Daily news and analysis

Juliana Calil

Company Administrator

“I have a degree in Business Administration and I worked for several years in the Investor Relations area of publicly traded companies. I left the market to have my 3 daughters and came back to take on this opportunity at Win$, developing and sharing content, in order to support traders decisions .”

Juliana Calil

March 3, 2021

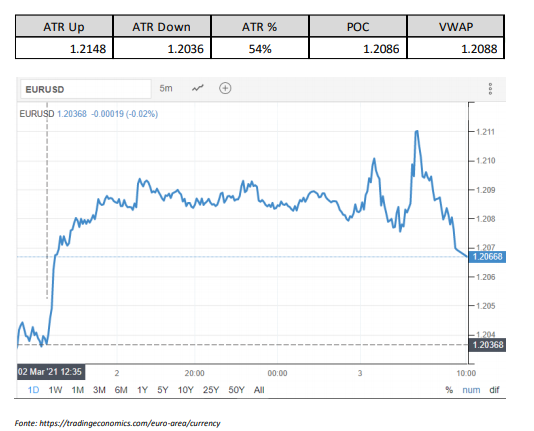

In the last part of yesterday’s session the EURUSD shot up, closing with a 0.35% appreciation at 1.2089. Today, after opening in1.2084, the EURUSD rose, reaching the level of 1.2112 on two occasions, but continues to oscillate around the POC and VWAP,close to 1.2086. Although the references indicate a probable drop in the value of EURUSD, in Payroll week the assettends to rise the day before and fall the day.

Good news about vaccines and greater fiscal stimulus is injecting optimism into the financial market. During the night, theMSCI Asia Pacific index added 1.3%, while Japan’s Topix index closed 0.5% above. In Europe, the Stoxx 600 Indexgained 0.5% at 5:50 am Eastern Time, with banks among the best performers. The S&P 500 futurespointed to a lot of green at the opening, the 10-year Treasury yield was at 1.445%, oil rose and golddropped down.

DXY is being traded at the level of 90.9 thousand points, with appreciation. The USDJPY is oscillating close to 107.0 and the USDCHFof $ 0.9174. Gold is trading at $ 1,723 an ounce, and silver at $ 26.6 an ounce.

The main factors considered by investors for their decision making at the moment are:

COVID-19:

While Texas Governor Greg Abbott announced that he was lifting some restrictionsanti-pandemics, such as the mandatory use of the mask in public places, US President Joe Biden has warnedthat the battle to defeat the virus is far from over and stated yesterday that by May 2021 allAmerican adult will have received at least the first dose of the vaccine and that in 1 year the country will be able to return to normal. He announced that Merck will help manufacture the Johnson & Johnson single-dose vaccine. Biden askedthat state and local governments prioritize vaccination for teachers and caregivers of children, so thatschools reopen safely, with full-time classes, by the end of this month. The number of diagnosesCOVID-19 diaries in the U.S. dropped to less than 50,000 for the first time since October 2020.

Japanese Prime Minister Yoshihide Suga said that the emergency situation established in the region ofTokyo, scheduled to expire on March 7, can be extended for another two weeks, to control therate of infections, which have slowed, but not as fast as some officials expected.o Brazil reported a record daily number of deaths as the resurgence of the virus fills the beds ofhospitals and pressures local governments to demand more drastic measures to contain the contagion

FISCAL POLICY:

US senators today begin the debate on the approval of the stimulus package$ 1.9 trillion budget, with majority leader Chuck Schumer saying he has enough votes to approve it.Schumer will need the support of all 48 Democrats, the two independent senators who agree with them, andVice President Kamala Harris also voted to approve the package before March 14, whencurrent benefit payments. How Republicans would need to withdraw just one Democratic vote to reshapesome provisions, the final form of the project remains uncertain. The version of the bill approved by the Chamberwould pay for vaccines and medical supplies and send a new round of emergency financial aid to families,small businesses and state and local governments. Includes US $ 1,400 in direct payments to individuals, insurance$ 400 weekly unemployment until August 29, 2021 and help for those who have difficulty paying rentand residential mortgages during the pandemic. As soon as the Senate votes on the package, possibly by the end of this week,the House will have to sign it one last time before sending it to Biden for it to be made into law. The leader of themajority in the House, Steny Hoyer, said the final vote would come next week.✓

MONETARY POLICY:

The issue of liquidity is coming up again, warned a report by the Bank of InternationalETFs Settlements – or Exchange Traded Funds, published this week. FED Governor Lael Brainard saidon Monday that vulnerabilities in the Treasury market warrant careful analysis. Although bankscentral banks have become an important source of liquidity in recent years, there are also signs that they areless willing to intervene in the next periods of tension.✓

MACROECONOMY:

Producer prices in the Eurozone increased by 1.4% in January 2021 compared to the previous month, abovemarket forecasts of 1.2%. It is the biggest gain in the PPI since January 2006. Year by year, pricesstagnated.o Mortgage applications in the United States increased 0.5% in the week ending February 26, afterthree consecutive periods of declines due to rising mortgage rates. Refinancing ordersof a home loan were 7% higher than a year ago; and those to buy a homeincreased by 1% in the same comparison. The average interest rate for 30-year mortgages increased by 0.15 pointspercentage, to 3.23%, the biggest weekly increase since March last year.

OTHERS:

Bitcoin rose more than 5%, to a record high, above $ 58,000, after companies like Tesla andMastercard said they were adopting the cryptocurrency. Nigeria is the third country in the world in terms ofnegotiations between people, behind the United States and Russia. Since 2020, Nigeria has been suffering from fallingdemand and the price of oil, the main factor in its GDP. As a consequence, foreign exchange reserves fell and inflationshot. The government devalued the local currency and limited international transactions with foreign currency and accessto the dollar at US $ 200 per month for each citizen – something similar to what happens in Argentina. Digital assets, in addition tohelp protect assets, still function as a means of making international money remittances. THENigerian model shows a very interesting suitability of cryptocurrency and maybe even a glimpse of what will be thefuture, especially in economically unstable countries

March 2, 2021

Highlights

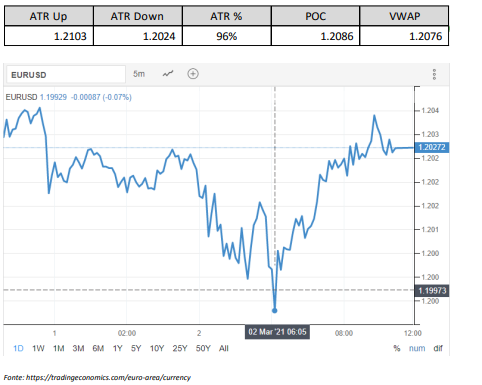

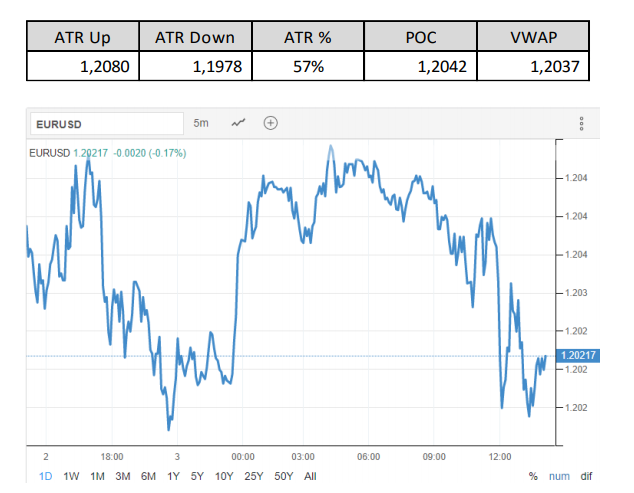

In yesterday’s session the EURUSD closed with a drop of 0.22%, very close to the POC, which was at 1.2042. Today, after openingin 1.2049, EURUSD fell to the level of 1.1994, from where it quickly returned to the POC and VWAP region, close to1.2020. Today, before the opening of the North American market, EURUSD was operating in a slight decline. Most of the referencesare close to 1.2020.

EURUSD fluctuates under pressure, after economic data shows that German retail sales have fallen for the second monthconsecutive January, and at a faster than expected pace, and that the level of unemployment in Germany and Spainincreased in February. However, Christine Lagarde promised yesterday that financing conditions will no longer berestrictive prematurely, ensuring that European businesses and families will have access to the finance they needto face this crisis.

HSBC published a note stating that “In the past two years, EUR / USD movements have been much more associated withother investment flows. Foreign exchange hedge flows have become more important and may remain so in the futurepredictable. The euro is likely to rise against a weaker dollar in 2021, given that US monetary conditionswill remain loose and risk appetite will remain more supported. However, if US short-term interest ratesstart to move more, or the long-term yield differentials become much more considerable, we maysee a more persistent recovery of the US dollar ”. The note points to a short-term resistance at 1.2062. TheCredit Suisse said it works with a 1.1800 low outlook at the end of November 2021.

DXY is being traded at the level of 91.1 thousand points, with appreciation. The USDJPY is oscillating close to 106.9 and the USDCHFof $ 0.9176. Gold is trading at $ 1,730 an ounce, and silver at $ 26.3 an ounce.

The main factors considered by investors for their decision making at the moment are:

- COVID-19:

- The number of new coronavirus infections increased globally last week for the first time inseven weeks, the World Health Organization said on Monday: it is too early for countries to trustvaccination programs and abandon other measures.

