Highlights

The week starts with EURUSD under pressure, as the US economy takes off in the post-pandemic and the European continues to skid. The FOMC (Fed monetary policy committee) meeting is the main event of theweek, and the minutes of the meeting are released on Wednesday afternoon, with a consensus pointing to optimismon growth projections, but still dovish, at least until substantial progress is made on both employmentand inflation.

Among the data to be released this week, the following stand out:

- Monday, 3/15

•Wholesale prices in Germany

•NY Empire State Manufacturing Index ( assesses the relative level of the general conditions ofbusiness in the state of New York)

•Eurogroup meeting (European finance ministers will discuss support measuresand the impact of the pandemic on the various sectors of the bloc’s economy)

Tuesday, 3/16

•Japan’s Industrial Production

•Inflation in France

•Inflation in Italy

•ZEW Monthly Economic Sentiment Indicator for Germany•ZEW Monthly Economic Sentiment Indicator for the Euro Zone

•US retail sales

•Industrial Production in the USA

Wednesday 3/17

•Euro zone inflation

•US construction industry

•Result of the FOMC meeting (minutes, decisions and press conference)

Thursday, 3/18

•Presentation by ECB President Christine Lagarde

•Eurozone trade balance

•Eurozone labor cost

•As on every Thursday, the US labor market

Friday, 3/19

•Germany’s producer price index (PPI)

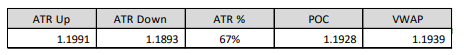

In today’s session, EURUSD, which opened at 1.1951, fell to a level of 1.1920, before the opening of the North American market.References indicate that EURUSD should reach the 1.1930 level in the coming hours.

DXY is being traded at the level of 91.8 thousand points. The USDJPY is oscillating close to 109.2. The USDCHF of $ 0.9298. THEgold is trading at $ 1,731 an ounce, and silver at $ 26.2 an ounce.

The main facts observed by investors at the moment are:

COVID-19

The infection rate continues to increase in Germany. The Netherlands has become the last country to discontinue useAstraZeneca / Oxford vaccine due to concerns about possible side effects after Norway, Iceland,Bulgaria, Luxembourg, Estonia, Lithuania and Latvia have also done so.

FISCAL POLICY

The federal government’s revenue in the United States has been declining since 1990.In the face of the challenges imposed by the pandemic, the expenditures of that same government have never been so high. Since the campaignelection, Biden has been talking about a tax hike that would raise up to $ 2.1 trillion over a decade.A date has not yet been set for the announcement of this plan, but everything indicates that it will follow the approval of the package.$ 1.9 trillion. Therefore, the market is now preparing for a tax increase, including: increased tax rateof the IRPJ from 21% to 28%, increase of the IRPF rate for individuals with income above US $ 400 thousand per year, reductionof tax benefits for pass-through companies, such as limited liability companies, expanding the reachproperty tax, and increased capital gains tax for individuals with an income greater than $ 1million a year. That done, the Biden government should focus on investment in infrastructure, which could provide the kindof lasting economic gains that not only support higher wages, but also promote the diffusion of thesegains between the different social strata.✓

MACROECONOMY

The New York Empire State Manufacturing Index jumped from 12.1 in February to 17.4 in March 2021,exceeding market forecasts of 14.5. Looking to the future, companies remained optimistic aboutthat conditions would improve in the next six months (36.4 vs 34.9), which would generate significant increasesin the business market.

Wholesale prices in Germany jumped 2.3% in February 2021 compared to the previous year. The biggestimpact of ores, metals and semi-finished metal products (15.3%) due to the very high prices ofiron ore in international markets. The prices of used and residual materials (48.3%) and grains,raw tobacco, seeds and animal feed (15.5%) also pushed up wholesale prices,while the main downward pressure came from the cost of live animals (-26.3%) and meat (-5.6%). In a basewholesale prices rose 1.4% in February, after a 2.1% increase in January.

OTHERS

Bitcoin fell more than 6% today, to $ 57,000, after reaching the historic high of $ 61,700 over the weekend.The virtual currency has almost doubled in price so far this year, driven by institutional buying and its appeal asprotection against potential inflation, after companies like automaker Tesla and Mastercard said thatwere adopting cryptocurrency