Daily news and analysis

Wyllian Capucci

MentorTrader Professional

“I put aside years of success as a civil engineer to really build my capital without depending on the government or any company for that. My success came after I learned to read what the big banks are doing in the market and started to join them.”

2 March 2021

02/03/2021 – What do you need to know for today?

Democrats argue over the details of the stimulus, the bubble alert and Biden’s regulatory choices testify.

Democrat vs. Democrat

President Joe Biden will attend a virtual meeting of all Senate Democrats today as he tries to keep lawmakers together to pass stimulus legislation this week. Progressive party members in the House sent a letter to Biden and Vice President Kamala Harris demanding that they override the Senate MP’s decision. The latter stated that legislating for a minimum wage of $ 15 an hour could not be approved under the budget’s fast-track rules. Moderate Democratic senators want a more targeted pandemic relief bill and expect little change to the package the House passed over the weekend.

Bubble

China’s top banking regulator said he was “very concerned” about bubbles in the European and American markets, as market recoveries are moving in the opposite direction from the underlying economies. He also expressed concern about price increases in the property market in China, something that the Banking and Insurance Regulatory Commission of China tried to calm by limiting loans to the sector. Bank of America also issued a warning about the bullishness of Wall Street, saying its measure of sentiment is close to a level that has historically been low for stocks. Yesterday, the S&P 500 Index closed 2.4% above, its best day since June last year.

New era

Biden’s choices to head the Securities and Exchange Commission and the Department of Consumer Financial Protection will face questions from the Senate Banking Committee at a hearing today. Gary Gensler, the former president of the Commodity Futures Trading Commission, and Rohit Chopra, CFPB nominee, will be asked about the GameStop Corp boom.

Rally stalls

Stock investors seem to be on the lookout for warnings of bubbles and over-optimism. Overnight, the MSCI Asia Pacific index fell 0.2%, while Japan’s Topix index closed down 0.4%. In Europe, the Stoxx 600 Index gained 0.5% at 7:50 am Brasília time, with consumer companies gaining from the drop in energy stocks. The S&P 500 futures pointed to a lower opening, the 10-year Treasury yield was at 1.448%, oil fell and gold got a little higher.

Arriving

Canadian GDP for the fourth quarter is at 10:30 am. US auto sales for February are published today. Fed Governor Lael Brainard and San Francisco Fed President Mary Daly speak later. Today’s profits are dominated by retailers with reports from Target Corp., Kohl’s Corp., Ross Stores Inc. and Nordstrom Inc. CERAWeek and the Global Metals and Mining conference continues.

1 March 2021

01/03/2021 – What do you need to know for today?

The bond markets relax, the stimulus bill goes to the Senate and the Johnson & Johnson vaccine is approved.

Yields fall

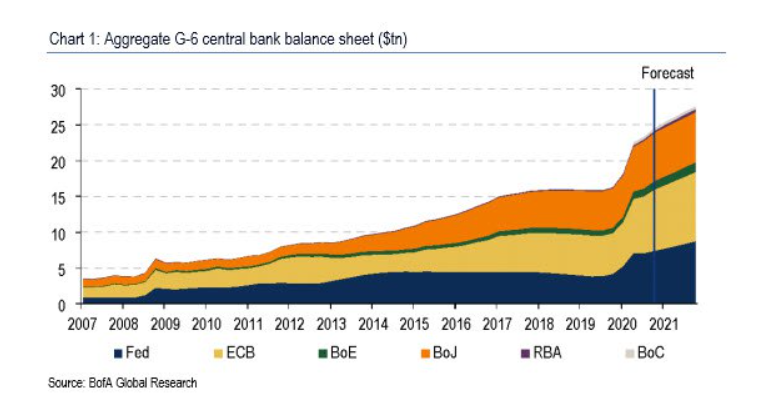

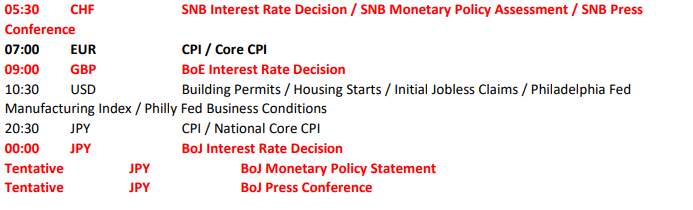

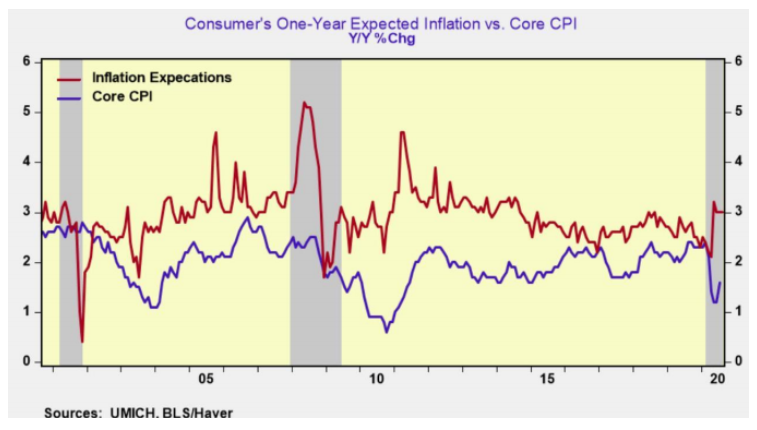

Global bond markets are stabilizing after last week’s defeat, with central banks around the world assuring investors that they will continue their accommodative policy measures. Although Federal Reserve and Bank of England officials said they saw little reason to worry about the rapid rise in earnings last week, the Australian monetary authority has signaled that it will stick to its yield target and the European Central Bank has said it will not tolerate higher yields. that risk damaging the economy. Increasingly, investors are also reevaluating the risk of an explosion in inflation, with some now thinking that fears of a rapid rise in consumer prices are overstated.

Stimulus

President Joe Biden’s $ 1.9 trillion stimulus bill, passed by the House on Saturday, without Republican support, goes to the Senate. Plans to penalize companies that do not raise the minimum wage have been shelved so that the package can move forward quickly, according to people familiar with the matter. With some unemployment support measures running out in two weeks, lawmakers’ focus is on getting the bill passed in the Senate and getting ready for Biden’s signature as soon as possible.

Virus

The approval of the Johnson & Johnson single-dose vaccine by the U.S. Food and Drug Administration is a welcome addition to the pandemic-fighting arsenal, as authorities worry about the circulation of new variants and the recent slowdown in pace reduction of cases. The FDA has also outlined a rapid approval process for new vaccines or booster doses to combat new strains. In Europe, new restrictions have been announced to combat local outbreaks in Italy and Norway, while the UK is trying to track cases of the Brazilian variant.

Stock Rally

With bond investors less and less concerned about the risks of high inflation, the appetite for equity risk is gaining momentum. Overnight, the MSCI Asia Pacific index added 1.5%, while Japan’s Topix index closed 2% above. In Europe, the Stoxx 600 Index gained 1.6% at 7:50 am, Brasília time, with all sectors of the industry in the green. The S&P 500 futures pointed to a similar increase in openness, the 10-year Treasury yield was 1.432% and oil and gold were higher.

Arriving

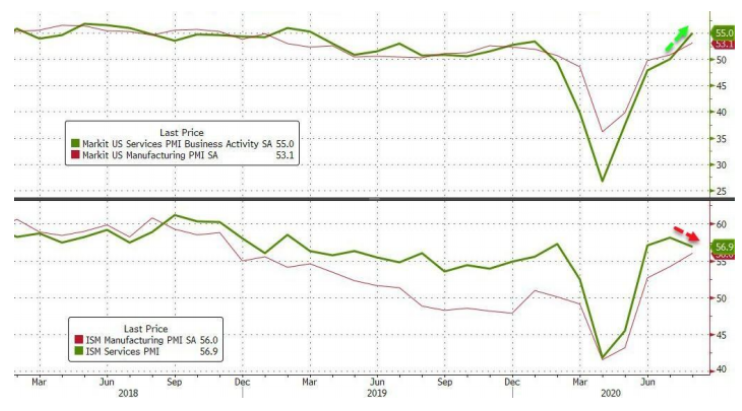

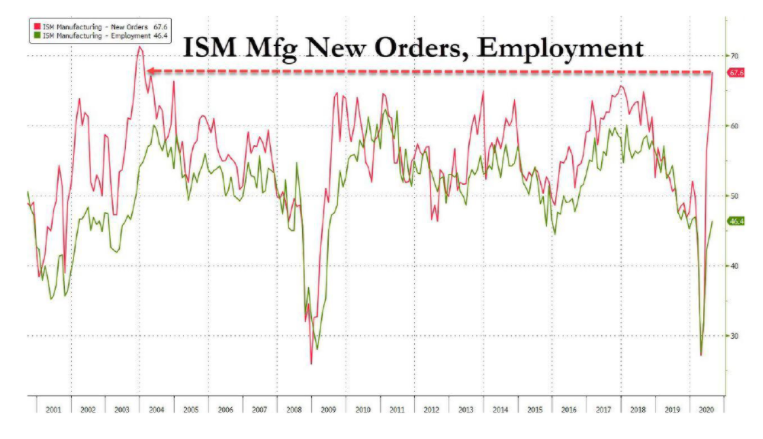

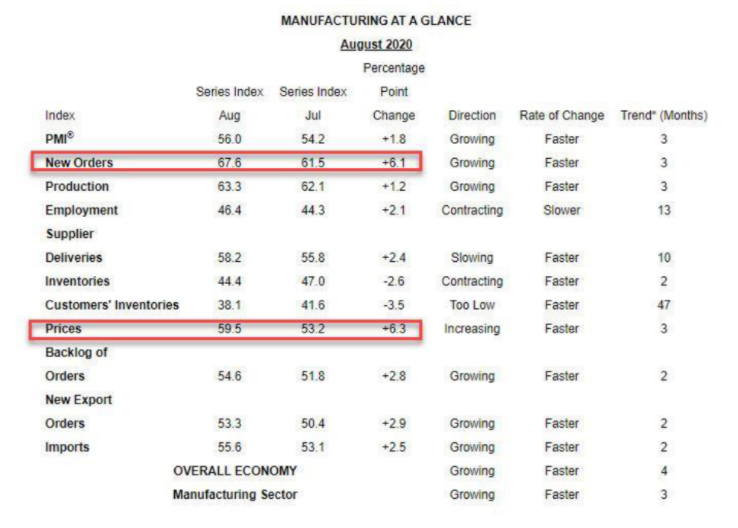

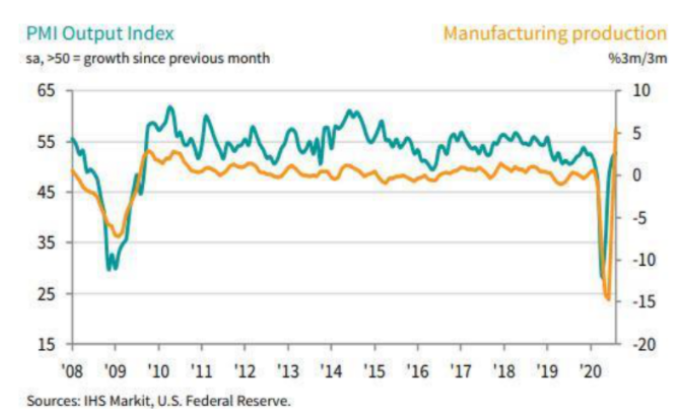

The US manufacturing PMI in February is at 11:45 am with ISM Manufacturing at 12:00 pm. New York Fed President John Williams and Fed Governor Lael Brainard speak later, and three regional presidents are on a panel on racism and economics conducted by the Minneapolis Fed. Zoom Video Communications Inc., NIO Inc. and Novavax Inc. are among the companies that reported results. CERAWeek begins.

26 de fevereiro de 2021

26/02/2021 – What do you need to know for today?

The bonds are confused, the House to vote on the stimulus and a control over inflation.