- European Commission President Ursula von der Leyen acknowledged to the Financial Times that she and her colleaguesunderestimated the complexity of the vaccination campaign against COVID-19 in the block and that only insecond quarter of 2021 the campaign will achieve planning, as the supply ofvaccines, which was recently renegotiated, will be reinstated. The Czech Republic’s hospital system ison the verge of collapse. With 10.7 million inhabitants, the country has 150 thousand people infected at the moment,of which almost 1,600 are in serious condition. In Italy, the new government should seek greater fiscal incentives,probable 32 billion euros, as the country’s economy remains far from returning to normal. At Germany, where unemployment rose for the first time in eight months this February, leaders are understrong pressure to seek a way to resume the economy with the pandemic under control. The lockdown oncountry should extend until March 28. The government of Spain has decided to prolong its current restrictions onnon-essential travel from countries outside the European Union by 31 March. China has set a target ofvaccinate 40% of its population by the end of June. So far only 3.5% of Chinese have been vaccinated, despitethe most populous country in the world recorded only 11 new cases of COVID-19 yesterday. In Israel, whichmanaged to mount an efficient vaccination campaign, more than 51% of the population took at least onedose and almost 37% took two.

- Among the new variants of the coronavirus, two stood out especially: B.1.1.7, identified by the firstBritain, which demonstrated the power to spread quickly, and B.1.351, from South Africa, which candodge human antibodies, decreasing the effectiveness of some vaccines. Now a third variantbegins to worry: P.1, identified in Brazil, discovered in late December. Three studies are concludingthat the power of this variant is different from the others: the ability to infect people who had already createdimmunity through previous Covid-19 exposures, and to weaken the effect of the Chinese vaccine onuse in Brazil. The new studies have not yet been published in scientific journals. Its authors warn thatdiscoveries have only begun to understand the behavior of P.1. “The findings apply to Manaus,but I don’t know if they apply to other places, ”said Nuno Faria, virologist at Imperial College London who helpedconducting much of the new research. P.1 is spreading across the rest of Brazil and has already been foundin 24 other countries. Experts reiterate that masks and social distance can work against P.1.And vaccination can help both reduce transmission and protect infected people from evolving into casesserious

- FISCAL POLICY:

- US Senate voting on the $ 1.9 trillion package is due to begin on Wednesday.

- MACROECONOMY

- Eurozone consumer price inflation is expected to remain stable at 0.9% in February 2021compared to the previous year, in line with market expectations. Energy prices are expected to falla smoother pace (-1.7%), and rising in services (1.2%), non-energy industrial goods (1.0%) and food,alcohol and tobacco (1.4%). The core of annual inflation, which excludes volatile prices for energy, food, alcohol andtobacco and for which the ECB analyzes its policy decisions, is expected to decelerate to 1.1% in February.

- Retail sales in Germany fell 4.5% in January 2021 compared to the previous month, due to thepartial closure of commercial activities in the country since December 16. Compared to Februaryby 2020, sales were 5.8% lower. Sales of non-food products decreased by 16.4%,especially textiles, clothing, footwear and leather articles (-76.6%) and furniture, appliances and materialsconstruction (-43.2%). On the other hand, sales increased by 4.3% in food, beverages and tobacco, whileInternet and direct mail sales grew 31.7%.

- The number of unemployed in Germany increased by 9 thousand, to 2.752 million in February 2021, inline with market expectations, of a reduction of 13 thousand. The unemployment rate remained unchangedby 6.0%

March 1, 2021

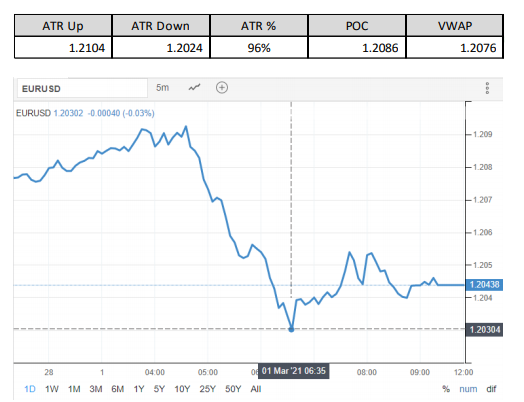

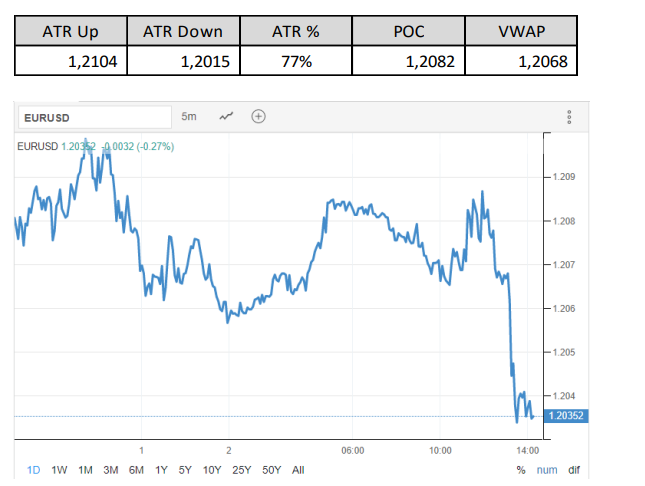

No final EURUSD session yesterday was withdrawn, recovering all the appreciation that took place throughout the day. The asset opened at 1.2163, reached 1.2243 and closed at 1.2176. For much of the day, the asset fluctuated outside the ends of the ATR, both above and below. The day’s POC stood at 1.2226 and the VWAP at 1.2202. Today, before the opening of the North American market, EURUSD was operating in decline after opening at 1.2158 and falling to the level of 1.2090, below the day’s ATR Down.

DXY is being traded at the level of 90.7 thousand points, with appreciation. The USDJPY is oscillating close to 106.3 and the USDCHF of $ 0.9058. Gold is trading at $ 1,760 an ounce, and silver at $ 26.8.

DXY is being traded at the level of 90.7 thousand points, with appreciation. The USDJPY is oscillating close to 106.3 and the USDCHF of $ 0.9058. Gold is trading at $ 1,760 an ounce, and silver at $ 26.8.

The rise in US Treasury bond yields, driven by expectations of a strong economic recovery driven by more fiscal stimulus, low interest rates and an efficient vaccination program against COVID-19, has been provoking USD appreciation. The yield on the 10-year bond reached 1.61% pa in the last few days.

The rise in US Treasury bond yields, driven by expectations of a strong economic recovery driven by more fiscal stimulus, low interest rates and an efficient vaccination program against COVID-19, has been provoking USD appreciation. The yield on the 10-year bond reached 1.61% pa in the last few days.

Today the market follows the release of data on personal earnings and expenses in the USA; on inflation and growth GDP in France. And in particular, the US House vote on the $ 1.9 trillion aid package.

The main factors considered by investors for their decision making at the moment are:

- COVID-19:

- There are already 2.5 million fatalities worldwide, with more than 113 million diagnoses. In the USA, The FDA is due to authorize the distribution of Johnson & Johnson’s single-dose vaccine today. The Biden government comes striving to contain the pandemic through the vaccination campaign, and today there are more Americans immunized by the vaccine than diagnosed with COVID-19 (so far, 68.3 million doses have been administered, with an average of 1.31 million doses applied per day). Gathered virtually yesterday, the 27 leaders of the Union European Union agreed to maintain “tough restrictions” on the free movement of people and goods as the bloc acts to combat the pandemic. “We need to prepare for a reality in which we are going to need continuous vaccination, perhaps for years, due to new variants of the coronavirus, “said German Chancellor Angela Merkel. Although infection rates are declining in most parts of the EU, there are fears of new peaks as new ones variants spread quickly. The summit president said that the bloc wants “more predictability and transparency “of pharmaceutical companies that failed to deliver contracted volumes of vaccines, placing at risk the EU’s goal of immunizing 70% of its adult population by September 2021. The Commission and EU countries have been criticized for errors in the joint immunization program and for the irregular arrival of doses. During the meeting yesterday, leaders discussed a passport system for vaccinated against COVID-19, which could facilitate air travel, helping several economies in the bloc, especially in southern Europe, where tourism is a fundamental part of economy, to avoid a repeat of last year’s weak summer vacation season. The European Commission scolded Germany, Belgium, Hungary, Denmark, Sweden and Finland earlier this week for closing borders to neighbors within the EU’s free movement area, in an attempt to curb the spread of the pandemic. Instead of resort to unilateral closings, the EU executive body is pressuring member states to stick to the rules established within the bloc, based on specific risk assessments shared by countries.

- FISCAL POLICY:

- The US House is going to vote today on the $ 1.9 trillion stimulus plan, but a Senate official announced that raising the minimum wage to $ 15 is unlikely to be included (the proposal is to increase the federal minimum wage from $ 7.25 to $ 15 an hour over four years – the $ 7.25 hourly floor does not increase since 2009). The Democratic-controlled House is expected to approve the bill, which includes $ 1,400 in payments direct payments, a weekly bonus of $ 400 for the unemployed, a child allowance of up to $ 3,600 for one year, in addition to billions of dollars to reinforce the vaccination campaign against COVID-19. This would be the sixth round of aid from the federal government in this pandemic.

