Weekly Analysis

Weekly Analysis

28/02/2021 – ANÁLISE SEMANAL – WEEKLY OUTLOOK

02/28/2021 – Approval of the stimulus package at the congress, PMI week Manufacturing / Services, Inflation in Europe and American Payroll. The RBA update its monetary policy.

After President Biden’s $ 1.9 trillion pandemic aid bill was passed by little in the Chamber at dawn on Saturday, all attention would now turn to the vote in the Senate. In the meantime, investors will also look at the US jobs report, which will be released on Friday; GDP data from Australia, Brazil, Canada and Turkey, as well as PMI surveys of manufacturing and services worldwide and monetary policy action by Reserve Bank of Australia

COT report

- COT ES: + 48.6k; Total = -31,287 (Previous week: -8.4k; Total = -79,861)

- COT NQ: -26.5k; Total = -5,388 (Previous week: -4,5k; Total = 21,115)

- EURO COT: -1.4k; Total = 138,365 (Previous week: -216; Total = 140,006)

- COT LIBRA: + 8.8k; Total = 30,978 (Previous week: + 1,05k; Total = 22,167)

- COT DXY: +436; Total = -13,851 (Previous week: -412; Total = -14,287)

- GOLD COT: -18.96k; Total = 215,733 (Previous week: -16.44k; Total = 234,696)

Profiles (Friday closing)

- ES: Simple distribution

- NQ: Long distribution in P pattern (with rejection at closing)

- EURO: Short distribution in P pattern

- LIBRA: Short distribution in L pattern

- GOLD: Double Short distribution in P pattern, with slight rejection at closing.

Weekend HEADLINES:

BIDEN $ 1.9TRI PANDEMIC STIMULUS DRAFT LAW APPROVED ON SATURDAY RUG IN THE CHAMBER. ATTENTION IS NOW TURNING TO THE SENATE.

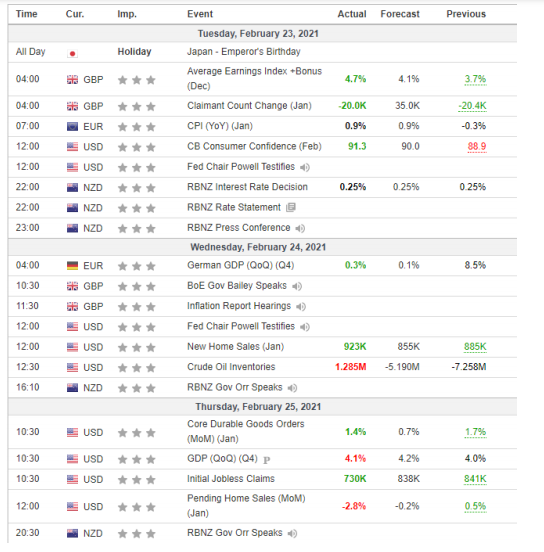

ECONOMIC CALENDAR (KEY EVENTS) – PREVIOUS WEEK

Highlights

- Powell: “We are still a long way from our goals. We will only squeeze the economy after we reach full employment and inflation stays above 2% ”

- Unemployment insurance: Decrease in the number of people seeking unemployment benefits through first time, decreased in the last week, pulled by California and Ohio.

- US durable goods orders up another month.