Jump

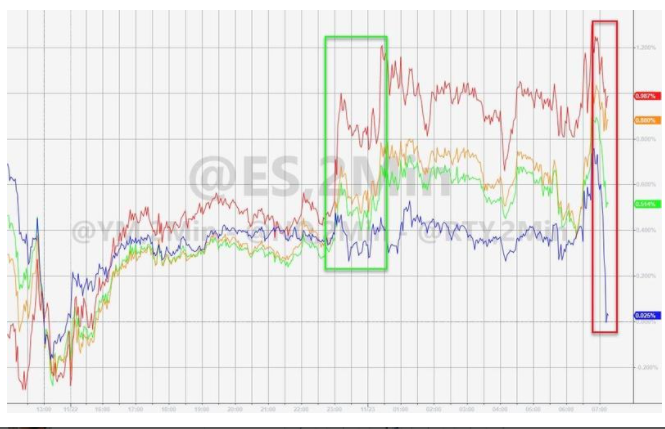

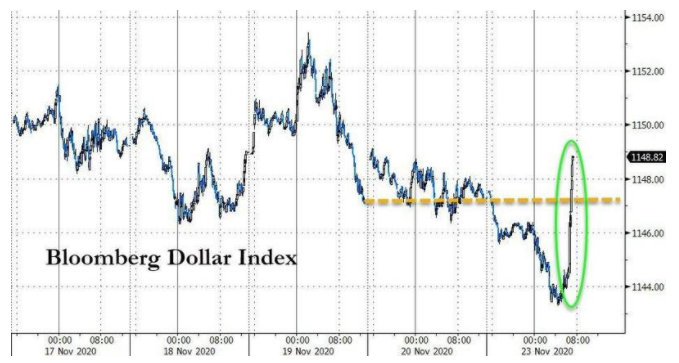

The surprising speed of the movement of US Treasury bonds yesterday, which saw the 10-year note yield reach 1.61% at one point, is being attributed to technical rather than fundamental reasons. The yield on the five-year note rose 0.75% after a seven-year bond auction saw record low demand. Traders rushed to manage positions after the peak, with liquidity also becoming an issue, as open trades on Treasury futures collapsed on the curve. The moves appear to have been a flash in the pan for now, with the 10-year yield dropping below 1.5% this morning.

Stimuli

The House is expected to approve the $ 1.9 trillion stimulus package today, bringing checks for $ 1,400 a step closer to most Americans. It appears that a Democratic political goal – the $ 15 minimum wage – will not be part of the plan after Senate MP Elizabeth MacDonough found that the measure did not qualify for budgetary reconciliation, meaning that changes will require 60 votes in the Senate. There is also a risk that President Joe Biden’s Covid aid package will trigger Medicare cuts.

Inflation

While technical factors are being blamed for the rapid rise in yields yesterday, there is no escaping market fears that price growth will accelerate faster than policymakers suggest. This morning’s personal income data is expected to show a 9.5% increase, driven by stimulus checks, while spending may have increased 2.5%. The PCE deflator, the Federal Reserve’s preferred inflation measure, could rise to 1.4%. With more stimuli coming and continued good news about the rapid advance of vaccines, the market will continue to worry about the risk of overheating the economy.

Stock slip

Yesterday’s bond market moves shook global stocks. Overnight, the MSCI Asia Pacific index fell 3.5%, while Japan’s Topix index closed down 3.2%. In Europe, the Stoxx 600 Index recovered some losses at the beginning of the session, falling 0.6% at 7:50 am Brasília time. Futures for the S&P 500, which took much of its sales out of the way in yesterday’s session, pointed to little change at the opening, oil was lower and gold fell.

Arriving

As well as data on income and personal expenses, we obtain the latest advance trade balance of wholesale goods and inventories at 10:30 am. G20 finance ministers and central bankers meet virtually. Cinemark Holdings Inc., AMC Networks Inc. and DraftKings Inc. are among the companies reporting the results. Warren Buffett’s annual letter to shareholders is published tomorrow.

25 de fevereiro de 2021

25/02/2021 – What do you need to know for today?

Bond yields increase again, claims data is due and more good news about vaccines.

Selloff

Developed market sovereign debt is taking another hit this morning, with 10-year Treasury yield rising to the highest in a year, and even Japan’s oldest benchmarks making a move. Fed Chairman Jerome Powell said he saw the sale as a “statement of confidence” in the economic outlook. In addition to the US, the European Central Bank is concerned that the rapid rise in yields could hamper the economic recovery and Australia’s central bank has started buying bonds to meet its yield target.

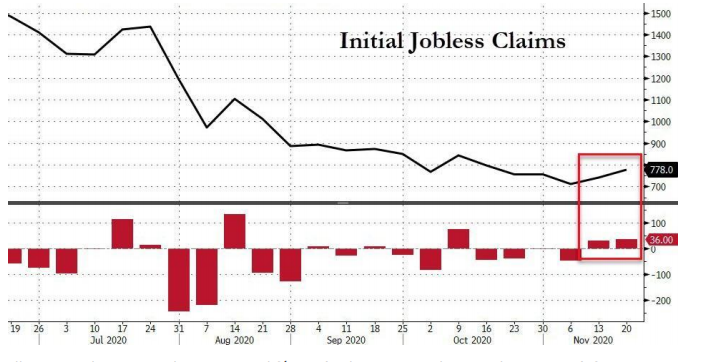

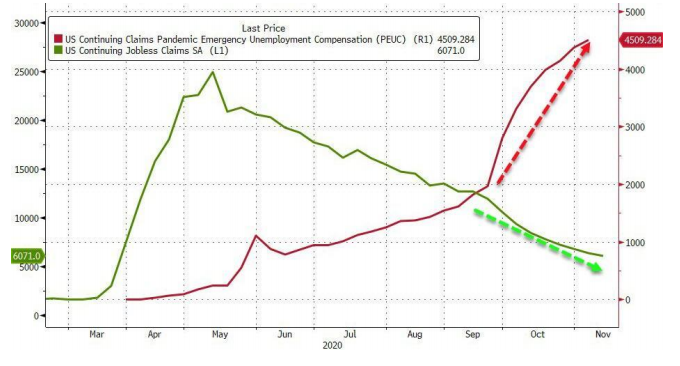

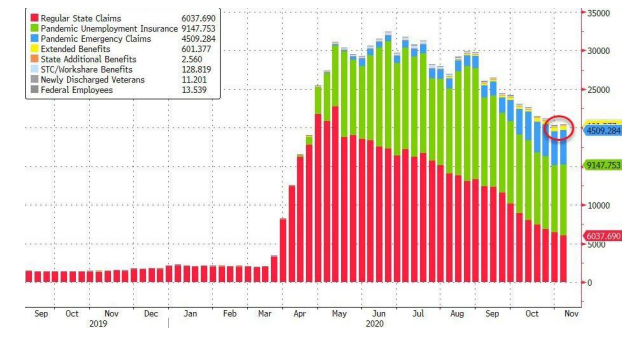

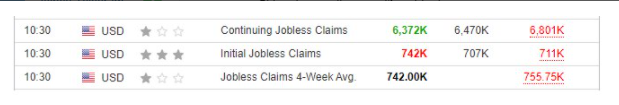

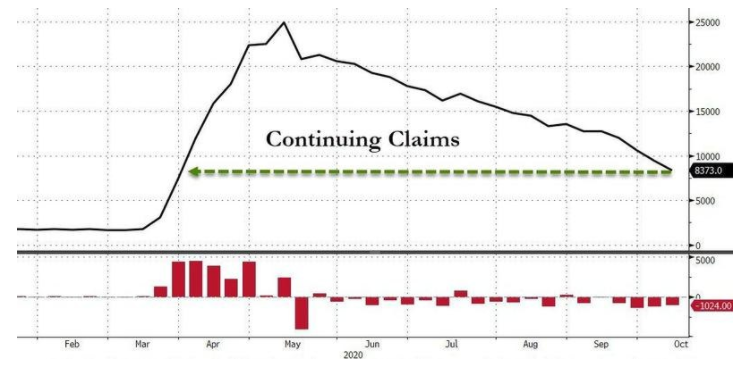

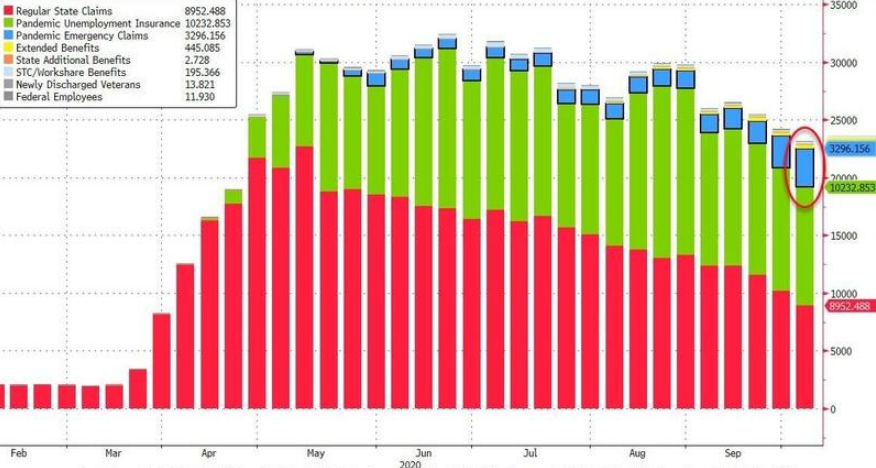

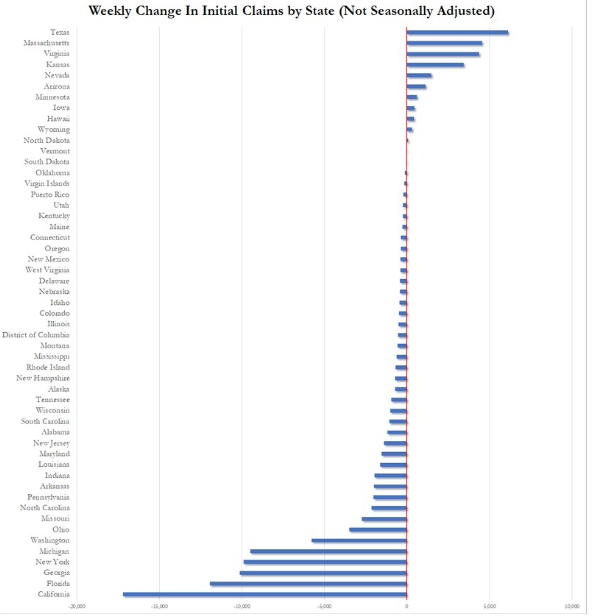

Claims

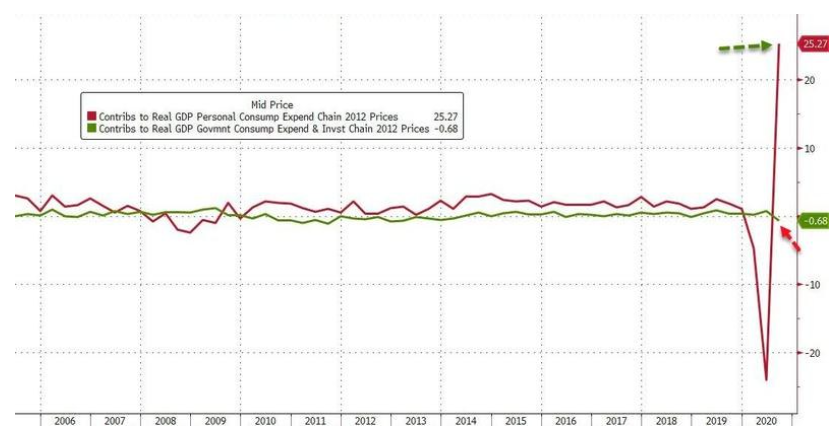

While investors are focused on the prospects for inflation and economic growth, during his testimony to Congress, Powell highlighted how far the US labor market is from maximum employment. Initial unemployment insurance claim data at 10:30 am Eastern time is expected to show little progress toward job recovery, with more than 800,000 new applicants likely filing the suit last week, according to economists’ estimates . The continuing claims are seen virtually unchanged.

End in sight?

A study that followed nearly 1.2 million people in Israel found that the vaccine Pfizer Inc. and BioNTech SE Covid-19 was extremely effective against the virus. It is so successful that outside experts have said that with enough widespread use, it may be possible to contain the pandemic. Bloomberg’s vaccination tracker shows that more than 218 million doses have been administered globally. A committee of outside consultants will give its recommendation on the Johnson & Johnson single-dose vaccine to the Food and Drug Administration today. Moderna Inc. said it has completed manufacturing a new version of its vaccine modified to target the South African strain.

Stocks go up

The factors that are causing the sale of bonds are also helping to raise inventories, with projections on how people can spend their stimulus checks also helping stocks. Overnight, the MSCI Asia Pacific index increased 1.4%, while Japan’s Topix index closed 1.3% above. In Europe, the Stoxx 600 Index gained 0.2% at 7:50 am Brasília time, with the best performing mining and energy stocks. The S&P 500 futures pointed to little change in the opening, as technology remains under pressure, oil has risen and gold has fallen.