- MACROECONOMICS

- In France, GDP in 4Q20 shrank 1.4% compared to the immediately previous quarter, due to the imposed blocks to contain the pandemic. Household consumption fell 5.4%, public spending fell 0.3% and fixed investment grew 1.1%. Both foreign trade and changes in inventories contributed positively to GDP growth. In relation to 2019, the economy contracted 4.9% in the 4Q and 8.2% in the year whole.

- Still in France, the annual inflation rate fell to 0.4%, with manufactured goods prices falling 0.5%, services grew 0.7% and food grew 0.8%. The monthly inflation rate fell 0.1% in February 2021.

- Also in France, the number of unemployed in January 2021 decreased by 33.1 thousand in relation to the month previous. Compared to the same month of the previous year, the number of unemployed people increased 286.4 thousand

- Personal income in the USA increased 10% in January 2021 compared to the immediately previous month. It was the biggest gain recorded since April 2020, due to an increase in government social benefits, through of the CRRSA (Coronavirus Response and Relief Supplemental Appropriations Act) Act. Personal spending in the USA increased 2.4% in the same comparison. It’s the biggest increase in consumer spending since June, driven by recreational products and vehicles (namely, information), as well as food and beverages, food and lodging services and health care (especially outpatient services). In contrast, declines were seen in housing spending and utilities (mainly electricity and gas).

- Still in the USA, consumer inflation in January 2021 increased 0.3% in relation to the month immediately previous. Commodity prices rose 0.7%, services prices decreased 0.2%. In the annual comparison, both prices advanced 1.5%.

- ACTIONS

- Frankfurt’s DAX 30 was down 0.1% this morning, in the same direction as other European markets, with investors worrying about rising US Treasury yields, which could lead banks to governments and governments to tighten monetary policy and reduce fiscal stimulus earlier than expected. On the corporate front, Deutsche Telekom’s profits increased with higher revenue, and BASF said it expects profits to recover in 2021. In the US, after a big drop in the previous session, investors continue to digest prospects for an increase in economic activity and an increase in inflation and assess the impact this will have on companies. Rightmove, which runs Britain’s largest online real estate portal, said it expects a robust market activity this year. British Airways owner IAG reported a record loss of € 7.4 billion in 2020.

February 25, 2021

EURUSD starts the month and week falling, maintaining the volatility seen in recent weeks. In the coming months, the asset it should move towards levels above 1.23, and may extend up to 1.25, despite the fair value of the pair being close to 1.15. Obviously there will be strong resistance to reaching such high levels, but it is possible. Right now, the skyrocketing yields on US treasury bills are pulling the EURUSD value down. The 1.19 level is almost certain will be achieved, and despite all the noise that the EU’s slow COVID-19 vaccination program will continue together with others related to fiscal and monetary stimulus, this market offers good opportunities for profits.

Today, investors remain cautious, waiting for the pronouncements of several ECB officials, including the President Christine Lagarde, to check the possibility of an increase in the pace of securities purchases by the Institution. In the USA, the $ 1.9 trillion fiscal stimulus package was approved by the House in the early hours of last Saturday, and now all the attention turns to the Senate vote. This Friday has Payroll disclosure. The market is estimating an increase of 165 thousand job vacancies, which would keep the unemployment rate unchanged at 6.3%.

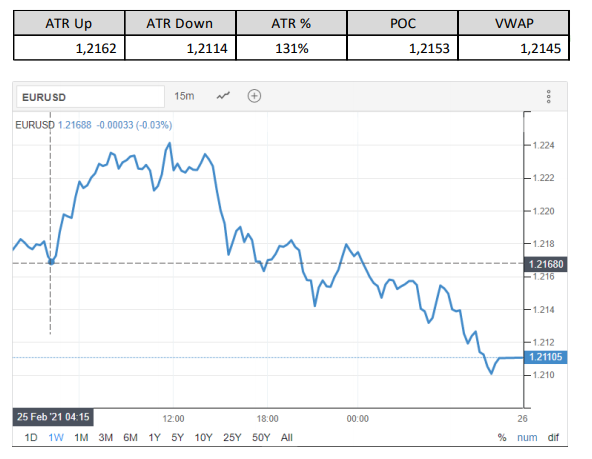

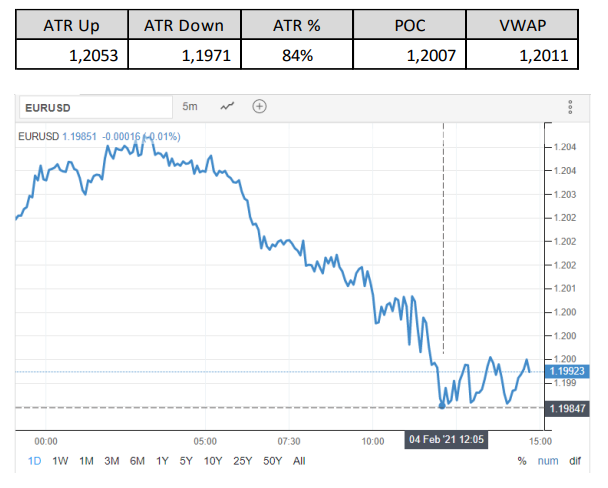

In last Friday’s session the EURUSD opened at 1.2176, reached 1.2062 and closed at 1.2074 with a fall of 0.84%, below the Day’s ATR Down of 1.2114. The day’s POC stood at 1.2153 and the VWAP at 1.2134. During the week, assets accumulated a drop of approximately 0.20%. Today, before the opening of the North American market, EURUSD was operating in decline, after opening at 1.2091 and fall to the level of 1.2035. With a good part of the references today above 1.2070, the risk-return opportunities perform well.

DXY is being traded at the level of 91.0 thousand points, with appreciation. The USDJPY is oscillating close to 106.7 and the USDCHF of $ 0.9138. Gold is trading at $ 1,739 an ounce, and silver at $ 26.8 an ounce.

The main factors considered by investors for their decision making at the moment are:

- COVID-19:

- In Europe, Italy must increase restrictions on the movement of people and goods to contain the strain first found in the UK. Norway will close restaurants and shops, and Finland has unleashed a emergency state. France has signaled that it needs another four to six weeks to start easing measures restrictive. The UK is tracking a person infected with the Brazilian variant of the coronavirus who, according to authorities, may be more resistant to vaccines. 6 cases of this strain have already been identified in the country. Germany reached the highest rate in daily diagnostics in almost three weeks, but even the finance minister is asking for a faster reopening of the economy. Merkel and the prime ministers are due to meet on Wednesday to evaluate a possible relaxation of restrictions.

- FISCAL POLICY:

- Joe Biden’s government took its first big step this weekend with the approval of the $ 1.9 trillion package by the House of Representatives. No Republicans voted in favor. Now the package will be voted in the Senate.

- In the UK, companies reported in IHS Markit / CIPS UK Manufacturing PMI an improvement in demand from various markets – including the USA, Asia, Scandinavia and (in some cases) continental Europe. Optimism business reached its highest 77-month high in February, with more than 63% of companies reporting that expect production to be higher within a year. The positive feeling was linked to the recovery pandemic, the reopening of the global economy (including less transportation restrictions) and uncertainties reduced Brexit.

- ACTIONS:

- Dow Jones futures opened the month rising more than 300 points, with Treasury yields starting to fall with the approval of the $ 1.9 trillion stimulus plan. Last week, the Dow Jones it lost 1.7%, the S&P 500 2.5% and the Nasdaq 4%.

February 25, 2021

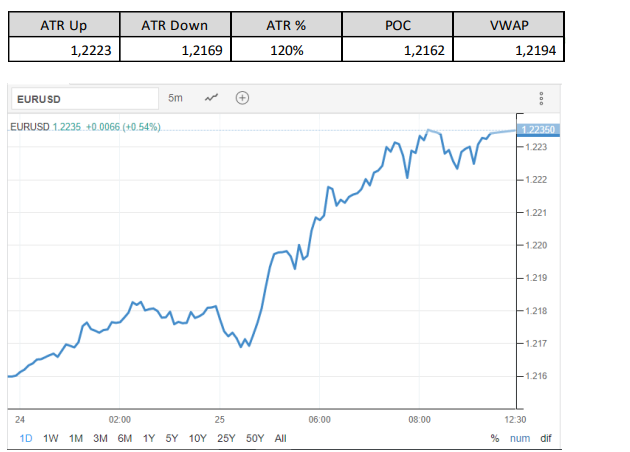

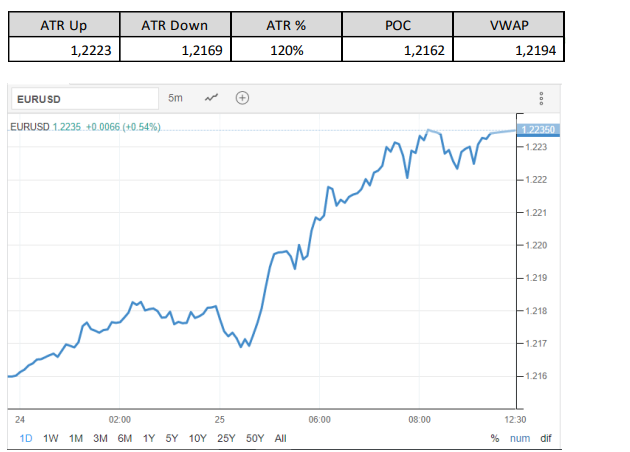

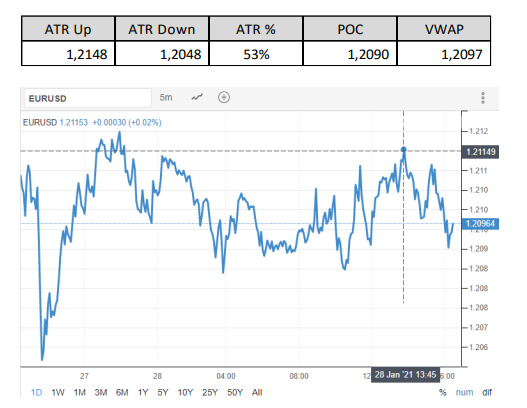

In yesterday’s session, EURUSD, which opened at 1.2150, closed with a 0.12% appreciation at 1.2164, after reaching a maximum of 1.2176 and minimum of 1.2109, which was an ATR down for the day. The day’s POC stood at 1.2155 and the VWAP at 1.2148. Today, the asset operates high, after opening at 1.2170 and rising to the level of 1.2235, above the ATR Above the day, before opening the market North American.

