic data, updated eurozone fourth-quarter GDP figures will be available,as well as industrial production in Germany, France, Italy and Spain. Other important publicationsare Germany’s foreign trade and current account; Retail trade in Spain; Rate ofunemployment in Switzerland; Ireland’s inflation rate; and unemployment rate in Turkey, productionindustrial and retail sales.

In Asia, China will publish inflation data for February, with markets pointing to anotherdrop in consumer prices and the biggest increase in producer prices since November 2018

In addition, trade data will provide insight into post-pandemic economic recovery, withexports and imports increased sharply in January-February.

Elsewhere, Japan’s key figures include the final GDP reading for the fourth quarter, sayshousehold expenses, producer prices and Eco Watchers Survey. Investors in Australiawill turn their attention to NAB’s business confidence, Westpac consumer confidence and thefinal reading of building permits. The Reserve Bank Governor of Australia, Philip Lowe, willprepared comments on monetary policy at the Australian Financial Business ConferenceReview.

Other highlights include: rate of inflation and industrial production in India; GDP figures for the quarterSouth Africa quarter, current account, manufacturing production and mining; and New ZealandBusiness NZ PMI.