Arriving

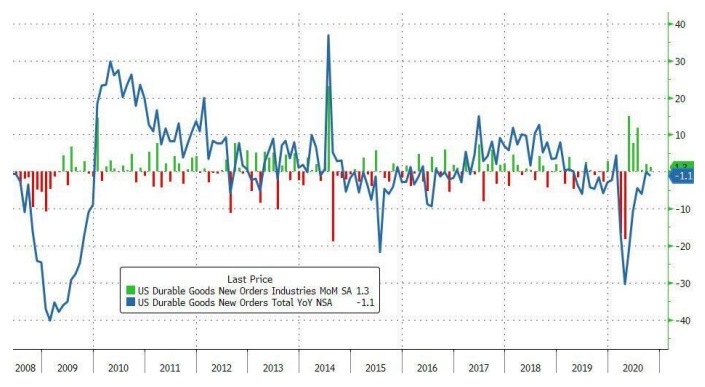

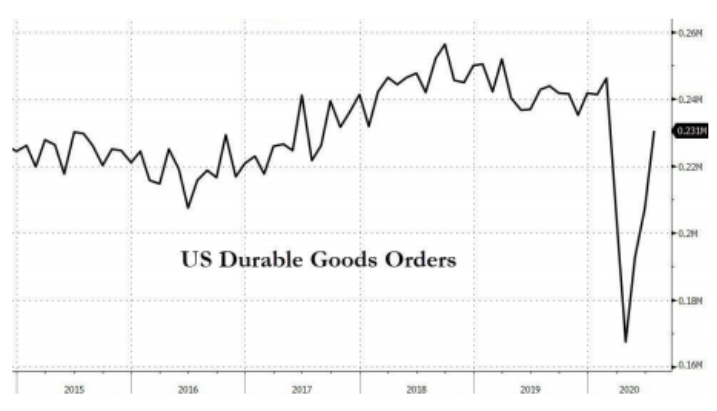

In addition to the claims, we also obtained the second reading for US GDP for the fourth quarter and January durable goods orders at 10:30 am. Pending home sales data is at 12 noon and Kansas City Fed manufacturing is at 1 pm. ARK Investment Management CEO Cathie Wood speaks at Bloomberg Crypto Summit. The increase in Treasury yields means that investors have new reasons to pay attention to Fed speakers. And there are no less than five on the list today, including Fed vice president for oversight, Randal Quarles. Salesforce.com Inc., Airbnb Inc., Dell Technologies Inc., Beyond Meat Inc. and Moderna Inc. are among the many companies that report results.

24 de fevereiro de 2021

24/02/2021 – What do you need to know for today?

Second day of Powell’s Q&A, the Wood effect and $ 100 forecasts for oil.

Home call

Volatility in the global bond and stock markets is easing today, after Fed Chairman Jerome Powell’s reassuring comments to the Senate Banking Committee yesterday. He signaled that the central bank is far from withdrawing its economic support measures, saying that there is still a long way to go to achieve its inflation and employment targets. Powell will testify to the House Financial Services Panel today.

Wood effect

Ark Investment Management’s Cathie Wood snapped up shares of Tesla Inc. with the continued sale destroying the company’s stock earnings for the year. Tesla reduced losses to end the session with 2.4% down and more than 4% higher in pre-market trading this morning. The Madeira effect was also seen in Bitcoin, which is steadily back at $ 50,000 for much of the Asian session, after she commented positively on the token in an interview with Bloomberg. This does not mean that its core funds have escaped the drop in technology, with the ARK Innovation ETF seeing its largest outflow ever recorded.

Calm markets

Global equity was showing little sign of recent volatility this morning, with the exception of stocks in Hong Kong, where an increase in trading taxes caused a drop in shares. The MSCI Asia Pacific index fell 1.8%, while Japan’s Topix index closed down 1.8%. In Europe, the Stoxx 600 Index gained 0.3% at 7:50 am GMT. The S&P 500 futures pointed to a small gain at the opening, the 10-year Treasury yield stood at 1.367% and gold a little higher.

Oil at $ 100?

The United States passed the bleak half a million pandemic deaths yesterday, with global fatalities of almost 2.5 million. Although hospitalizations and deaths have fallen since the peak of January, President Joe Biden emphasized the need to continue wearing masks and to distance himself socially at a White House ceremony that marked the toll yesterday. On the vaccination front, there is growing evidence of its effectiveness, while AstraZeneca Plc’s Covid-19 antibody cocktail proved to be effective against virus variants in initial tests.

Arriving

The December FHFA and S&P CoreLogic price numbers are at 11 am. Consumer confidence from the Conference Board and Richmond Fed Manufacturing for February is at 12 noon. The International Petroleum Week begins. Home Depot Inc., Macy’s Inc., Toll Brothers Inc. and CoStar group Inc. are among the companies that reported results.

23 de fevereiro de 2021

23/02/2021 – What do you need to know for today?

As technology stocks hit, the reflection trade continues and Powell’s testimony is due.

Off bets

The biggest stock market results remain under pressure this morning. Futures for the high-tech Nasdaq 100 fell 1.5%, after the index fell 2.6% in yesterday’s trading on a sale on some of the hottest pandemic purchases, such as Peloton Interactive Inc., which sank 10%. Tesla Inc. shares are expected to fall again at the opening, with futures trading well below $ 700. CEO Elon Musk’s bet on Bitcoin has also taken a hit, with the cryptocurrency dropping significantly again this morning.

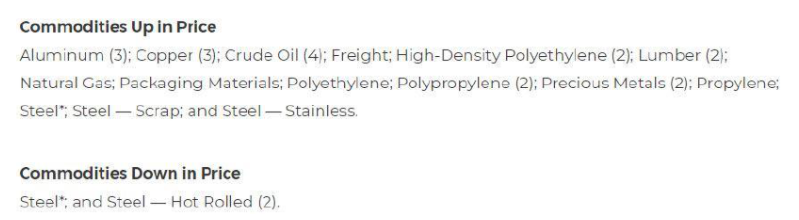

Reflection

Positioning for a global economic recovery remains the dominant theme of the market, with yields on developed market securities rising again. The Bloomberg Commodity Spot Index, which tracks price movements for 23 raw materials, rose to its highest level since March 2013 yesterday. Oil is also rising, with a barrel of West Texas Intermediate for April delivery at $ 62.36 at 6:50 am Brasília time. The S&P 500 futures pointed to a drop in the gap.

Powell

With everything going on, investors will be glued to the testimony of Fed Chairman Jerome Powell to the Senate Banking Committee today. He is likely to cite the millions of Americans who are still out of work due to the pandemic and to repeat that the Federal Reserve is not considering withdrawing support anytime soon. It will also almost certainly face questions about the inflationary risk posed by the proposed stimulus plan, with asset prices already high. Your testimony starts at 12:00.

500,000

The United States passed the bleak half a million pandemic deaths yesterday, with global fatalities of almost 2.5 million. Although hospitalizations and deaths have fallen since the peak of January, President Joe Biden emphasized the need to continue wearing masks and to distance himself socially at a White House ceremony that marked the toll yesterday. On the vaccination front, there is growing evidence of its effectiveness, while AstraZeneca Plc’s Covid-19 antibody cocktail proved to be effective against virus variants in initial tests.

Arriving

The December FHFA and S&P CoreLogic price numbers are at 11 am. Consumer confidence from the Conference Board and Richmond Fed Manufacturing for February is at 12 noon. The International Petroleum Week begins. Home Depot Inc., Macy’s Inc., Toll Brothers Inc. and CoStar group Inc. are among the companies that reported results.

23 de fevereiro de 2021

23/02/2021 – What do you need to know for today?

As technology stocks hit, the reflection trade continues and Powell’s testimony is due.

Off bets

The biggest stock market results remain under pressure this morning. Futures for the high-tech Nasdaq 100 fell 1.5%, after the index fell 2.6% in yesterday’s trading on a sale on some of the hottest pandemic purchases, such as Peloton Interactive Inc., which sank 10%. Tesla Inc. shares are expected to fall again at the opening, with futures trading well below $ 700. CEO Elon Musk’s bet on Bitcoin has also taken a hit, with the cryptocurrency dropping significantly again this morning.

Reflection

Positioning for a global economic recovery remains the dominant theme of the market, with yields on developed market securities rising again. The Bloomberg Commodity Spot Index, which tracks price movements for 23 raw materials, rose to its highest level since March 2013 yesterday. Oil is also rising, with a barrel of West Texas Intermediate for April delivery at $ 62.36 at 6:50 am Brasília time. The S&P 500 futures pointed to a drop in the gap.

Powell

With everything going on, investors will be glued to the testimony of Fed Chairman Jerome Powell to the Senate Banking Committee today. He is likely to cite the millions of Americans who are still out of work due to the pandemic and to repeat that the Federal Reserve is not considering withdrawing support anytime soon. It will also almost certainly face questions about the inflationary risk posed by the proposed stimulus plan, with asset prices already high. Your testimony starts at 12:00.

500,000

The United States passed the bleak half a million pandemic deaths yesterday, with global fatalities of almost 2.5 million. Although hospitalizations and deaths have fallen since the peak of January, President Joe Biden emphasized the need to continue wearing masks and to distance himself socially at a White House ceremony that marked the toll yesterday. On the vaccination front, there is growing evidence of its effectiveness, while AstraZeneca Plc’s Covid-19 antibody cocktail proved to be effective against virus variants in initial tests.

Arriving

The December FHFA and S&P CoreLogic price numbers are at 11 am. Consumer confidence from the Conference Board and Richmond Fed Manufacturing for February is at 12 noon. The International Petroleum Week begins. Home Depot Inc., Macy’s Inc., Toll Brothers Inc. and CoStar group Inc. are among the companies that reported results.

19 de fevereiro de 2021

19/02/2021 – What do you need to know for today?

Texas thaws, Biden is open to talk to Iran and it’s PMI day.

Guilt game

As power begins to return in Texas after the biggest forced blackout in U.S. history, state governor Greg Abbott harshly criticized the grid manager and asked lawmakers to determine winter protection for the power infrastructure. For the markets, the resumption of oil production capacity in the region has been a relief, with oil executives saying that most of the lost production would be restored in a few days. Global oil prices, which rose with the standstill, are falling again this morning.

Iran speaks

Although the closure of Texas was a short and sharp shock to the oil market, there are signs of diplomatic reach between the US and Iran that, if successful, would have broader implications for the global supply of oil. The Biden government said it would be willing to meet with Iran to find a way to return to the nuclear deal that was abandoned by President Donald Trump. The sequence of any resumption of negotiations will be difficult, with Tehran already calling for the lifting of sanctions before sitting down with the United States. The other signatory countries to the 2015 agreement want to restore it, which could put Iran back on the table.

PMI Day

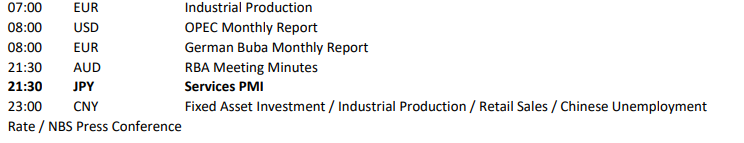

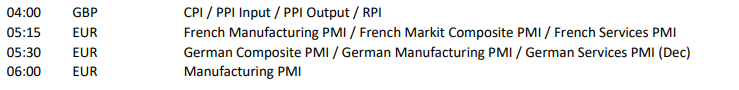

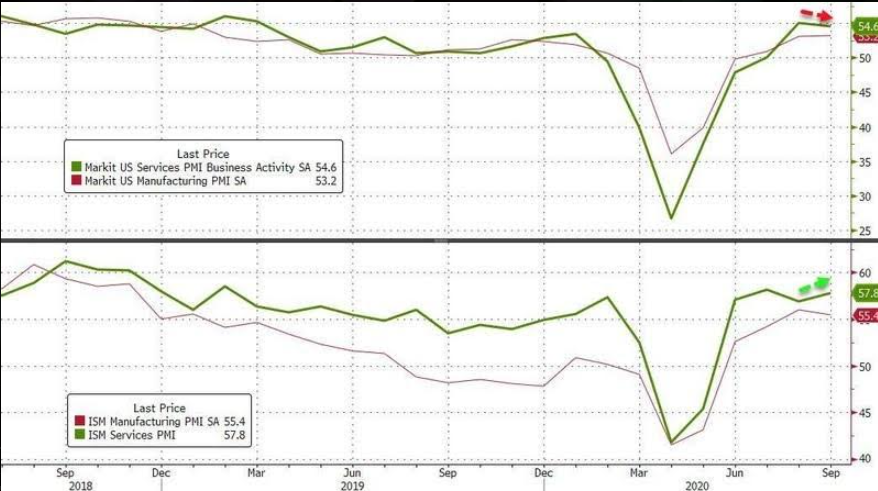

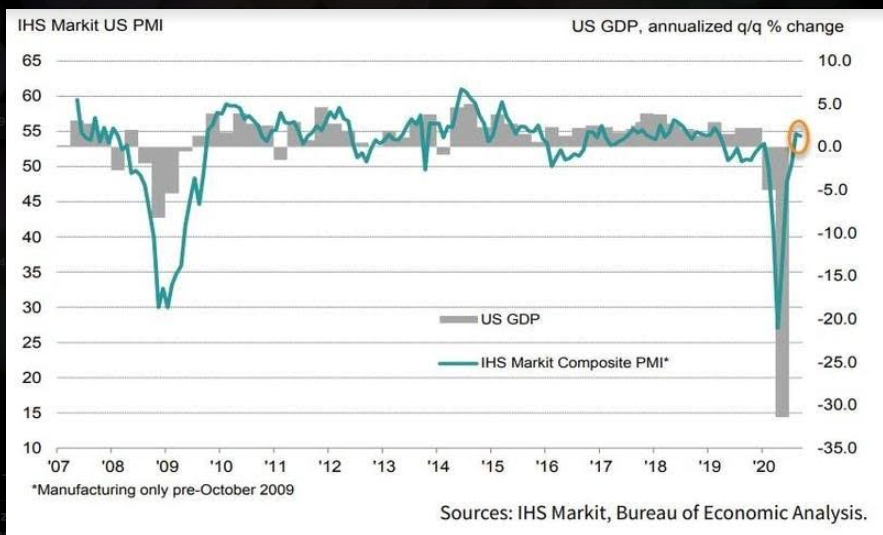

Current data from the survey of purchasing managers shows a mixed picture of the global recovery. In Japan, manufacturing activity has expanded, while measures to combat the pandemic have continued to weigh on services. It was a similar story in France and Germany, where manufacturing has grown again, while the drop in services means that the private sector remains under pressure. A composite indicator for the euro area was 48.1 for February. In the UK, problems in the supply chain due to Brexit helped to push factory activity to the weakest level in nine months. PMI data for the U.S. economy is published at 11:45 am Eastern Time.