DXY is being traded at 89.8 thousand points. Following the USD, the USDJPY is oscillating close to 106.1 and the USDCHF of $ 0.9058. Gold is trading at $ 1,793 an ounce, and silver at $ 28.1.

Investors are optimistic about the end of the blockages and the reopening of economies, with the improvement in the situation of the economy German economy and the prospect of more monetary and fiscal stimuli in the main economies of the western world. That feeling is pulling investors out of the USD, although higher yields on U.S. Treasury bonds have limited higher losses in safe heaven.

The benchmark interest rate for 10-year US Treasury bonds shot up again, to 1.43%, with investors betting on a strong economic recovery driven by more fiscal stimulus, low interest rates and an efficient vaccination program against COVID-19.

Among the events monitored by the market today, we will have a consumer climate indicator GfK in Germany; indicators on the assessment of the economy, industry and services sector in Europe, and, as on every Thursday, data on the US labor market. Tomorrow, data on personal earnings and spending in the US will be released; on inflation and GDP growth in France; inflation in Spain. Also tomorrow, the US House will vote on legislation to provide the $ 1.9 trillion aid package.

The main factors considered by investors for their decision making at the moment are:

- COVID-19

- Germany registered 10,774 new cases yesterday, the biggest addition in a day since February 6. The chancellor Angela Merkel warned that Europe’s largest economy is in the middle of a third wave of infections and must proceed carefully with the reopening of schools and businesses. Meanwhile, the rate of vaccination remains slow in the country. THE Hungary reported the biggest daily increase in the number of cases in the past two months. Finland, which is also experiencing a resurgence of the pandemic, prepares to tighten the lockdown.

- MONETARY POLICY

- Comments by EDF President Jerome Powell, who presented his report to the Committee Senate Banking on Tuesday and the House Financial Services Committee on Wednesday, reinforced that the the US economy needs more support and that the EDF is committed to the current accommodative policy, which means that the Institution will continue to buy assets and zero interest rates, which Powell considers the best way to boost the labor market, and, consequently, the economy in general. Powell showed that the recovery in the country remains irregular and will continue on an uncertain path, and that inflation will remain above 2% for a while. In the presentations, Powell also spoke more about how the pre-pandemic economy had benefited the poorest Americans and how important it is to ensure that they can participate in the recovery economical. He answered several questions from Republican senators who are reluctant to sign the package $ 1.9 trillion aid. Democrats and Republicans wanted Powell to articulate justifications for their positions favorites on fiscal policy: Republicans looking for evidence that excessive stimulation could generate a damaging inflation and democrats seeking arguments to support an argument for aggressive fiscal stimulus continuous. Although the EDF has traditionally not been about fiscal policy, Powell has made it clear in recent months that the monetary policy alone cannot revive the economy. He ended with the statement that at the moment “nothing is more important than widespread vaccination ”.

- MACROECONOMICS

- The consumer climate indicator GfK in Germany increased to -12.9 in March 2021, better than the -15.5 of the previous month, which was the worst reading in 8 months. “Consumers are recovering from the shock that hit them after the strong blockade in mid-December. The recent drop in the number of infections and the vaccination campaigns feed the hope that the measures will be relaxed soon “, says Rolf Bürkl, consumer specialist at GfK.

- The Eurozone economic sentiment indicator increased to 93.4 in February 2021, above the market expectations. It was the highest reading since March last year, driven by the improvement in confidence in the industry (-3.3 vs -6.1 in January), services (-17.1 vs -17.7) and among consumers (-14.8 vs – 15.5). In retail trade, confidence decreased (-19.1 against -18.5) and in civil construction it remained virtually unchanged (-7.5 versus -7.7). In the industry, there was the third consecutive monthly increase in reaching levels above those observed before the pandemic. The expectation for the future has thus improved how evaluations have improved regarding the current level of order books and the adequacy of inventories of finished products. In the service sector, managers have better demand expectations.

- Initial claims for unemployment insurance in the U.S. are expected to drop to 838,000 in the week ending 20 February. Ongoing claims are likely to drop to 4.47 million in the week of February 13, of 4.49 million in the previous week, remaining well above the levels observed before the pandemic.

- ACTIONS

- In an article published on the Nasdaq website, Martin Tillier evaluates the latest Global Fund Manager Survey, from Bank of America / Merrill Lynch (BAC). It is a monthly survey on the vision of the current conditions of 225 managers of funds, which together control about $ 645 billion. Tillier points out that “this month’s survey showed a remarkable unanimity: more than 90% of respondents believe that we are in a V-shaped recovery and that this will be a good year for the market, while only 13% believe that stocks are in a bubble. Because of optimism, the cash allocation in these funds dropped to 3.8%, which raises the following question: where will the money come from buy stocks and boost markets from here? The answer comes from the retail investor. It’s trillions of dollars that individual American investors have in cash. However, people are currently looking for a savings security, even though saving money does not offer any real return. An old saying among traders says the top comes just after reluctant retail investors are convinced to enter a bullish run. The point is that we are not there yet. This is likely to happen when the economy starts to reach the market, when the number of vaccines grows, unemployment falls further and strong growth returns. So, the feeling of that the market was right all along will force the resistant to buy. That is why, although we believe that we are yes in a bubble, I also believe that it should still last. ” Therefore, it is important to be aware of the fact that, although the fair value of EURUSD is close to 1.15, it has a positive correlation with the S & P500, and can still keep going up for the next month

February 25, 2021

In yesterday’s session, EURUSD, which opened at 1.2150, closed with a 0.12% appreciation at 1.2164, after reaching a maximum of 1.2176 and minimum of 1.2109, which was an ATR down for the day. The day’s POC stood at 1.2155 and the VWAP at 1.2148. Today, the asset operates high, after opening at 1.2170 and rising to the level of 1.2235, above the ATR Above the day, before opening the market North American.

DXY is being traded at 89.8 thousand points. Following the USD, the USDJPY is oscillating close to 106.1 and the USDCHF of $ 0.9058. Gold is trading at $ 1,793 an ounce, and silver at $ 28.1.

Investors are optimistic about the end of the blockages and the reopening of economies, with the improvement in the situation of the economy German economy and the prospect of more monetary and fiscal stimuli in the main economies of the western world. That feeling is pulling investors out of the USD, although higher yields on U.S. Treasury bonds have limited higher losses in safe heaven.

The benchmark interest rate for 10-year US Treasury bonds shot up again, to 1.43%, with investors betting on a strong economic recovery driven by more fiscal stimulus, low interest rates and an efficient vaccination program against COVID-19.

Among the events monitored by the market today, we will have a consumer climate indicator GfK in Germany; indicators on the assessment of the economy, industry and services sector in Europe, and, as on every Thursday, data on the US labor market. Tomorrow, data on personal earnings and spending in the US will be released; on inflation and GDP growth in France; inflation in Spain. Also tomorrow, the US House will vote on legislation to provide the $ 1.9 trillion aid package.

The main factors considered by investors for their decision making at the moment are:

- COVID-19

- Germany registered 10,774 new cases yesterday, the biggest addition in a day since February 6. The chancellor Angela Merkel warned that Europe’s largest economy is in the middle of a third wave of infections and must proceed carefully with the reopening of schools and businesses. Meanwhile, the rate of vaccination remains slow in the country. THE Hungary reported the biggest daily increase in the number of cases in the past two months. Finland, which is also experiencing a resurgence of the pandemic, prepares to tighten the lockdown.

- MONETARY POLICY

- Comments by EDF President Jerome Powell, who presented his report to the Committee Senate Banking on Tuesday and the House Financial Services Committee on Wednesday, reinforced that the the US economy needs more support and that the EDF is committed to the current accommodative policy, which means that the Institution will continue to buy assets and zero interest rates, which Powell considers the best way to boost the labor market, and, consequently, the economy in general. Powell showed that the recovery in the country remains irregular and will continue on an uncertain path, and that inflation will remain above 2% for a while. In the presentations, Powell also spoke more about how the pre-pandemic economy had benefited the poorest Americans and how important it is to ensure that they can participate in the recovery economical. He answered several questions from Republican senators who are reluctant to sign the package $ 1.9 trillion aid. Democrats and Republicans wanted Powell to articulate justifications for their positions favorites on fiscal policy: Republicans looking for evidence that excessive stimulation could generate a damaging inflation and democrats seeking arguments to support an argument for aggressive fiscal stimulus continuous. Although the EDF has traditionally not been about fiscal policy, Powell has made it clear in recent months that the monetary policy alone cannot revive the economy. He ended with the statement that at the moment “nothing is more important than widespread vaccination ”.

