Juliana Calil

04/21/2021

Highlights

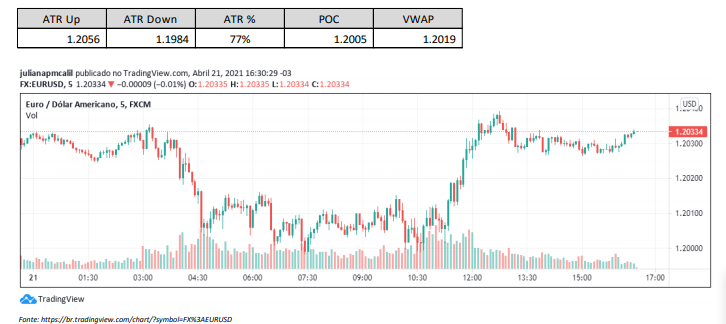

The increase in the number of COVID-19 diagnoses in countries like India, Canada and Japan has left investors morecautious during the first part of today’s session, which favored the dollar. However, the results disclosure seasonQ1 corporate figures left investors more optimistic about the recovery of the private sector after thepandemic. Thus, even after reaching 1.998, EURUSD returned to the level of 1.2035.

The meeting of the European Central Bank’s monetary policy committee, whose decisions will be released tomorrow, should notsurprise the market, which does not expect changes in interest rates or economic projections. However, investorsmust observe the pace of purchases by the PEPP (Pandemic Emergency Purchase Program). The Committee left this programunchanged at its March meeting, at EUR $ 1.85 trillion in bond purchases through March 2022, but decided to acceleratebond purchases on a monthly basis to alleviate some of the upward pressure on sovereign debt yields in the region.In March, the PEPP purchased EUR $ 74 billion, up from the EUR $ 53 billion in March and the EUR $ 60 billion in January and February

DXY is being traded at the level of 91.1 thousand points. The USDJPY is oscillating close to $ 108.0. The USDCHF of $ 0.9169.Gold is trading at $ 1,793 an ounce, and silver at $ 26.5 an ounce.

The main facts observed by investors at the moment are:

COVID-19:

The State Department strongly recommended that US citizens reconsider all travelabroad and said it would issue specific warnings not to visit around 80% of the countries in the world with theobjective of controlling the spread of COVID-19 in the country.

Spain has reached a milestone in its vaccination efforts, as the number of people finally vaccinatedhas exceeded the number of people infected with the virus since the beginning of the pandemic.

FISCAL POLICY:

The European Union’s plan to raise EUR $ 750 billion in financial markets to financeprojects throughout the block and thus reduce the economic shock of the Covid-19 crisis, has been at a standstill since the end ofMarch, when Germany’s highest court raised concerns that the additional loan could becomea permanent feature of EU policymaking. After defining that the funds in question should beused exclusively to deal with the consequences of the pandemic, with limits on volume, duration andpurpose of the loan, the path has been cleared. Austria, Estonia, Finland, Hungary, Ireland, Lithuania, Netherlands, Polandand Romania are yet to go through the same process from now on. If all goes well, the first disbursementsmay happen as early as July 2021.

MACROECONOMY:

Mortgage applications in the US increased 8.6% in the week ended April 16, 2021,the first increase in seven weeks, with interest rates dropping to their lowest levels in about two months.House refinancing increased by 10.4% and purchase orders for a house increased by 5.7%. The interest rateaverage for 30-year fixed-rate mortgages dropped to 3.2%, the lowest in two months.

SHARES:

The top 3 US stock indices today recovered part of the declines seen in the last 2 days. DowJones is up 0.82%, S&P 500 is up 0.77% and Nasdaq 0.75%. In today’s session, Netflix shares fellaround 7% because, even though the company reported better than expected results, it did not reach the target ofsubscribers for the first quarter. The results published today by Verizon and NextEra Energy outperformed thosepredictions. In Europe, the Spanish IBEX 35 closed with an increase of 0.7%. The German index the DAX 30 closed up 0.85%with Akzo Nobel, Roche and Heineken showing strong quarterly results. The French CAC 40 closed with a high of0.7%, with Carrefour posting a 4.2% increase in revenue (same stores) in the first quarter, and Kering,conglomerate of the luxury market, reporting higher revenues than those obtained before the pandemic, mainlydepending on Gucci’s performance.