Markets rise

Global stock markets are ending a mixed week on a quiet note. Overnight, the MSCI Asia Pacific index remained largely unchanged, while Japan’s Topix index closed down 0.7%. In Europe, the Stoxx 600 Index gained 0.4% at 7:50 am, with gains again being the biggest drivers of movements. The S&P 500 futures pointed to a higher opening, the 10-year Treasury yield was at 1.308% and gold fell.

Arriving

Existing home sales data for January is at 12 noon, with the most recent Baker Hughes probe count at 3 pm President Joe Biden attends a virtual G-7 meeting. Richmond Fed Chairman Thomas Barkin and Boston Fed Chairman Eric Rosengren speak later. Deere & Co. reports earnings.

18 de fevereiro de 2021

18/02/2021 – What do you need to know for today?

Texas’ big freeze goes global, specific data is due and GameStop audiences superior.

Frozen market

With millions of Texans in the dark for the fourth day after the exceptionally cold weather caused widespread blackouts, the consequences for energy markets are becoming a worldwide problem. Nearly 40% of U.S. oil production is offline, helping to push Brent’s global reference price to more than $ 65 a barrel in the Asian session. Although temperatures are expected to rise this weekend, it could take weeks for production to be fully restored, as operators need to assess wells for damage. There may also be some political scramble after Texas Governor Greg Abbott said he was banning gas from leaving the state, a move that some say violates the US Constitution’s trade clause.

Unemployed

Weekly data on initial unemployment insurance claims at 10:30 am. A small improvement is expected to reach 770,000, according to the average estimate of economists consulted by Bloomberg. While the economic data for the U.S. economy has been stronger than expected recently, there was little in yesterday’s Fed minutes to suggest that officials are willing to reduce the stimulus any time soon. The biggest challenge for Fed President Jerome Powell, who is entering the final year of his term, will be whether he will strike the right time to signal a retreat in accommodative measures.

WSB vs Congress

Congressional hearing on the rise driven by retail investors in GameStop Corp. shares. in January it starts today. Robinhood Markets and Citadel, central players in the events that have unfolded, will deliver a unified message that conspiracy theories suggesting that they worked together to harm retail investors are completely false. Among those who are expected to testify today is Keith Gill, aka Roaring Kitty and DeepF —- ngValue online, who said he invested in the company as he believes in it. Gill was also hit by a lawsuit that accuses him of misrepresenting himself as an amateur investor and making a profit by artificially inflating the stock price.

Calm markets

Bond yields resumed their upward pace this morning, while industrial commodities are receiving another boost. Shares are falling. Overnight, the MSCI Asia Pacific index fell 0.8%, while Japan’s Topix index closed down 1%. In Europe, the Stoxx 600 Index fell 0.3% at 7:50 am, with banks leading the losses. The S&P 500 futures pointed to a drop in the gap, the 10-year Treasury yield was at 1.282% and gold went up.

Arriving

In addition to the claims data, the United States will start housing in January and the Philadelphia Fed’s business prospects for February are at 10:30 am. The oil inventory data is at 1 pm. Fed Governor Lael Brainard and Atlanta Fed President Raphael Bostic speak later. It’s another big day for the profits of Walmart Inc., TripAdvisor Inc., Barrick Gold Corp. and Dropbox Inc. among the many companies that reported.

17 de fevereiro de 2021

17/02/2021 – What do you need to know for today?

Treasury yields increase, the cold climate continues and more promising pandemic signs.

Just beginning?

The 10-year Treasury yield rose above 1.33% in overnight trade, reaching the highest level since February 2020. Although this movement has slowed somewhat in European trade, volatility markets are signaling that US bonds may experience more violent swings in the coming months. There are many reasons for the change, as investors try to assess the impact of a stimulus bill yet to be completed and the reopening of the American economy. The increase in earnings is not an exclusively American phenomenon, with the Bloomberg Barclays Global Aggregate Index having its worst start to the year since 2013.

Deep freezing

U.S. oil production has dropped by about 3.5 million barrels a day, with production in the Permian Basin of Texas plummeting by up to 65%, while the region suffers from winter storms. With millions of people still without power in what is the biggest forced blackout in the history of the United States, questions are already being asked about how the power grid may have been so poorly prepared for bad weather. There are few signs that conditions are improving today, with shutdowns expected to last as the cold weather forecast predicts.

Vaccine

The rapid deployment of vaccines in the United States is also falling victim to the cold snap, with sites closed in Chicago, power outages causing delays in Houston and transport of gunshots. However, things are looking better for supply after the weather delays have passed, after President Joe Biden invoked federal law to increase production of vaccines Moderna Inc. and Pfizer Inc. The latest infection wave has passed, with forecasts now predicting a sharp drop in the pace of Covid-19 deaths in the U.S. in the coming weeks.

Calm markets

All the excitement this morning seems to be in the bond market, as the recent rise in stocks seems to have lost momentum. Overnight, the MSCI Asia Pacific index amounted to less than 0.1%, while Japan’s Topix index closed down 0.2%. In Europe, the Stoxx 600 index was 0.4% lower at 7:50 am Eastern Time as the results season continued with a mixed bag of results. The S&P 500 futures pointed to few changes at the opening, oil was above $ 60 a barrel and gold below $ 1800 an ounce.

Arriving

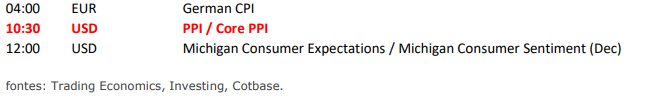

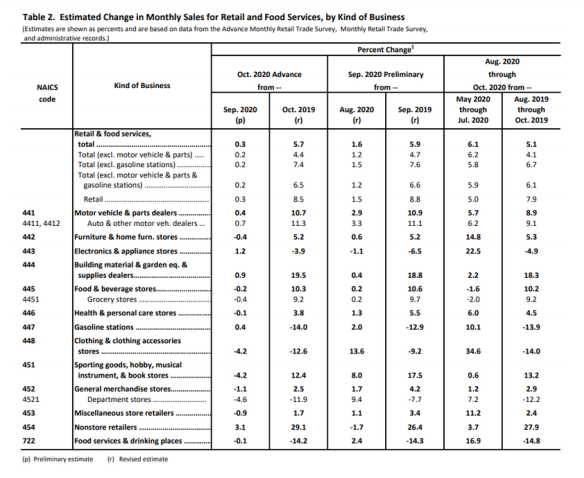

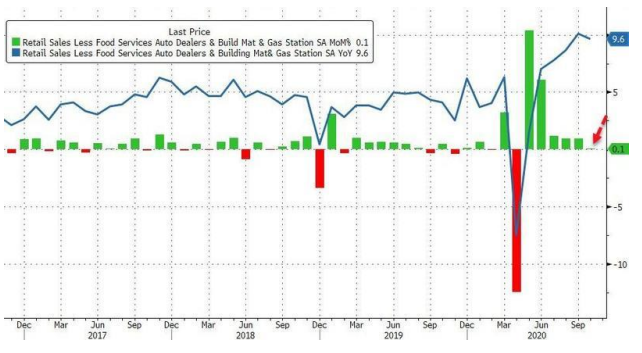

US retail sales are expected to have recovered strongly in January, with data published at 10:30 am US PPI and Canadian inflation for the month is also around that time. The last figures for industrial production are at 11:15 am. The minutes of the January Fed meeting are at 14:00. Richmond Fed Chairman Thomas Barkin and Boston Fed Chairman Eric Rosengren speak later. Shopify Inc., Baidu Inc. and Hilton Worldwide Holdings Inc. are among the companies that reported results.

16 de fevereiro de 2021

16/02/2021 – What do you need to know for today?

Democrats are back to stimulus work, the US energy crisis is deepening and more signs that the pandemic is easing.

Stimulus

Democratic lawmakers are quickly leaving the impeachment trial behind, as they return to the business of creating a stimulus package that will pass the Senate. With little time to go before the main benefits of the last round of pandemic relief on March 14, provisions like the $ 15 federal minimum wage will require delicate treatment. President Joe Biden is planning public events this week, including a city hall event in Milwaukee later today, to reorient the country in fighting the pandemic and to gather support for its economic plan.

Deep freezing

The unprecedented cold climate, which broke daily temperature records in hundreds of places in the southern United States, is paralyzing energy systems. Nearly 5 million people are without electricity, with no end in sight, as freezing conditions are expected to continue until tomorrow. Oil refineries and gas production in the region have been hit hard, while pipeline operators have declared force majeure, helping to push spot prices to “crazy” levels. President Biden approved an emergency declaration for Texas, making more federal resources available to the state.

Vaccine

US signals on the progress of the pandemic remain promising, with cases of Covid-19 and hospitalizations dropping dramatically, with almost 12% of the population receiving at least one dose of the vaccine. In the UK, Prime Minister Boris Johnson is drawing up plans to gradually ease restrictions, saying he wants the current blockade to be the last. Hong Kong is relaxing Thursday’s rules of social detachment, while a study in Israel showed a 94% drop in symptomatic cases among those who received two doses.

Market slip

There is no obvious threat today to derail the largest stock earnings sequence in 17 years. Overnight, the MSCI Asia Pacific index added 0.6%, while Japan’s Topix index closed 0.6% above. In Europe, the Stoxx 600 Index had risen 0.1% at 7:50 am Brasília time, with energy stocks having the best performance. The S&P 500 futures pointed to a strong start to the trading week, the 10-year Treasury yield was at 1.243%, oil rose and gold won.

Arriving

Empire Manufacturing for February is at 10:30 am. December ICT flow data at 6 pm Fed Governor Michelle Bowman, Kansas City Fed President Esther George, Dallas Fed President Robert Kaplan and San Francisco Fed President Mary Daly spoke later. Hedge funds disclose their investments in 13f deposits. CVS Health Corp., Palantir Technologies Inc. and Occidental Petroleum Corp. are among the companies that reported results.

11 de fevereiro de 2021

10/02/2021 – What do you need to know for today?

A ‘health check’ of the job market today, Democrats focused on the stimulus take advantage of Powell’s comments and more warnings about a slow recovery.