- MACROECONOMICS

- The consumer climate indicator GfK in Germany increased to -12.9 in March 2021, better than the -15.5 of the previous month, which was the worst reading in 8 months. “Consumers are recovering from the shock that hit them after the strong blockade in mid-December. The recent drop in the number of infections and the vaccination campaigns feed the hope that the measures will be relaxed soon “, says Rolf Bürkl, consumer specialist at GfK.

- The Eurozone economic sentiment indicator increased to 93.4 in February 2021, above the market expectations. It was the highest reading since March last year, driven by the improvement in confidence in the industry (-3.3 vs -6.1 in January), services (-17.1 vs -17.7) and among consumers (-14.8 vs – 15.5). In retail trade, confidence decreased (-19.1 against -18.5) and in civil construction it remained virtually unchanged (-7.5 versus -7.7). In the industry, there was the third consecutive monthly increase in reaching levels above those observed before the pandemic. The expectation for the future has thus improved how evaluations have improved regarding the current level of order books and the adequacy of inventories of finished products. In the service sector, managers have better demand expectations.

- Initial claims for unemployment insurance in the U.S. are expected to drop to 838,000 in the week ending 20 February. Ongoing claims are likely to drop to 4.47 million in the week of February 13, of 4.49 million in the previous week, remaining well above the levels observed before the pandemic.

- ACTIONS

- In an article published on the Nasdaq website, Martin Tillier evaluates the latest Global Fund Manager Survey, from Bank of America / Merrill Lynch (BAC). It is a monthly survey on the vision of the current conditions of 225 managers of funds, which together control about $ 645 billion. Tillier points out that “this month’s survey showed a remarkable unanimity: more than 90% of respondents believe that we are in a V-shaped recovery and that this will be a good year for the market, while only 13% believe that stocks are in a bubble. Because of optimism, the cash allocation in these funds dropped to 3.8%, which raises the following question: where will the money come from buy stocks and boost markets from here? The answer comes from the retail investor. It’s trillions of dollars that individual American investors have in cash. However, people are currently looking for a savings security, even though saving money does not offer any real return. An old saying among traders says the top comes just after reluctant retail investors are convinced to enter a bullish run. The point is that we are not there yet. This is likely to happen when the economy starts to reach the market, when the number of vaccines grows, unemployment falls further and strong growth returns. So, the feeling of that the market was right all along will force the resistant to buy. That is why, although we believe that we are yes in a bubble, I also believe that it should still last. ” Therefore, it is important to be aware of the fact that, although the fair value of EURUSD is close to 1.15, it has a positive correlation with the S & P500, and can still keep going up for the next month

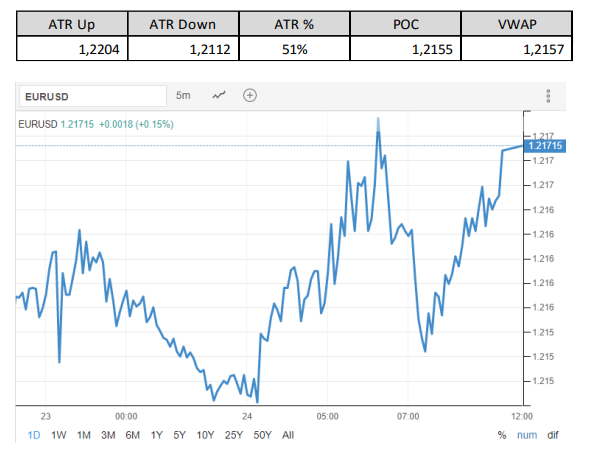

February 25, 2021

In yesterday’s session, the EURUSD, which opened at 1.2155, closed with a soft fall of 0.04% at 1.2149, after reaching a high 1.2181 and a minimum of 1.2135. The day’s POC stood at 1.2148 and the VWAP at 1.2154. Today, the asset operates high, reaching the 1.2170 level twice, until 12:30 pm in London, before the opening of the North American market.

DXY is being traded at the level of 90.0 thousand points. Following the USD, the USDJPY is oscillating close to 105.8 and the USDCHF of $ 0.9066. Gold is trading at $ 1,809 an ounce, and silver at $ 27.8 an ounce.

Money began to migrate from safe heavens such as the dollar, the Swiss franc and the Japanese yen, to currencies that should benefit a recovery in the global economy as well as for countries like the United Kingdom, which are recovering rapidly from the pandemic through the vaccination program.

The market is under the influence of the words of the President of the FED, Jerome Powell, who yesterday presented to the North American Congress the first part of his analysis on the economic situation of the country, rejecting the possibility that a policy loose monetary policy, such as that adopted by the Institution, can trigger strong inflation. Powell also said that the Fed remains working with the objective of generating jobs, which would be the solution for the resumption of the country’s economic strength after the pandemic. He reiterated that US interest rates will remain low and that the Fed will continue to buy bonds to support the US economy. The outlook for global GDP growth, which is negative for the dollar, is weighing more at the moment than the nominal yields of US government bonds, which are positive for the dollar.

Yield on 10-year reference US Treasuries reached 1.39% on Monday, a fairly high level. THE difference between 5 and 30 year olds reached the highest level in more than six years on Monday, reflecting the investors’ expectations of a strong economic recovery in the short term.

Investors are also optimistic about the end of the blockades and the reopening of economies. In addition, the German economy it grew more than initially thought in the fourth quarter of 2020, boosting this optimism.

Among the events monitored by the market today, Powell presents the second part of his update on the economy from the USA to Congress and data on the sale of real estate in the USA will be released. Tomorrow, we will have the GfK consumer in Germany; indicators on the assessment of the economy, industry and services sector in Europe, and, as every Thursday, data on the US labor market. On Friday, data on personal income and expenses in the USA; on inflation and GDP growth in France; inflation in Spain. Still on Friday, the US House of Representatives will vote to legislation to provide the $ 1.9 trillion aid package.

The main factors considered by investors for their decision making at the moment are:

- COVID-19: In Japan, the government is considering suspending the state of emergency in the vicinity of Tokyo before planned, given the decrease in the number of COVID-19 diagnoses. The decision may come this Friday. In the U.S., 20 million doses of the Johnson & Johnson one-shot vaccine will be available soon, enabling 130 million Americans to be immunized by March. In Europe, AstraZeneca should deliver about half of the vaccines it has committed to supply to the European Union in the second quarter. However, the deficit would not affect the EU’s goal of vaccinating 70% of the adult population by the end of the summer. The Spanish government announced an extra € 11 billion package to help small and medium-sized businesses and self-employed people in the country deal with the crisis.

- MACROECONOMY:

- Mortgage applications in the United States fell 11.4% in the week ending February 19, the largest weekly drop since April 2020, due to higher interest rates and the harsh winter that is plaguing the country in this period. Requests to refinance real estate loans fell 11.3% in comparison weekly, but increased by 50% over the same period last year. Funding requests to buy a house they fell 11.6% weekly and grew 7% annually. The interest rate for 30-year financing increased to 3.08% per year last week, the highest since September 2020.

- o The industrial sentiment indicator in France rose to 97 in February 2021, compared to 99 forecasts. It was the highest reading since March last year, but remained below pre-pandemic levels. The slight improvement over the previous month mainly reflects the prospects for production, on recovery after the current lockdown in the country was released. Expectations regarding the employment remained unchanged.

- The German economy grew 0.3% in 4Q20, above the estimated growth of 0.1%, due to the especially the 8.3% increase in gross capital formation, especially in the civil construction sector. THE commerce also contributed positively, while consumer spending (-3.3%) and government (-0.5%) shrunk. In 2020, compared to 2019, the German economy contracted 3.7%. The German economy is expected to grow 3% in 2021 compared to the previous year.

- ACTIONS: Investors are swapping tech stocks for stocks that should earn more from a recovery economical. Growth-sensitive banks, industrial and energy stocks rose with Bank of America, Caterpillar Inc and Chevron Corp rising between 0.4% and 0.6%.

- OTHERS: Bitcoin returned to the $ 50,000 level today, after a strong sale in the previous two sessions, after the Square announced a $ 170 million bitcoin purchase as part of its ongoing commitment to cryptocurrency. The digital currency lost 15% of its record earlier in the week due to concerns about an overvaluation. THE Bitcoin has risen 75% so far this year, driven by institutional purchases and its appeal as a protection against the potential inflation resulting from the massive central bank and government stimulus measures.

February 24, 2021

One week ends with EURUSD recovering the amount lost in the past few days. Today, EURUSD opened a session returning to level of 1.21, after opening a session at 1.2092. DXY is being traded at the level of 90.3 thousand points. Following the USD, the USDJPY is oscillating close to 105.4 and the USDCHF is $ 0.8942. Gold is being traded at $ 1,771.0 an ounce, and silver at $ 27.0

Today the market will be keeping an eye on the results of the Purchasing Managers’ Index (PMI) survey for markets in Europe and the USA.

Today is the meeting of the leaders of the G7, a group that brings together the 7 richest countries on the planet (United States, France, United United Kingdom, Germany, Canada, Italy and Japan) and the main representatives of the European Union. The group should discuss especially Covax, an initiative to finance vaccinations against COVID-19 in low-income countries, indicating a coordinated effort to face the pandemic. Biden will announce that the US Government will contribute $ 4 billion to Covax. Boris Johnson, who can boast of the success of his vaccination campaign, he promised to redistribute most of his surplus through Covax. The European Union must donate 1 billion euros in vaccines to the poorest nations.