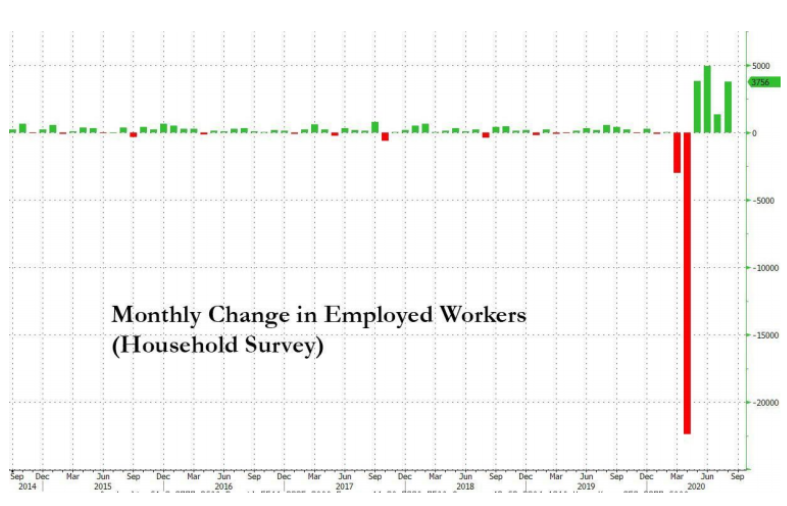

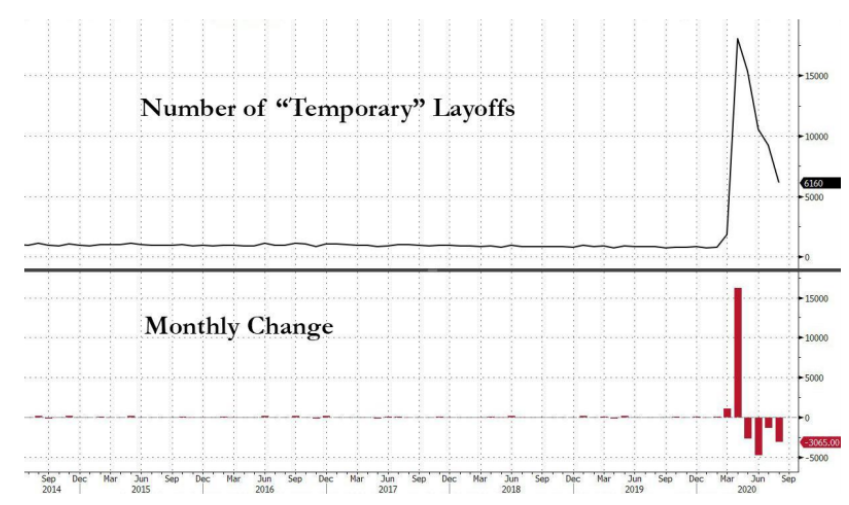

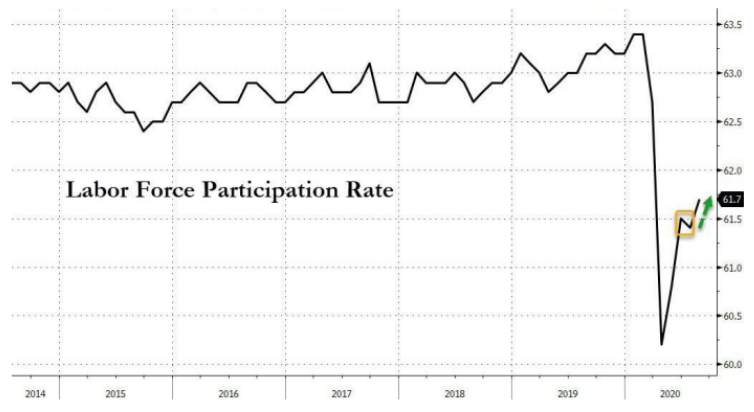

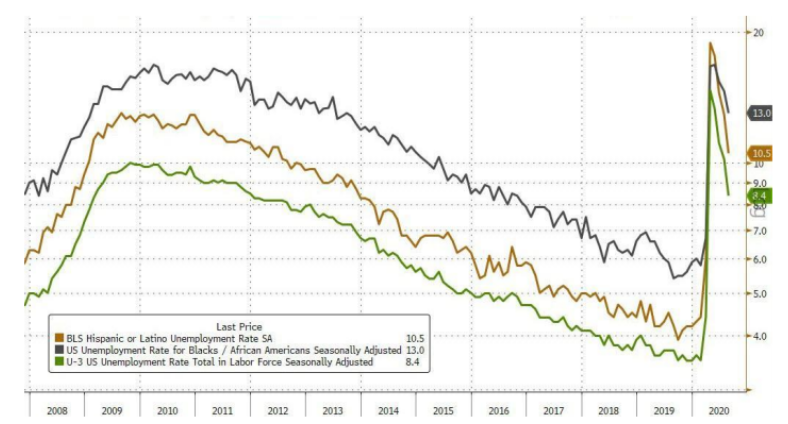

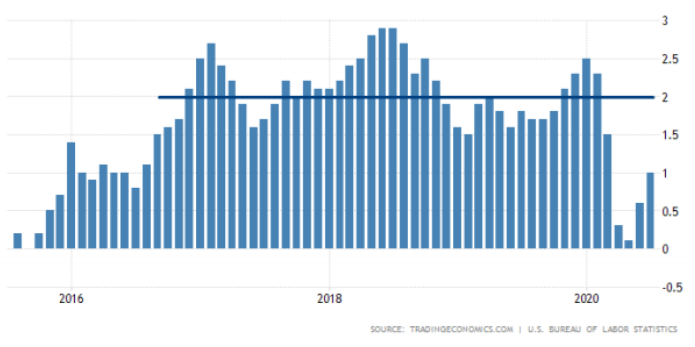

Unemployment

Insurance Fed Chairman Jerome Powell said yesterday that the US labor market remains far from a full recovery and that monetary policy will remain very accommodative until “substantial progress” in employment and inflation. There were few signs of this progress in yesterday’s data that was slower than expected on price growth, and the initial number of claims for unemployment benefits at 10:30 am Brasília time has dropped only slightly to 760,000.

Stimulus

Powell’s comments on the need for continued fiscal and monetary support were tapped by Democratic lawmakers who worked out the details of President Joe Biden’s stimulus bill on House committees. Powell’s comments give lawmakers ammunition to fight fears that a big package could serve to overheat the economy. Senate panels are planning to skip formal hearings and votes on the issue, as House time is taken over by former President Donald Trump’s impeachment trial

Impeachment

After the Senate voted 56 to 44 to proceed with the impeachment trial of former President Donald Trump, the arguments in the case begin today. While it is highly unlikely that he will be convicted on the sole charge of inciting insurrection, Senate minority leader Mitch McConnell signaled that his fellow Republicans should view the final vote as a matter of conscience. Democratic impeachment managers will present their case today, with arguments starting at noon

Calm markets

Stocks are having another relatively slow session as investors digest Powell’s comments and assess the outlook for inflation and the economy. Overnight, the MSCI Asia-Pacific Index increased 0.1% before the Lunar New Year celebrations in the region. Japan’s markets were closed for the holiday. In Europe, the Stoxx 600 Index gained 0.4% at 7:50 am, with the best performing technology stocks. The S&P 500 futures pointed to a higher opening, the 10-year Treasury yield was at 1.142%, oil fell and gold fell.

Arriving

The US auction of $ 27 billion in 30-year bonds at 3 pm today will be closely watched after the instrument’s yield rose briefly above 2% earlier this week. Subsequently, there will be rate decisions by central banks in Mexico and Peru. OPEC’s latest report on the oil market is also today. It is another gigantic day for profits, with Walt Disney Co., AllianceBernstein Holding LP, Expedia Group Inc., Kraft Heinz Co. and PepsiCo Inc. among the many reporting companies.

10 de fevereiro de 2021

10/02/2021 – What do you need to know for today?

A reality check on the information, the latest pandemic and the impeachment trial are underway

Price check

January inflation data, published at 10:30 am Eastern Time, is expected to show moderate and sustained growth in the U.S. This may be of little comfort to market participants, who are increasingly concerned about a potential increase in inflationary pressure. While the arguments are based on the size of the proposed stimulus plan and the health of balance sheets, Pimco is suggesting that those looking for a price drop will prove to be wrong again. Fed Chairman Jerome Powell is speaking in New York today, a speech that investors will be on the lookout for any comment on price stability.

Virus

Pimco’s optimistic view of inflation is centered on the long road to economic recovery, as the pandemic’s decline continues. Although the number of cases is decreasing and vaccinations continue, governments are generally being cautious about allowing economic activity to resume. Air travel remains under heavy pressure, with the UK’s quarantine measures the latest blow to the struggling industry. There is some good news about vaccine supply, with Pfizer’s partner BioNTech SE starting production at a new facility in Germany, and the UK government saying that a single dose of this injection provides two-thirds protection against Covid.

Impeachment

After the Senate voted 56 to 44 to proceed with the impeachment trial of former President Donald Trump, the arguments in the case begin today. While it is highly unlikely that he will be convicted on the sole charge of inciting insurrection, Senate minority leader Mitch McConnell signaled that his fellow Republicans should view the final vote as a matter of conscience. Democratic impeachment managers will present their case today, with arguments starting at noon

Calm markets

The global stock recovery continues to rise, albeit at a slower pace. Overnight, the MSCI Asia Pacific index increased 0.7%, while Japan’s Topix index closed up 0.3%. In Europe, the Stoxx 600 Index gained 0.2% at 7:50 am, with mining companies having the best performances, with high metal prices. The S&P 500 futures pointed to a small gain at the opening, the 10-year Treasury yield was at 1.16%, oil was rising and gold was higher.

Arriving

US wholesale inventory data for December is at 12 noon, with the latest oil inventory numbers at 12:30 pm. Powell speaks at 4 pm, with the US January budget statement also at that time. It is another big profit with General Motors Co., Uber Technologies Inc., Coca-Cola Co. and CME Group among the many companies that have reported.

09 de fevereiro de 2021

08/02/2021 – What do you need to know for today?

Biden prepares the independent stimulus strategy, Bitcoin emerges and Trump’s second impeachment trial begins.

Fast track

President Joe Biden appears to be easing his desire to win some Republican support for his $ 1.9 trillion stimulus project. White House press secretary Jen Psaki said the plan is likely to move forward according to the budget procedure, meaning it will only need a simple majority in the Senate to pass. Biden is being won over by Liberal Democrats, who cite the reduction in the size of the 2009 bailout as the cost of reaching an agreement with the Republicans. In the current package, House Democrats are proposing limits for the next round of payments to families, which would drop to zero for those earning more than $ 200,000.

Bitcoin

Although yesterday’s news said that cryptocurrencies were getting interesting again, we had no idea what Elon Musk had up his sleeve. Although he extolled the virtues of Dogecoin on Twitter, the biggest market move was in Bitcoin, which came after Tesla Inc. announced it had made a $ 1.5 billion investment in the cryptocurrency. In Asia, the digital token went over $ 48,000 for the first time, with fans of the currency saying that adoption by the fourth largest company on the S&P 500 Index could be the beginning of a more conventional adoption.

Impeachment

The Senate today begins the second impeachment trial of former President Donald Trump with a fight over whether he can proceed. Trump faces a single charge of inciting an uprising related to the January 6 riots at the Capitol in Washington. His lawyers argue that the trial violates his freedom of expression and rights to due process, in addition to being “constitutionally defective”. The debate today over whether the trial can proceed will be resolved in the Senate by a simple majority, which means it is likely to start properly tomorrow, when Trump’s defense team will start up to 16 hours of presentations.

Mixed markets

Rising stock prices are taking a break today, with investors digesting another series of profits and weighing the impact of rising inflation expectations. Overnight, the MSCI Asia Pacific index increased 0.4%, while Japan’s Topix index closed 0.1% above. In Europe, the Stoxx 600 Index was 0.4% lower at 7:50 am Brasília time, with energy companies among the few showing gains. The S&P 500 futures pointed to a slight drop in the opening, the 10-year Treasury yield was at 1.146% and gold went up.

Arriving

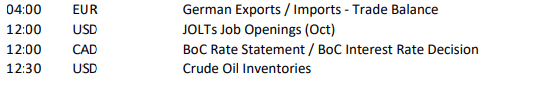

December US JOLTS job openings data is at 12 noon. Light commodity investors will closely monitor the US Department of Agriculture’s global agricultural supply and demand estimates at 2:00 pm for evidence of reduced corn and soybean supplies. St. Louis Fed President James Bullard is the only speaker on monetary policy today. Twitter Inc., Cisco Systems Inc., DuPont de Nemours Inc. and Lyft Inc. are among the many companies that report profits.

08 de fevereiro de 2021

08/02/2021 – What do you need to know for today?

Stimulus step, inflation is back and cryptocurrencies are back to life.

Full employment

President Joe Biden and Treasury Secretary Janet Yellen made their proposal for the $ 1.9 trillion stimulus package for American voters over the weekend. Yellen said the United States could return to full employment by 2022 if a series of sufficiently robust measures is implemented. Lawmakers intend to approve stimulus measures before the expansion of unemployment benefits ends on March 14. In addition to Republican objections to the package, prominent economists and former lawmakers are recording doubts. Even Democrat Lawrence Summers says that doing too much now poses inflationary risks.

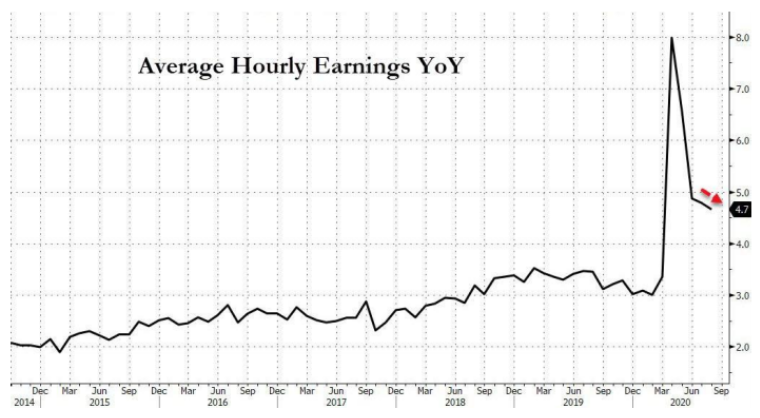

Inflation

Summers is not alone in worrying about inflationary pressures. The pace of US price growth implicit in the Treasury Bond market accelerated to the fastest pace since 2014, with the 10-year equilibrium rate above 2.2% this morning. Yields on the oldest American benchmark rose above 2% for the first time in almost a year. The movements are not only in the Treasuries market, with comments by the President of the European Central Bank, Christine Lagarde, on the need to slowly withdraw monetary and fiscal support, leading to increased returns across the euro area – with the exception of Italy , where the presence of Mario Draghi continues to excite investors.