The main factors considered by investors for their decision making at the moment are:

- COVID-19: according to the U.S. Food and Drug Administration, food and food packaging are not sources of coronavirus transmission. The FDA noted that COVID-19 is a respiratory disease transmitted from person to person. person: “the chances of infection from touching the surface of the food package or eating food are considered extremely low. “The statement contrasts with the approach taken by China, which has been testing imports banning suppliers whose shipments were found to be contaminated. On the other hand, a team ATR Up ATR Down ATR% POC VWAP 1.2138 1.2087 110% 1.2093 1.2111 Page 2 led by WHO, which investigates the origins of the virus, said last week that food products in the chain cold are a likely route of transmission.

- MACROECONOMICS

- The balance of the order book of the Confederation of British Industry rose 14 points compared to the month previous, its highest reading since February 2020 and above market expectations. The index of production expectations rose 22 points, while the export order portfolio indicator decreased 6 points. Manufacturing activity remains irregular, but so far it appears to have been less impacted than than in the previous blocks. However, a mixed picture persists between the different sub-sectors manufacturers, pointing to the asymmetric impact of restrictions.

- SHARES

- In Italy, the shares of the luxury company Moncler skyrocketed, with an 8% jump in 4Q20 sales, supported by for a strong performance in China.

- In France, Renault recorded its biggest loss recorded last year, while Allianz’s profits fell less than expected and Danone warned of a difficult first quarter.

- OTHERS:

- Bitcoin reached another record high of $ 52,932 today, and has advanced to market capitalization close to $ 1 trillion. Bitcoin’s gains were fueled by signs that it is gaining acceptance among major investors and companies, from Tesla and Mastercard to BNY Mellon. Even so, many analysts and investors remain skeptical of the irregularly regulated and highly volatile digital asset, which is still underused for trade. JP Morgan analysts said current bitcoin prices are well above estimates for the fair value.

February 23, 2021

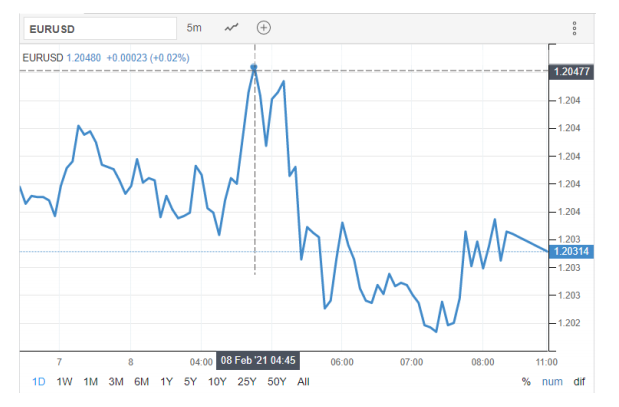

After a sharp devaluation yesterday afternoon, as shown in the chart below, EURUSD opened a session today at 1.2089 and fell to around 1.2060, remaining at this level before the opening of the North American market. DXY is being traded at the level of 90.9 thousand points. Following the USD, the USDJPY is oscillating close to 106.0 and the USDCHF of $ 0.8957. Gold is trading at $ 1,791.0 an ounce, and silver at $ 27.1. Gold remains under selling pressure, falling for the 5th consecutive session. However, one perspective is that metal prices are expected to rise in the long run

Higher yields on U.S. government bonds are said to be primarily responsible for this decline in value of the pair. 10-year US Treasury reference yields rose above 1.30% for the first time since February 2020 amid firm expectations of massive fiscal spending in the country, coupled with a more robust economic recovery broadly as vaccination efforts gain strength. While more government spending supports growth, this means more debt issuance by the Treasury, which, together with the increase in energy costs, increased higher inflation investors.

Today, investors follow the release of FOMC minutes and data on retail trade and industry on USA, including the PPI (producer price index). Tomorrow will be released weekly data on the labor market and data on the US construction market. On Friday, the market will keep an eye on the survey results Purchasing Managers’ Index (PMI) for markets in Europe and the USA

The main factors considered by investors for their decision making at the moment are:

- COVID-19:

- The US has recorded the lowest daily number of new coronavirus infections since October 25. THE positive outlook will bring the New York City subway system back up and running 24 hours from 22 of February. In Europe, the United Kingdom is already beginning to draw up plans to lift national restrictions on socialization, ATR Up ATR Down ATR% POC VWAP 1.2109 1.2000 95% 1.2092 1.2081 Page 2 shopping and business travel. For Prime Minister Boris Johnosn, the priority will be to reopen schools from 8 March, but no decision has yet been made on whether all age groups will return to classrooms at the same time. time. The prime minister will detail his “roadmap” to end the blockade on February 22. The United Kingdom reported 9,765 new cases of COVID-19 yesterday, compared to an average of 13,200 daily cases in the last 7 days. THE last time the UK reported less than 10,000 new cases had been on 2 October 2020. Germany increased traffic restrictions at its borders to prevent the spread of the virus, and since Sunday only German citizens and residents of the country can enter Germany from the Czech Republic and the Tyrol region on Austria, two areas where the most infectious variants of the coronavirus are widespread, which was considered a “Excessive measure” by the Austrian government, which will not reopen restaurants, bars and cafes before the Easter holiday. Until today, almost 109 million people worldwide have contracted COVID-19, of which 2.4 million have died. Vaccination campaigns have already distributed more than 173 doses, however, the emergence of new strains of the virus continues cause concern.

- MONETARY POLICY

- Barclays Research discusses its expectations for the FOMC minutes to be released tomorrow: “The Fed did not make any changes to its political stance or future direction at its January meeting, the that was widely expected. We expect the minutes to focus on two elements: first, that the FED believes that there is a long way to go before the economy can achieve its goals, even if a large package of tax aid is approved by the end of the first quarter, as we hope. Second, through the progress of the vaccination campaign, the Fed has lowered its risk assessment. Together, these two elements indicate that the Institution is more optimistic than before about the prospects, but is in no hurry to change its political stance accommodative “.

- MACROECONOMICS

- The construction sector in the Euro Zone contracted 2.3% compared to the previous year, in December 2020, a fourth consecutive month of decline. On a monthly basis, the sector contracted 3.7%, compared to a advance of 2.3% in November.

- In Spain, the central bank said the country’s public debt increased to 117.1% of GDP in 2020, from 95.5% a year earlier, in the midst of the pandemic crisis

- Producer prices in the USA increased 1.3% over the previous month, in January 2021, exceeding the market consensus of a gain of 0.4%. It was the biggest increase in producer prices since the beginning of the index in December 2009, mainly due to a record 1.3% increase in the price of services. You goods prices rose 1.4%, due to a 5.1% jump in energy costs. On an annual basis, prices the producer advanced 1.7% in January, exceeding the forecasts of 0.9%.

- US retail sales increased 5.3% month-on-month in January 2021, exceeding forecast for the increase of 1.1%. It is the strongest gain since June, in a sign that new checks from stimulus helped boost consumer spending. The biggest increases were seen in sales in electronics and home appliance stores (14.7%); out-of-store retailers (11%); furniture (12%); articles sports, hobby, musical instruments (8%); and food and drink locations (6.9%). Retail sales, which exclude automobiles, gasoline, building materials and food services, which correspond to more than close to the consumer spending component of the gross domestic product, increased by 6%, recovering from a drop of 2.4% in December

- Mortgage applications in the United States fell 5.1% in the week ending February 12, a second consecutive week of decline. Requests to refinance real estate loans fell 4.7%, but increased 51% year on year; while those to buy a house fell 6.1%, but were 15% higher than the previous year. The average 30-year fixed mortgage rate increased by 2 basis points to 2.98% in the last week, but fell 79 basis points compared to the previous year.

- SHARES

- In France, the shares of the fashion conglomerate Kering, owner of Gucci and Yves Saint Laurent, plunged 8% after a 8.2% drop in group sales, with its flagship brand Gucci reporting a 10.3% drop in organic sales in the fourth quarter

- OTHERS: Bitcoin’s recovery continued on Wednesday, setting another historic record after breaking $ 50,000 for the first time the day before, driven by interest among investors and companies worldwide catapulted by Tesla’s big bitcoin purchase. MicroStrategy announced on Tuesday that it would sell $ 600 millions in convertibles to buy more bitcoins. Cryptocurrency increased more than five times in the past year, driven by institutional purchases and its appeal as a hedge against potential inflation resulting from massive central bank and government stimulus measures.

News

Christopher Smart, chief global strategist at the Barings Investment Institute, recently stated that concerns about the Long-term unemployment or rampant inflation in the US seems “irrelevant at the moment”. Although the numbers of today they are comforting, inflation will undoubtedly increase in the coming months. The main questions are: how high and how much will it last?

An article from the ING bank shows that, given the increase in commodity prices, energy and the increase in observed in the light of the impacts of the pandemic, inflation would reach 3% a.a. In addition, with the deployment process vaccine gaining momentum, potentially paving the way for a fuller economic reopening already in 2Q21, many companies can take the opportunity to raise their prices and thus recover the profits lost in the pandemic. IT IS this is more likely to happen in sectors that have faced supply constraints, such as the leisure and hospitality industry. You customers are desperate to try things they haven’t been able to do in the past 12 months, and in this case, the pricing power will be strong. In addition, the observed increase in the price of rental properties on the market the US – which alone represent 7.9% of the inflation basket – could lead to inflation above 3.5% and possibly get close to 4% a.a. already in May 2021.

The degree of support for this level of inflation will probably be determined by the response of the labor market. The USA are largely a service sector economy, which means that the main factor of inflation in the medium to long term is the price of the labor force. If the economy sees rapid employment growth and wages start to rise, it is when inflation can become a much bigger and more ingrained problem. There are currently 9.8 million fewer people in the than 12 months ago and that suggests that we shouldn’t worry too much yet, but it’s something we need to look at near.

According to Danske Research, “the fair value for EURUSD would be in the range of 1.08-1.20, depending on the model employed. The performance of the US asset trend remains strong relative to European counterparts and the COVID-19 pandemic accelerated the adoption of technology, favoring flows to the USA. An appreciation reversal (lower EURUSD) could come from rising US real rates, weakening EU optimism or a Chinese slowdown. We expect a EURUSD in the second half of 1.16 ”.

Credit Suisse highlights the importance of the 1.2146 resistance to the short-term directional bias: “EURUSD has stagnated as expected on the 55-day average and the resistance to price rises at the end of January at 1.2146 / 90 and we continue seeking this limit to define the top of a temporary range. Support remains at 1.2122 / 12 initially, below the which we can see a fall back to 1.2081. Below, now, we would see a smaller top compete to reinforce an environment comprehensive support. However, we continue to see this as a temporary break and we expect an eventual break above 1.2190 for a resumption of the upward trend in the core. So, we would expect a move back to the maximum values of 1.2345 / 55 ”.

February 22, 2021

Highlights After days of lower turnover, with New Year holidays in Asia and markets closed in the US because of the holiday of Presidents Day, investors returned to work still optimistic about the global economic recovery, more fiscal stimulus in the main economies and the good pace of vaccination campaigns against a COVID-19 worldwide. Given this scenario and also the debt levels in the USA, DXY remains very weak, traded at a low other currencies. The risk-sensitive Australian dollar hit a month-high of $ 0.7802 and the New Zealand kiwi hit a peak of $ 0.7257 over five weeks. The rise in oil prices raises the Canadian dollar and the crown Norwegian. The Chinese yuan fell 0.1% to 6.4132 per dollar after the Financial Times reported that Beijing the country is considering imposing restrictions on exports of rare earth minerals to harm US companies that use them.

EURUSD opened the session at 1.2132 and rose to around 1.2170, remaining at this level before the market opened North American. DXY is being traded at the level of 90.2 thousand points. Following the USD, the USDJPY is fluctuating near 105.5 and the USDCHF is oscillating around $ 0.8877. The Japanese yen, the safe haven of the Asian market, also comes suffering from a strong risk appetite. Preliminary data showed that the Japanese economy grew 3.0% in the quarter, exceeding expectations for a 2.3% expansion, amid a recovery in corporate spending and a further increase private consumption. However, Japan’s industrial production fell by 1% in December compared to the month previous year, the second month of decline. Gold is trading at $ 1,820.5 an ounce, and silver at $ 27.6.

Today, investors follow the release of data on the labor market in Europe and the monthly ZEW indicator of Economic sentiment for the Eurozone. Tomorrow the market will keep an eye on the release of the FOMC minutes and data on retail and industry in the US, including the producer price index (PPI). On Thursday, data will be released weekly labor market data and monthly data on the US construction market. Already on Friday the market will be keeping an eye on the results of the Purchasing Managers’ Index (PMI) survey for markets in Europe and in the USA.

The main factors considered by investors for their decision making at the moment are:

- COVID-19: In Spain, the number of new infections continues to fall, with 30,251 new cases reported on Monday, 16,844 less than a week earlier. Hospital occupancy has also been declining, albeit at a faster pace slower than new infections. In the USA, almost 70 million doses of the vaccine have been distributed until the last Sunday. Joe Biden will participate next Friday in a meeting with the leaders of the G-7, in which he should discuss the pandemic and include the USA in the WHO global vaccination plan, an alliance of dozens of countries that aims to ensure fair distribution of vaccines against COVID-19 worldwide.

- MACROECONOMICS

- The number of people employed in the Eurozone increased by 0.3% in 4Q20, above market expectations an increase of 0.1%. In relation to the previous year, the number of jobs fell by 2.0%.

- The ZEW Economic Sentiment Indicator for the Eurozone rose 11.3 points, to the highest level of last five months in February 2021. 76.9% of respondents estimate an improvement in activity while 7.3% expected it to worsen and 15.8% did not expect changes.

- The ZEW Economic Sentiment Indicator for Germany rose 0.4 points in February 2021, exceeding market forecasts. It is the biggest reading since September, since the markets are believing that the German economy will be back on the growth path in up to six months. A recovery is expected in the retail trade, accompanied by higher inflation expectations

- In France, the unemployment rate dropped to 8% in 4Q20, from 9.1% below market expectations of 9%. It was almost stable (-0.1 points) compared to 4Q19, although the data was partially distorted by six-week blocking measures, during which jobseekers were unable to register as unemployed.

- Shares:

- This week, companies in the tourism industry, hard hit by the pandemic, like Norwegian Cruise Lines, Marriott and TripAdvisor are expected to release their 4Q20 results.

- European stock markets remain bullish, with Frankfurt’s DAX 30 breaking a new record before to erase earnings to hover around 14,100. French company Michelin projected growth of up to 10% markets for 2021 and increased its prospect of dividends. Glencore Xstrata, a company Anglo-Swiss mining commodity multinational has reinstated its dividends amid profits records.

- OTHERS: Bitcoin reached a new record this Tuesday, approaching the $ 50,000 mark after the Tesla’s large bitcoin purchase has prompted institutional and corporate investors to do the same. THE Counterpoint Global, a Morgan Stanley unit, was the last to announce that it is considering the possibility of bet on virtual currency, following similar movements by Mastercard and Bank of New York Mellon. THE cryptocurrency has risen about 70% so far this year.

- News:

- An article published by Reuters shows that the North American economic recovery is near, insofar as jobs are being created.

- The January 2021 Payroll showed a smoother than expected recovery. However, the market remains optimistic as to future prospects. The details show some weakness and some oddities. For example, the drop of 10,000 vacancies in industry and 3 thousand in civil construction do not correspond to surveys by the Institute of Supply Management (ISM), based on data obtained from procurement and supply executives at more than 400 industrial companies, nor on data on the civil construction activity, which are growing. The retail trade had a drop of 38 thousand vacancies, while the sector of leisure and hospitality fell by 61 thousand vacancies.

- The number of employed persons is still 9.82 million below that of 11 months ago, while the proportion of employed persons productive age who actually have a job remains incredibly low by historical standards, at 57.5%. This is at the same level as the 1970s, when women’s participation rates in the labor market were much higher lower than they are today. In addition, it emphasizes structural issues in the US labor market, with a large number of people classified as ill and millions of other people caring for those ill, unable to work. How As with all recessions, there is also an increase in the number of people who retire early.

- Still, the February Payroll is expected to be better, given that the reopening of California, the country’s most populous state, is underway. progress. March’s is expected to accumulate even better results with the resumption of the economy in New York from 14 February. ISM’s strong job readings are also expected to suggest more hires in the coming months.

- However, significant improvements in the labor market will only be seen when sectors strongly affected by the pandemic, such as tourism, leisure and hospitality, can return to their normal activities.

- The EDF has made every possible effort to obtain maximum jobs and safeguard financial stability in the USA. Institution President Jerome Powell said last week that the United States is “far” from returning to a work that offers social and economic benefits, reduces economic disparities and cures the damage of recessions. “The full realizing the benefits of a strong labor market will require continued support from both short-term policy and long-term investments, ”he said in a webcast for the New York Economic Club,“ so that all those who job seekers have the skills and opportunities that will allow them to contribute and share the benefits of prosperity.” Maximum employment, said Powell, “is a broad and inclusive goal.” In practice, this means looking not only at the labor market in general, but also for various employment deficiencies, especially among workers in low and moderate income.

- Adjusting monetary policy to address income inequalities, often reflecting issues of racial equity, is more difficult than it looks. A recent New York EDF study shows that an accommodative monetary policy to support low-income workers can be a boomerang because it also fuels increases in asset prices, which benefit disproportionately those with more assets.

- Easy money has basically the same impact on employment, says the study. “The unemployment rate for blacks falls about 0.2 percentage points higher than the white unemployment rate after an unexpected monetary policy shock of 100 basis points. ” The result: “Employment and income gains for black families are small compared to wealth gains of white families

February 10, 2021

Highlights

Despite the lack of positive news from the eurozone, EURUSD continues to rise this week. Investors are doing profits from the recent rise in the USD, with the prospect that large US fiscal spending combined with accommodative monetary policy will keep the US dollar under pressure

EURUSD opened the session in the region of 1.2116 and is oscillating close to the POC and VWAP region, in 1.2125-1.2123 respectively. DXY is being traded at the level of 90.4 thousand points. Following the USD, the USDJPY is fluctuating near 104.7 and the USDCHF is oscillating around $ 0.8908. Gold is trading at $ 1,843.7 an ounce, and silver at US $ 27.3

Today’s session is influenced by the publication of January inflation rates in Germany and the USA. Stronger inflation than expected in the eurozone may offset concerns about the Bank’s potential monetary policy action European Central Bank (ECB). However, if ECB President Lagarde continues to express concern about the strength of the euro in this morning’s speech, this may also diminish the euro’s appeal. Still, if the US dollar continues to decline from the highs EUR / USD is likely to continue to rise. At the end of the day, the speech of Fed President Powell will be monitored closely looking for information on the US fiscal stimulus package.