Coins

Bitcoin rose again above $ 40,000 on Saturday, before lowering its last high to trade at $ 39,300 this morning. The cryptocurrency has seen renewed interest with enthusiasts touting the digital asset as a hedge against inflation, while the interest of fund managers continues to rise. The currency that dominates retail interest at the moment is Dogecoin, the ironic cryptocurrency that features a Shiba Inu dog as a mascot, after several Elon Musk tweets about him, and an apparent Twitter endorsement by Snoop Dogg. The world of digital assets is also being adopted by central banks, which are working to ensure that they do not lag behind developments.

Markets rise

Hopes for stimulus, the possibility of inflation somewhere on the horizon and a slowing virus infection rate are driving stocks to new records. Overnight, the MSCI Asia Pacific index increased by 0.7%, while Japan’s Topix index closed up 1.8%. In Europe, the Stoxx 600 Index rose 0.4% at 7:50 am Brasília time, with cyclical stocks leading the advance. The S&P 500 futures pointed to another upward opening, the 10-year Treasury yield was at 1.173% and gold rose slightly.

Oil Rally

While investors’ concerns about inflation may be driven primarily by expectations about the success of US fiscal measures, the role of oil prices in the equation should not be underestimated. This morning, Brent crude rose above $ 60 for the first time in more than a year, while the West Texas Intermediate barrel for March rose more than 1% to trade at $ 57.50. In addition to betting on an economic recovery, the price of oil has been driven by the success of the actions of OPEC and its allies to rebalance the market. Saudi Arabia remains in the lead, restricting supplies this month and next.

05 de fevereiro de 2021

05/02/2021 – What do you need to know for today?

It’s job day, the Senate approves a stimulus plan and more news about vaccines.

Back to growth

Today’s payroll report is expected to show that US employers added 105,000 jobs in January, according to the average estimate of economists polled by Bloomberg. The unemployment rate is expected to remain at 6.7%, moderating the increase in hourly wages, when the data are published at 10:30 am Eastern Time. All of this would echo the recent trend of promising US economic data, something that investors are beginning to see as a risk to the easy passage of a stimulus bill.

Progress

Speaking of stimulus, the basis for President Joe Biden’s $ 1.9 trillion package continues to advance in Congress. The Senate voted this morning along party lines – with Vice President Kamala Harris casting the vote – to adopt a budgetary measure that will allow the stimulus to pass without any Republican support. The measure now returns to the House for agreement on amendments added at the Senate’s 15-hour session, before lawmakers can draft a relief bill under special rules. The House and Senate commissions have until February 16 to settle the details of budget rules.

Vaccines

Johnson & Johnson asked US drug regulators to release their experimental Covid-19 vaccine for emergency use. If approved at a February 26 meeting of external consultants from the U.S. Food and Drug Administration, the single injection vaccine would be a strong addition to the country’s fight against the pandemic that killed 450,000 Americans. Elsewhere, Russian and Chinese vaccine manufacturers are in talks to test a combination of their vaccines in order to get better results. Economists are becoming increasingly concerned about the uneven global distribution of vaccines, with a report by the International Chamber of Commerce saying that the cost of failing to inoculate the world could reach $ 9.2 trillion.

Markets rise

Progress in stimuli, vaccines and a strong earnings season continues to be welcomed with investor optimism. Overnight, the MSCI Asia Pacific index increased 0.7%, while Japan’s Topix index closed 1.4% above. In Europe, the Stoxx 600 Index rose 0.4% at 7:50 am, driven by positive gains from construction and banks. The S&P 500 futures pointed to another upward movement at the opening before the jobs report, the 10-year Treasury yield was at 1.157%, oil rose and gold won.

Arriving

Progress in stimuli, vaccines and a strong earnings season continues to be welcomed with investor optimism. Overnight, the MSCI Asia Pacific index increased 0.7%, while Japan’s Topix index closed 1.4% above. In Europe, the Stoxx 600 Index rose 0.4% at 7:50 am, driven by positive gains from construction and banks. The S&P 500 futures pointed to another upward movement at the opening before the jobs report, the 10-year Treasury yield was at 1.157%, oil rose and gold won.

04 de fevereiro de 2021

04/02/2021 – What do you need to know for today?

Stimulus efforts are progressing amid party grudges, due data and regulators come together to discuss the retail craze.

Verifications

verifications While President Joe Biden is unwilling to change the size of $ 1,400 stimulus checks for individuals in his $ 1.9 trillion package, Democrats in Congress are weighing whether to lower the earnings threshold above which payments are eliminated. With the White House still hoping to get some Republican support for measures to boost the economy, Republican Party lawmakers are involved in internal power struggles between the party’s moderate and Trump-supporting wings. The Senate will also final approve the budget resolution today, the debate for which opened in a party vote on Tuesday.

Claims

The driving force behind the stimulus package is obviously the damage done to the US economy by the pandemic. Recent data suggests that a recovery is beginning, with the rising trend receiving a health check at 10:30 am Eastern Time, when the latest weekly unemployment insurance numbers are published. Economists polled by Bloomberg expect a drop to 830,000, still high. The January payroll report will be released tomorrow, with 100,000 new jobs expected to be added.

Consumer protection

Today’s regulators’ meeting overseen by Treasury Secretary Janet Yellen to discuss the recent market volatility driven by retail investors is seen as a test of how the new management will deal with consumer and investor protection issues. While the U.S. Securities and Exchange Commission is already investigating social media and online message boards for signs of collusion and lawmakers in Washington have acted to hold hearings on the matter, there is little to suggest that today’s meeting will lead any concrete action. GameStop Corp.’s stock, which has been the model for recent volatility, is slightly higher in the pre-market this morning.

Mixed markets

This week’s bullish movement in global equities is loosing its breath today, with corporate earnings rising and the dollar rising. Overnight, the MSCI Asia Pacific index fell 0.6%, while Japan’s Topix index closed down 0.3%. In Europe, the Stoxx 600 Index was 0.1% higher at 7:50 am in mixed trading, while investors were digesting a series of company results. The S&P 500 futures pointed to a slight increase in openness, the 10-year Treasury yield was at 1.137%, oil rose and gold fell.

Arriving

US factory and durable goods orders in December are at 12 noon. Dallas Fed Chairman Robert Kaplan and San Francisco Fed Chairman Mary Daly speak later. It’s a huge day for earnings, with Ford Motor Co., Snap Inc., Merck & co. Inc., Gilead Sciences Inc., Clorox Co., Philip Morris International Inc., T-Mobile US Inc. and Pinterest Inc. among the many, many companies that reported.

02 de fevereiro de 2021

02/02/2021 – What do you need to know for today?

Democrats are pushing forward, vaccine progress and Reddit favorites are losing ground.

Budget reconciliation

House Speaker Nancy Pelosi and Senate Majority Leader Chuck Schumer presented a budget resolution yesterday, the first step in a process called budget reconciliation that would allow much of the $ 1.9 trillion stimulus plan President Joe Biden’s approval by the Senate with only a simple majority. The move does not mean that hopes for a bipartisan agreement are dead, with yesterday’s meeting between the White House and Republican senators dubbed “very productive”.

Vaccines

The vaccination program in the United States has reached a significant milestone with the number of people receiving at least one dose of the Covid-19 vaccine now greater than the total number of reported infections in the country. The deputy director of the Center for Disease Control and Prevention signaled that the outbreak may have peaked, saying: “If this pandemic were an action, we might be looking to sell.” The benefits of a rapid vaccine launch are clear in the UK, where the pound has rebounded strongly as investors have become more optimistic about the outlook for the economy. Meanwhile, German Chancellor Angela Merkel is trying to reassure citizens about the availability of vaccines amid slow implementation in the region.

On?

The great movement in the shares of GameStop Corp. last week it seems to be decreasing. The video game retailer’s shares fell 23% in the pre-market, with turnover and rates decreasing. Silver is also well below yesterday’s highs, with metal dropping below $ 28 an ounce this morning. While it is probably too early to say whether the changes are over now, it is already clear that, once the dust settles, regulators will take a closer look at the role of social media in mobilizing investors. The Chamber’s Financial Services Committee has scheduled a hearing for February 18, which will examine the role of regulators and companies like Robinhood Markets in the recent volatility.

Markets rise

The stock markets are up again today as the United States adopts stimulus measures and the continued good news in front of vaccines helps to raise investor sentiment. Overnight, the MSCI Asia Pacific index increased 1.3%, while Japan’s Topix index closed 0.9% above. In Europe, the Stoxx 600 Index gained 1.2% at 7:50 am Eastern time, with all industry sectors in the green. The S&P 500 futures also pointed to a strong opening, the 10-year Treasury yield was at 1.105%, oil rose to a one-year high and gold fell.

Arriving

Today’s calendar is presented by the letter A, with Alphabet Inc., Amazon.com Inc. and Alibaba Group Holding Ltd. all reporting profits. January vending data is released later. Dallas Fed Chairman Robert Kaplan and Cleveland Fed Chairman Loretta Mester are expected to speak. Treasury Secretary Janet Yellen meets with Senate Democrats to discuss Covid’s relief. The oil revenue season continues with Exxon Mobil Corp. and ConocoPhillips announcing the results

01 de fevereiro de 2021

01/02/2021 – What do you need to know for today?

Silver skyrockets, the army takes power in Myanmar and a big week for the oil market.

White metal

Silver was briefly traded above $ 30 an ounce this morning, as the precious metal became the latest asset to receive a boost from activity by retail investors. Although the futures market has certainly taken a leap, much of the buying seemed to be focused on obtaining physical supplies, with sellers of coins and gold bars overloaded over the weekend. There’s an interesting subtext, as Ken Griffin’s Citadel Advisors LLC – who injected money into the struggling Melvin Capital amid little pressure from GameStop Corp. – is one of the main holders of the iShares Silver Trust ETF. Now it looks like it will benefit from the rise in metal.

Myanmar, Russia

Myanmar’s military detained Aung San Suu Kyi and declared a state of emergency for a year, nullifying his party’s overwhelming victory in the November elections. Communications with the nation of 55 million people were irregular, with the country’s stock market interrupting negotiations due to a connection error. The USA, the United Nations and the European Union urged the military to respect the results of the elections. There were more protests in Russia over the weekend, with 4,000 prisoners while protesters demanded the release of opposition leader Alexey Navalny.

Oil week

The executive officers of Exxon Mobil Corp. and Chevron Corp. talked about the merger of the two largest U.S. oil companies last year, Dow Jones said. The negotiations were preliminary and are not in progress, according to the report. The news starts a week that will be very hectic for the oil market, with almost all major producers reporting results. OPEC and its allies will review their December agreement on Tuesday, after a preliminary report estimated 99% compliance with production levels. Oil was trading slightly higher at $ 52.37 a barrel at 7:50 am Eastern Time.

Markets rise

The stock markets are starting the month on a positive note after a disappointing end of January. Overnight, the MSCI Asia Pacific index rose 1.5%, while Japan’s Topix index closed up 1.2%. In Europe, the Stoxx 600 Index gained 1.1% at 7:50 am, with miners by far the best. The S&P 500 futures pointed to a higher opening, the 10-year Treasury yield was at 1.074% and gold went up.

Arriving

Canada’s manufacturing PMI for January is at 11:30 am, with the U.S. number at 11:45 am and the manufacturing ISM at 12pm Minneapolis Fed Chairman Neel Kashkari, Dallas Fed Chairman Robert Kaplan, Atlanta Fed Chairman, Raphael Bostic and Boston Fed chief Eric Rosengren will speak later. President Joe Biden will meet with Republican senators at the White House today to discuss an alternative proposal for relief from Covid-19.

29 de janeiro de 2021

28/01/2021 – What do you need to know for today?

A run by Robinhood for money, regulators monitor the day’s trade and vaccine news.

Shaken up

Robin Hood Markets – the Silicon Valley company with the popular fee-free trading app – found itself at the center of GameStop Corp’s retail frenzy. when the Wall Street clearinghouse demanded large sums of capital as collateral from brokers amid an increase in the volume of shares with a high degree of floating sold. After trying to control risk for the first time by banning certain trades, sparking protests from American customers and even politicians, the company raised more than $ 1 billion and used credit lines to weather the storm. As for GameStop, it went up more than 100% in the pre-market.

Spreading mania

While GameStop was the poster girl for market movements driven by Reddit, companies like AMC Entertainment Holdings Inc. have also seen their prices rise, while capitalizing on the action to raise money. The buying craze is not limited to highly sold stocks, with silver getting a jump yesterday. While US regulators have said they are “actively monitoring” volatility in the options and stock markets, financial veteran Mark Mobius said there should be no action and that regulators should just ensure that trades are done “efficiently. and fair “. Meanwhile, it took no more than an Elon Musk tweet about ‘Bitcoin’ for the cryptocurrency to rise 15%.

Vaccines

Equity markets are under pressure again today, as major economies still face pandemic headwinds and higher levels of volatility mean that investors are becoming more risk averse. Overnight, the MSCI Asia Pacific index fell 1.4%, while Japan’s Topix index closed at 1.7%. In Europe, the Stoxx 600 Index fell 1.1% at 7:50 am Brasília time, with banks being the ones that fell the most. The S&P 500 futures pointed to a drop in openness, the 10-year Treasury yield was at 1.071%, oil was rising and gold was higher.

Market drop

The US personal spending and income data for December, as well as the PCE report, is at 10:30 am. MNI Chicago PMI is at 11:45 am. Pending home sales in December and the University of Michigan sentiment reading in January are at 10 am. The Baker Hughes probe count is at 3 pm. Dallas Fed Chairman Robert Kaplan and San Francisco Fed Chairman Mary Daly speak later. Caterpillar Inc., Eli Lilly & Co., Chevron Corp. and Colgate-Palmolive Co. are among the many companies that reported the results later.

Arriving

As with complaints and GDP data, US retail and wholesale inventory data for December is at 10:30 am. The new home sales figures for the month are at 12 noon and Kansas Fed manufacturing activity in January is at 1 pm Virtual Davos, Bloomberg The Year Ahead and the Future Investment Initiative in Riyadh continue. It’s another busy day for earnings with Visa Inc., Mastercard Inc., McDonald’s Corp., American Airlines Group Inc. and Comcast Corp. among the many companies that report results.

28 de janeiro de 2021

28/01/2021 – What do you need to know for today?

GameStop goes global, base data expires and further Covid restrictions are lifted.

Long shorts

Strongly sold companies around the world are seeing their stocks jump as brokers bet on the next destination in the flood of cash from retailers. There is a long list of potential targets – companies that have interest levels sold above 30% of their shares – that have risen in the past few days. GameStop Corp. shares they rose again in pre-market trades, from $ 500. For hedge funds, the attack on their short positions is proving painful and moving the broader market as they reduce their exposure to stocks at the lowest rate. fast since 2014.

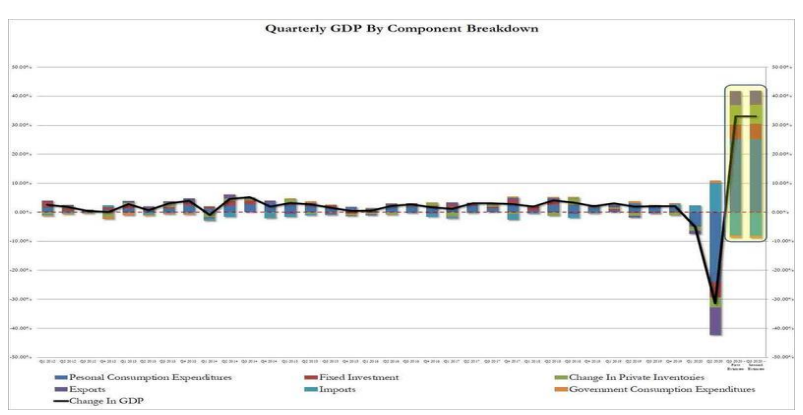

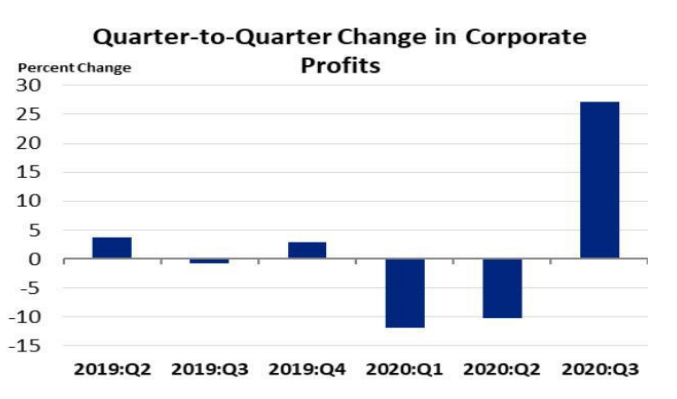

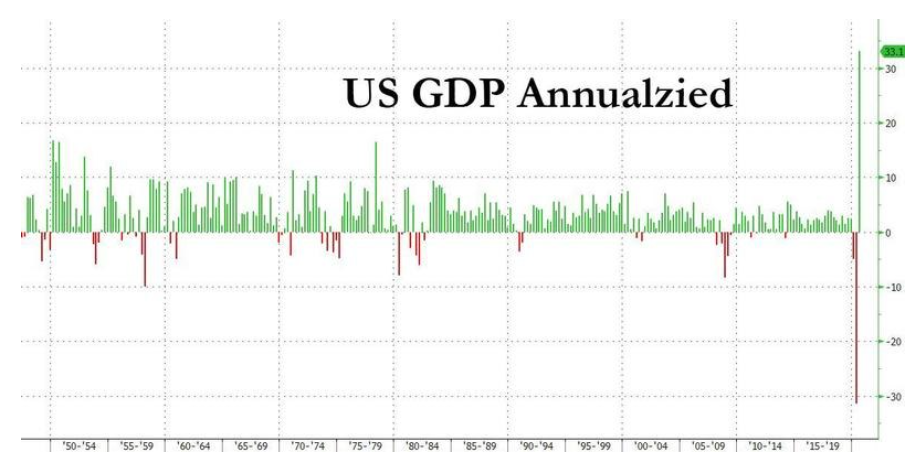

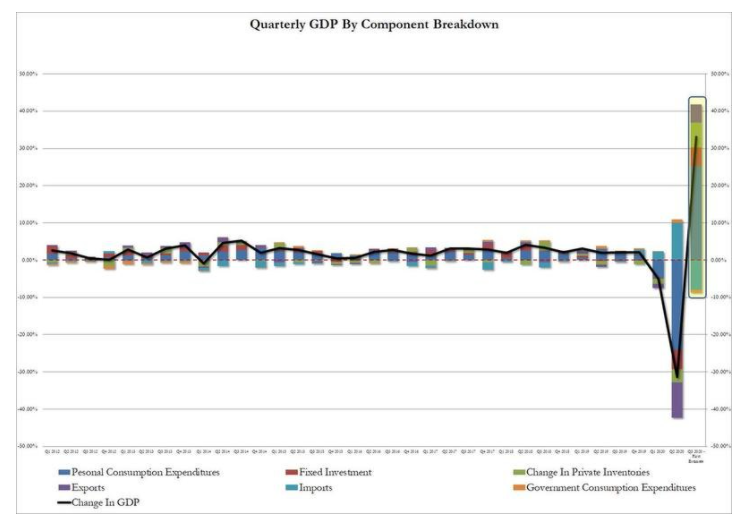

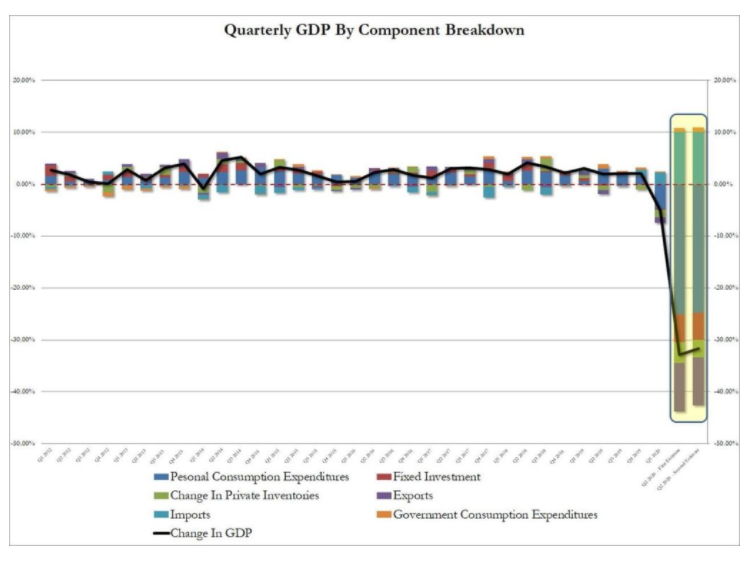

GDP, claims

The U.S. economy probably grew 4.2% in the last quarter of 2020, a far cry from the 33.4% expansion of Covid’s recovery in the previous three months. Last year ended with the resurgence of the pandemic and the weakening of the labor market, factors that Fed Chairman Jerome Powell highlighted yesterday when he reiterated that there will be no reduction in support for the economy for “some time”. We will have another job health check this morning when weekly unemployment insurance claims are published, with economists interviewed by Bloomberg predicting a small decline to 875,000, still high. GDP and claims numbers are published at 10:30 am Eastern Time.

Relaxation

The European Union and AstraZeneca Plc remain at odds after the drugmaker rejected demands that it receive supplies from its UK factories to increase doses for the bloc. There was some good news on the vaccine front with Pfizer Inc. and BioNTech SE saying the results of the studies indicate that the vaccine is effective against the UK and South Africa variants. In the USA, cases are falling rapidly in the states from the west and falling across the country. Governor Andrew Cuomo lifted restrictions at most of New York’s hot spots, declaring an end to the rise in the post-holiday virus.

Market drop

Stock markets are falling today, driven by a series of concerns in the wake of weaker-than-expected technology gains, the consequences of frantic retail trade and continuing pandemic concerns. Overnight, the MSCI Asia Pacific index fell 1.9%, while Japan’s Topix index closed at 1.1%. In Europe, the Stoxx 600 Index fell 1% at 7:50 am, with all but two sectors of industry in the red. The S&P 500 futures pointed to further losses at the opening, the 10-year Treasury yield was at 1.008%, oil fell and gold was slightly lower.

Arriving

As with complaints and GDP data, US retail and wholesale inventory data for December is at 10:30 am. The new home sales figures for the month are at 12 noon and Kansas Fed manufacturing activity in January is at 1 pm Virtual Davos, Bloomberg The Year Ahead and the Future Investment Initiative in Riyadh continue. It’s another busy day for earnings with Visa Inc., Mastercard Inc., McDonald’s Corp., American Airlines Group Inc. and Comcast Corp. among the many companies that report results.

27 de janeiro de 2021

27/01/2021 – What do you need to know for today?

GameStop craze, Fed decision day and disclosure of balance sheets from Apple, Facebook and Tesla.

One

This morning newsletter usually covers the important issues of the day, covering market trends and events. But, let’s be honest, practically the only thing people are talking about is the incredible recovery of GameStop Corp’s shares. The stock, which started the year below $ 20, was above $ 300 in the pre-market this morning, after luminaries like Elon Musk and Anthony Scaramucci weighed in on the phenomenal recovery. While GameStop is the most obvious example, this rise is part of a broader movement, where an army of retail traders flock to the best-selling stocks on Wall Street. The size of the movements is already leaving a mark on some hedge fund titans as the short squeeze unbalances anyone who is basing their investments on something that seemed like a fundamental analysis.

FED day

The Federal Open Market Committee (FOMC) is almost certain to keep interest rates close to zero and the pace of asset purchases unchanged in its decision today at 16:00, Brasília time. Despite hopes of a strong recovery, recent disappointing economic data, including on the labor market, mean that Fed Chairman Jerome Powell is likely to reaffirm that now is “not the time” to discuss a lessening of the stimulus. Your press conference will begin at 4:30 pm. There is no update to the FOMC forecasts today.

Earnings

Microsoft Corp. had a strong start to the season of big profits with technology yesterday, reporting sales well above analysts’ expectations. After today’s close, Apple Inc.’s iPhone sales will be in focus when the company reports. For Tesla Inc., which saw its stock price rise almost 8-fold last year, revenue from the sale of regulatory credits will be of interest, as will sales and order numbers. Facebook Inc. may see a jump in revenue, Bloomberg Intelligence said

Market Slip

The stock markets are down as investors digest a wave of earnings reports pending the Fed’s last decision. Overnight, the MSCI Asia Pacific index fell 0.3%, while Japan’s Topix index closed 0 , 7% above. In Europe, the Stoxx 600 Index fell 0.5% at 7:50 am, with energy stocks losing the most. The S&P 500 futures pointed to some weakness in the opening, the 10-year Treasury yield was at 1.043%, oil rose and gold fell.

Arriving

December durable goods orders in the United States are at 10:30 am, with crude oil inventories at 12:30 pm. President Joe Biden must speak about climate change and will sign a series of executive actions to combat global warming. The Bloomberg Virtual Davos and The Year Ahead event continue. In addition to all today’s technology gains, we have also received updates from many other companies, including Boeing Co., Abbott Laboratories, Stryker Corp. and Las Vegas Sands Corp.

26 de janeiro de 2021

26/01/2021 – What do you need to know for today?

The stimulus is still weeks away, the states are easing Covid’s restrictions and the big technology earnings season begins.