The main factors considered by investors for their decision making at the moment are:

- COVID-19: Germany is due to announce today an extension of the current lockdown until March 14, due to concerns about the spread of more contagious variants of the virus. Even so, a gradual reopening of shops and hotels in the coming weeks is likely. The number of people infected with the coronavirus in Germany increased by 8,072 on Wednesday, down from 9,705 last week. However, 813 people died with the disease yesterday, a statistic that continues to increase. With 14 new cases reported in China on Tuesday, unchanged from the previous day, a WHO report states that the virus did not originate in a laboratory in Wuhan.

- MONETARY POLICY: ECB President Lagarde will participate in a news webinar organized by The Economist in the late afternoon, although significant comments on the ECB’s monetary policy are not expected. FED President Powell will attend a webinar at New York’s Economic Club this afternoon.

- MACROECONOMICS:

- Mortgage orders in the United States fell 4.1% in the week ending February 5. Among them, refinancing orders fell 4.2%, to the lowest level in three months, and refinancing orders financing fell 4.7%. The average 30-year fixed mortgage rate rose 4 basis points to 2.96%, the level highest since the week ended November 13.

- o Industrial production in France fell 0.8% month-on-month in December 2020, below market forecasts increase of 0.2%. Manufacturing fell 1.7%, while coke and refined oil production fell due to the closure of several refineries (-30.5%). Other decreases were also observed in the manufacture of machinery and equipment goods (-3.5%) and in the manufacture of food products and beverages (- 1.8%). In contrast, production in mining and quarries, energy and water supply increased by 4.3%. Compared to February 2020, the period before the pandemic, production remained 4.9% lower

- Annual inflation in Germany was confirmed at 1% in January 2021, in line with estimates. It’s the first increase in consumer prices in 7 months as the highest VAT rates were passed on to consumers after the temporary reduction in value added tax, which was a measure government stimulus package, which ended on December 31, 2020. It also impacted inflation at charge on CO2 emissions introduced earlier this year. Food prices rose by 2.2%, with highlight to meats (3.5%), fruits (3.2%) and vegetables (3.1%). Additional upward pressures also came net rent excluding heating expenses (1.3%), prices of social equipment services (6%) and vehicle maintenance and repair (3.4%). On the other hand, energy prices fell 2.3%, mainly heating oil (-13%) and motor fuels (-2.9%) and transport fuels decreased by 8.1%. On a monthly basis, consumer prices increased by 0.8%.

- The annual inflation rate in the USA was stable at 1.4% in January 2021, the same as in December and slightly below 1.5% market forecasts. Food prices increased by 3.8%, while the cost of energy decreased by 3.6%. In the month, consumer prices rose 0.3%, in line with projections and after revised downward slump of 0.2% in December. The gasoline index continued to increase, increasing 7.4% and accounting for most of the seasonal variation in the index of all items. Although electricity rates and natural gas have decreased, the energy index rose 3.5%. The feed index rose slightly 0.1%, since an increase in the rate of food out of the home more than offset the drop in the index home food

- ACTIONS:

- In Italy, the FTSE MIB traded slightly higher on Wednesday, with traders continuing to follow the formation of a new government in Italy and the vaccination campaign. The banking sector will remain in highlight, while investors await the profits of Banca Generalis and Banca Sistema.

- In Spain, the IBEX 35 fell around 8,066 on Wednesday, with investors waiting for any developments around the US fiscal stimulus and monitoring COVID-19 numbers. The number of new infections is decreasing, but fatalities remain at levels only surpassed by the worst days of last spring. The Spanish government has announced that it will extend the travel ban in the UK, Brazil and South Africa until March 2, out of concern for new variants of the virus. Border restrictions with Portugal will remain in force until 1 March.

- slowing coronavirus infections and hopes for a major US stimulus package. The actions Societe Generale were among the best performers after the bank’s profits forecasts and the bank’s CEO said that “the fourth quarter results provide further confirmation of the recovery in our business observed in the third quarter after the beginning of the year marked by the impacts Covid crisis ”. Total’s shares plunged on the second day after the company announced a 66% in 2020 profit. France reported 18,870 new infections on Tuesday, well below 23,337 in the week previous.

- In the US, US futures rose slightly on Wednesday, after 6 consecutive days of bullishness. The investors focus on the earnings release season, reducing the number of infections by coronavirus and expecting more stimuli. The earnings of Cisco, Lyft, Mattel and Twitter released after the closing on Tuesday exceeded forecasts. The earnings of Coca-Cola, Under Armor and General Motors, released this morning were larger than expected, although GM warned it could cut earnings in 2021. Uber is due to report today. Apple reportedly partnered with Taiwan Semiconductor Manufacturing to develop micro OLED screens, which it plans to use on its devices augmented reality. Meanwhile, Eli Lilly’s combined antibody to combat COVID-19 received US FDA emergency use authorization

- In China, the Shanghai Composite Index reached its highest index in 13 years with official data showing that producer prices in China rose for the first time in a year in January and at the fastest rate since May 2019. This is the last trading day before the Lunar New Year holiday. Market sentiment too was driven by the news that foreign direct investment in China grew 4.6% in January in compared to the same period last year, with the increase in investment from Japan. Meanwhile, the new China’s bank lending reached new highs in January due to seasonal demand

News

A liquidity trap is a contradictory economic situation in which interest rates are very low and interest rates are high savings, making monetary policy ineffective. It happens when there is a negative outlook for the economy. Described for the first time by economist John Maynard Keynes, is a case where consumers choose to avoid investments and keep your funds in cash (in savings or checking account) waiting for the most opportune moment to return to invest. In this case, the central bank’s efforts to stimulate economic activity are hampered.

For example, if the Federal Reserve in the USA tries to stimulate the economy by increasing the supply of dollars, there will be no effect because people will tend to hold the money, not put it in the economy. This lack of borrowers tends to affect consequently the purchase of cars or houses. Likewise, if the FED lowers the interest rate, money will not will circulate.

The solution to this situation, in general, is to increase consumer confidence in starting to spend / invest again, instead of saving. This can happen through a (big) drop in prices. When this happens, people just can’t avoid spending money. Or even through increased government spending, a tactic that it works by setting an example of trust, as well as strengthening job growth.

In the 1990s, Japan faced a liquidity trap. Japan faced deflation throughout the 1990s and, in 2019, still has a negative interest rate of -0.1%. The liquidity traps appeared again in the wake of the crisis financial crisis and the ensuing Great Recession, especially in the euro area. Interest rates were set at 0%, but investment, consumption and inflation remained under control for several years after the crisis peaked. The Central Bank European Council has resorted to quantitative easing (QE) and negative interest rate policy (NIRP) in some areas to break free of the liquidity trap.

DXY continues to lose momentum on Wednesday after new data showed the US inflation rate rose less than expected, easing concerns that it would rise too fast with the new fiscal stimulus. THE market concern is that if inflation rises too much, interest rates will have to rise earlier than expected, which it would migrate money from circulation to bonds. If inflation falls below expectations, it is a sign that consumption continues weak, and that money, which should be in circulation, stimulating the economy and creating jobs, is saved.

February 08, 2021

Highlights

On Friday, with the release of the US Payroll for January and the final approval of the draft budget that includes the $ 1.9 trillion stimulus, the USD showed enormous weakness, which caused the EUR to rise without any resistance. THE EURUSD started from 1.1964 to close the day at 1.2042, up 0.67%.

American Democrats are using a procedural device, called reconciliation, to force approval of the measure even if Senate Republicans oppose the package. “It is very clear that our economy is still in trouble”, said President Biden, assessing the Payroll result as weak, and increasing pressure on the House. The Department of US Labor reported on Friday that 49,000 jobs were created in January, 6,000 in the private sector. THE The labor market remains 10 million jobs below its pre-pandemic levels. Yesterday, the Secretary of the Treasury, Janet Yellen, said the fiscal stimulus package could generate enough growth to restore full employment in the US in the next year. In this scenario, investors’ risk appetite increases.

EURUSD opened the session at 1.2049 and is oscillating close to the POC and VWAP region at 1.2033-1.2036 respectively. DXY is being traded at 91.2 thousand points. Following the USD, the USDJPY is oscillating close to 105.3 and the USDCHF is oscillating close to $ 0.9009. Gold is trading at $ 1,820.8 an ounce, and silver at $ 27.2. Even if in appreciation at the moment, the medium to long term prospects for the DXY, USDJPY and USDCHF assets remain low due to the risks posed by record debt levels. Thus, and for metals, the medium to long term prospects higher prices. Specifically on silver, it appears that traders’ attempt to act en masse by Reddit has failed, at least temporarily. Looking ahead, the growing demand for industrial applications, as that the economy gains strength, it should also raise silver prices in the long run.

As last week, investors will be aware of the COVID-19 numbers and the approval process for the US economic stimulus. Important data disclosures this week include inflation in the US, China and India; Numbers ATR Up ATR Down ATR% POC VWAP 1.2091 1.1986 47% 1.2032 1.2036 Page 2 fourth quarter GDP for the United Kingdom; consumer sentiment to the US and industrial production and foreign trade to Germany.

The main factors considered by investors for their decision making at the moment are:-