Mid-March

Stop me if you’ve heard this before, but the stimulus talks seem doomed to a long battle in the Senate. Majority leader Chuck Schumer said yesterday that his goal is to secure approval for the next round of Covid-19 relief until mid-March, when the unemployment benefits from the last package are over. President Joe Biden said he is open to reformulating the $ 1.9 trillion proposal, adding that the process of reaching an agreement is just beginning. There is some progress being made elsewhere in the Senate, with Janet Yellen confirmed yesterday as Secretary of the Treasury. Senators will take office as jurors at Donald Trump’s impeachment trial later, but will then pause on this issue to get further confirmation for Biden’s office.

Pandemic

California and other major states are beginning to ease restrictions as new cases of the virus and hospitalizations decline in the United States. It is a different story in Europe, where German Chancellor Angela Merkel told party colleagues that the country’s pandemic management has “gotten out of hand” and that stricter brakes are needed. In the Netherlands, there was another night of riots against the government imposing a curfew, just weeks before a national election. The World Health Organization has warned that vaccination coverage will not reach a point that will stop transmission of the virus in the near future.

Earnings

Microsoft Corp. kicks off the big tech profit season after the bell, with Bloomberg Intelligence suggesting that a drop in corporate sales may have been offset by consumer gaming and demand for PCs. The results from Starbucks Corp. will be focused on the prospects for 2021, with Johnson & Johnson’s focus firmly on the date of the company’s vaccine. Previously, UBS Group AG reported a very strong end to 2020 and announced that it would buy back up to 4 billion francs ($ 4.5 billion) in shares over the next three years.

Mixed markets

Global equity investors remain cautious as Biden’s stimulus plan is bogged down in Washington and fears about the spread of virus mutations create a climate of risk avoidance. Overnight, the MSCI Asia Pacific index fell 1.4%, while Japan’s Topix index closed down 0.8%. In Europe, the Stoxx 600 Index gained 0.6% at 7:50 am GMT, with financial services companies among the best performers after UBS results. The S&P 500 futures pointed to a small drop in the opening, the 10-year Treasury yield was at 1.045%, oil won and gold fell.

Arriving

November US house price data is at 11 am, with the latest consumer confidence data and the Richmond FED Manufacturing numbers at 12 noon. It is a busy day in the Senate with the vote of Antony Blinken as secretary of state, a panel hearing on Gina The appointment of Raimondo as secretary of commerce and the inauguration of senators for the impeachment trial. Bloomberg holds a virtual event for the following year.

25 de janeiro de 2021

25/01/2021 – What do you need to know for today?

Biden’s stimulus challenge, more travel restrictions and virtual Davos begins.

Trillion dollar question

A bipartisan group of lawmakers challenged White House economic adviser Brian Deese about the size of the proposed $ 1.9 trillion stimulus plan on a call yesterday. The package is facing increasing resistance, with even moderate Republicans calling for a smaller deal. Also in Washington today, House impeachment administrators will hand the Senate the only article accusing former President Donald Trump of inciting the January 6 riot on Capitol Hill. Discussions on the case will not begin until February 8.

Pandemic

Global coronavirus cases are approaching 100 million, with infections in the United States accounting for more than a quarter of that total. President Joe Biden will continue to restrict travel from Europe to the US, with all travelers arriving in the country required to give a negative test result within three days of the trip starting on Monday. With more than 65.6 million vaccines administered in 56 countries, according to data collected by Bloomberg, investors are beginning to defend the countries that have had the fastest launches.

Davos online

Chinese President Xi Jinping will speak today at the online “Davos Agenda” organized by the World Economic Forum. French President Emmanuel Macron, German Chancellor Angela Merkel and Indian Prime Minister Narendra Modi are also expected to speak at the week-long event. For Xi, the speech comes at a time when relations between China and the US reach a low point, with the Biden government signaling that it will continue to maintain a hard line towards Beijing.

Mixed markets

Global equities are beginning the week cautiously as investors assess the chances of a fresh stimulus against further signs of the damage the pandemic has caused to economic activity. Overnight, the MSCI Asia Pacific index rose 0.9%, while Japan’s Topix index closed up 0.3%. In Europe, the Stoxx 600 Index gave up previous gains to trade largely unchanged at 7:50 am GMT, after German IFO survey numbers were below expectations. The S&P 500 futures pointed to an opening gain, the 10-year Treasury yield was at 1.08%, oil was rising and gold was higher.

Arriving

The Chicago Fed National Activity Index for December is at 10:30, with Dallas Fed Manufacturing for January at 12:00. The Senate will vote on Janet Yellen’s appointment as Treasury Secretary at 7:30 pm. President Biden will sign an executive order on manufacturing. Stock brokers will be on the lookout to see where GameStop Corp. trades at the opening, after the company’s shares more than doubled earlier this morning. In other corporate news, Kimberly-Clark Corp. and Steel Dynamics Inc. are among the companies reporting today.

24 de janeiro de 2021

24/01/2021 – What do you need to know for today?

Demonstrations in Russia, New blockades, Big Techs’ balance sheet week and the Fed’s interest and monetary policy.

In the US

It will be a busy week of economic data, including new GDP growth figures, Fed monetary policy decisions and corporate earnings, with reports from Apple, Microsoft, Facebook and Tesla. Investors will continue to focus on the pandemic, especially on new and more contagious strains (South Africa), and will carefully monitor President Biden’s legislative agenda in a divided Congress. Elsewhere, the IMF is expected to disclose its World Economic Outlook and the growth figures for Germany, Mexico and Hong Kong will also be highlighted.

22 de janeiro de 2021

22/01/2021 – What do you need to know for today?

Biden’s warning about Covid, the blockages may last until summer, and it’s PMI day.

Darker days

President Joe Biden warned that the United States could see 100,000 deaths from the pandemic in the next month and urged the country to take a “wartime” stance while pressing Congress for more help. The president’s chief economic adviser, Brian Deese, plans to meet with a bipartisan group of lawmakers in the coming days to discuss the stimulus plan, as Republican resistance to the $ 1.9 trillion package appears to be strengthening. Dr. Anthony Fauci is back at the forefront of the country’s pandemic response after being removed from the previous government.

Pandemic

The hope that the activity can return to normal in the most affected economies is becoming increasingly distant, despite the progress being made in vaccinations. UK Prime Minister Boris Johnson has signaled that the current blockade in the country could last until the summer, while local officials have suggested paying people who test positive for the virus to stay home. German Chancellor Angela Merkel said it would be the end of September before anyone wishing to be vaccinated could get an injection. Rabies is increasing across Europe as Pfizer’s vaccine supply dwindles. In the US, President Biden will sign executive actions today that will boost food assistance for impoverished Americans.

Slow down

The damage caused to economic activity was made clear in the European Purchasing Managers Index figures, which clearly signaled a double dip in the euro area. IHS Markit’s private sector activity indicator fell to 47.5, with the services sector continuing to lag behind, while manufacturing in Germany remained strong. UK production fell at the fastest pace since May, with Brexit delays adding to the slowdown caused by the pandemic. US economy PMI data is released at 11:45 am Eastern Time this morning.

Market drop

All the warnings and weak data are not falling on investors’ ears, with markets around the world losing ground. Overnight, the MSCI Asia Pacific index fell 0.7%, while Japan’s Topix index closed down 0.2%. In Europe, the Stoxx 600 Index fell 1% at 7:50 am, with all sectors of the industry in the red. The S&P 500 futures pointed to a loss at the opening, the 10-year Treasury yield was at 1.096%, oil fell and gold fell.

Arriving

US PMIs are at 11:45 am and existing home sales in December at 12:00. The crude oil inventory data is at 1 pm. The Senate can take confirmation votes on Secretary of State Antony Blinken’s nominee and Treasury Secretary Janet Yellen’s nominee today. Baker Hughes rigs count at 3 pm and Schlumberger NV is among the companies reporting profits.

21 de janeiro de 2021

21/01/2021 – What do you need to know for today?

Biden’s new pandemic approach, past due data and ECB decision day

Busy start

President-elect Joe Biden will begin his term today with at least 15 executive actions that will reverse some of President Donald Trump’s key policies. The United States will again join the Paris climate agreement and the World Health Organization, and will stop building the wall on the Mexican border. Biden will also end the travel ban against some predominantly Muslim countries and revoke the license for the Keystone XL pipeline. It will also present measures to reduce inequality and ease the burden of student debt. The opening, under strong security, will see Biden take the oath of office at noon today.

Claims

The pandemic that has seen more than 400,000 American deaths means that the Biden government will have only a brief honeymoon period. There will be another check on the damage being done to the economy at 10:30 am Eastern time this morning, when the latest unemployment benefit claim data is released. The number of people signing up for benefits is expected to remain high after last week’s surprising jump to close to 1 million. Continued claims could reach 5.3 million.

Earnings

Netflix Inc. skyrocketed more than 13% in the pre-market after the company announced that it had added more subscribers than expected and would no longer need to borrow money to build its entertainment empire. The technology sector also received a boost this morning with the reported results from chip maker ASML Holding NV. Morgan Stanley concludes what has been a season of big profits for the biggest banks on Wall Street when it announces before opening today.

Decision day

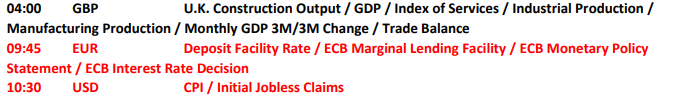

The European Central Bank is not expected to announce any changes to its ultra-long term policies when the last decision is announced at 9:45 am. President Christine Lagarde will face questions about the bank’s response to the pandemic at a press conference at 10:30 am. , while a series of new measures take action to stem the spread of the virus. German Chancellor Angela Merkel will give a press conference later, with the death toll rising to 50,000. Today, central banks in Japan, Norway and Turkey keep rates unchanged.

Markets rise

Global equities continue to move in one direction today, with the MSCI World Index hitting an intraday high earlier. Overnight, the MSCI Asia Pacific index added 0.8%, while Japan’s Topix index closed 0.6% above. In Europe, the Stoxx 600 Index gained 0.5% at 7:50 am, while investors were waiting for the last ECB decision. The S&P 500 futures pointed to a slight increase in openness, the 10-year Treasury yield was at 1.089%, oil fell and gold remained virtually unchanged.

Arriving

Initial US housing data for December is published at 10:30 am, with the Philadelphia Fed’s latest business forecast also at that time. The technology sector, which grew with earnings from Netflix Inc., will undergo another test today, when Intel Corp. and International Business Machines Corp. PPG Industries Inc., Baker Hughes Co. and Northern Trust Corp. are among the many other companies that have announced results.

20 de janeiro de 2021

20/01/2021 – What do you need to know for today?

Biden gets straight to the point, Republicans back off on stimulus and another big day for gains.

Unroll

President-elect Joe Biden will begin his term today with at least 15 executive actions that will reverse some of President Donald Trump’s key policies. The United States will again join the Paris climate agreement and the World Health Organization, and will stop building the wall on the Mexican border. Biden will also end the travel ban against some predominantly Muslim countries and revoke the license for the Keystone XL pipeline. It will also present measures to reduce inequality and ease the burden of student debt. The opening, under strong security, will see Biden take the oath of office at noon today.

Stimulus

While policy changes under Biden are certainly a change in tone towards the White House, investors are likely to be more concerned in the short term with the progress of a new stimulus package to help the economy still under pressure from the pandemic. Janet Yellen encountered Republican resistance to the $ 1.9 trillion relief plan during her confirmation hearing in the Senate yesterday. The Biden government will need 10 Republican senators to vote in favor of the package if it is to be quickly approved.

Earnings

Netflix Inc. skyrocketed more than 13% in the pre-market after the company announced that it had added more subscribers than expected and would no longer need to borrow money to build its entertainment empire. The technology sector also received a boost this morning with the reported results from chip maker ASML Holding NV. Morgan Stanley concludes what has been a season of big profits for the biggest banks on Wall Street when it announces before opening today.

Markets rise

While it is certainly a big day on the political front, global actions are relatively calm. Overnight, the MSCI Asia Pacific index rose 0.6%, while Japan’s Topix index fell 0.3%. In Europe, the Stoxx 600 Index was 0.6% higher at 7:50 am GMT, with luxury goods manufacturers seeing an increase with positive sales figures in China. The S&P 500 futures pointed to an opening gain, the 10-year Treasury yield was at 1.104%, oil was at $ 53.50 a barrel and gold was rising.

Arriving

Canada’s CPI reading in December will be at 10:30 am, followed by the BoC’s interest decision at 12pm, where Governor Tiff Macklem is expected to keep the policy unchanged. In addition to the inauguration of Joe Biden, Washington will also see the inauguration of the Democratic senators who won the runoff elections in Georgia. Procter & Gamble Co. and Kinder Morgan Inc. report profits.

19 de janeiro de 2021

19/01/2021 – What do you need to know for today?

Yellen’s pitch, Trump’s last day and another hectic day for earnings.

Tax chops