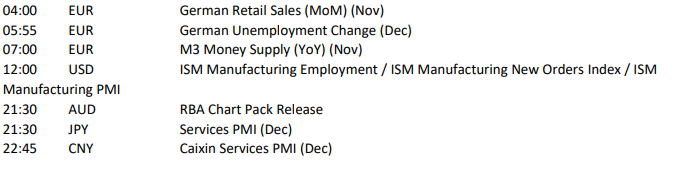

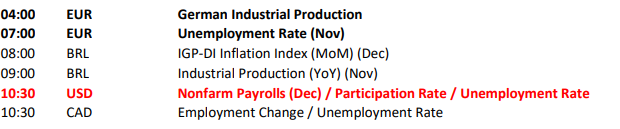

ECONOMIC CALENDAR (KEY EVENTS) – NEXT WEEK

BALANCE SHEET CALENDAR

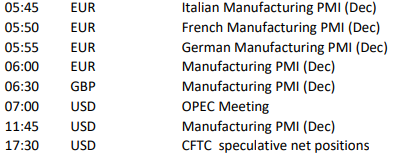

In the US, investor focus is on the February jobs report, which will provide a view on the state of the labor market recovery. The non-agricultural payroll should increase by 165 thousand, which would still leave the economy with about 10 million jobs lacking jobs since the peak of February 2020; while the unemployment rate is expected to remain unchanged at 6.3%, well above pre-pandemic levels of around 3.5%. Meanwhile, the ISM PMI surveys are expected to signal strong manufacturing and service growth rates during February, despite high levels of unemployment and lack of government support. Other publications notable are external trade balance; factory orders; construction spending; Change of ADP employment; Economic optimism of IBD / TIPP; and the final readings from the Markit PMIs and the labor productivity in the fourth quarter.

In other parts of America, the following key figures include Canada’s GDP growth in the quarter and current account, trade balance and PMI surveys from Markit and Richard Ivey School of Business; Mexican business morale, gross fixed investment and PMI Markit Manufacturing; and the GDP figures, industrial production, foreign trade and PMI Markit for the fourth quarter of Brazil.

Across the Atlantic, all eyes are on the UK Chancellor’s budget Rishi Sunak, who is likely to reveal additional support measures for businesses and families affected by the pandemic. In front of economic data, the main launches in Great Britain include final Markit PMI data, Halifax and Nationwide housing price indices, sales of new cars and monetary indicators from the Bank of England. The PMI flash survey signaled levels stable levels of UK private sector production, helped by a smaller decline in service sector activity and a resumption in the expansion of industrial production.

In Europe, next week will see the publication of the minutes of the ECB policy meeting, a second Eurozone GDP estimate for the fourth quarter and a first analysis of February PMIs for the region. Preliminary Eurostat estimates showed that the bloc’s economy has shrunk 0.7% in the period from October to December due to the containment measures of COVID-19; while the Markit PMI data should point to a more marked contraction in the service sector in the Germany and France, although the reading for the euro area is falling less, while a slowdown in the growth of manufacturing activity should be generalized. Other important data to The following include: Eurozone instant consumer confidence, trade balance, production industrial and construction; Investor morale in Germany and producer prices; Unemployment rate in France; Foreign trade data from Italy and Spain; Industrial production and trade balance of Switzerland; and consumer confidence and Turkey’s budget balance. Turkey’s central bank it will also decide on interest rates, but no change is expected.

Elsewhere in Europe, investors will keep an eye on the final Markit PMI surveys for the euro area, Germany and France, while Italy and Spain will publish their estimates preliminary. In addition, the main inflation, unemployment and retail trade reports will be launched for the eurozone and Germany, while several European countries will continue to update GDP growth figures for the fourth quarter, including Italy and Turkey. Other data to follow include: Euro Area producer prices; Factory orders in Germany; Trade balance and France’s current account; Consumer prices and retail sales in Switzerland; and inflation data from Holland, Turkey and Russia. Poland’s central bank will decide on interest rates.

In China, traders will turn their attention to the February PMI updates from NBS and Caixin, with forecasts pointing to steady growth in manufacturing activity, as the country continues to recover from the coronavirus crisis. In Japan, Jibun Bank will publish its PMIs finals for February. Other important data for Japan includes consumer confidence, the rate of unemployment and capital expenditures in the fourth quarter.

The Reserve Bank of Australia will hold its monetary policy meeting, but no change is expected. With regard to economic data, the main data to be observed include GDP of the fourth quarter, current account, Ai Group manufacturing, construction and services indexes, balance building permits and housing loans. Elsewhere, the quick estimate India for foreign trade and Markit PMIs will be highlighted.

Other highlights for the Asia-Pacific region include: final GDP reading for the fourth quarter of South Korea, inflation, industrial production, retail sales, trade balance and manufacturing PMI Markit; New Zealand building permits and foreign trade prices; Retail sale of Hong Kong; Inflation rates for Thailand, Indonesia and the Philippines.

14/02/2021 – ANÁLISE SEMANAL – WEEKLY OUTLOOK

02/14/2021 – The beginning of the week has holidays around the world. The banks centrals disclose their meeting

The Federal Reserve, the ECB and the RBA will release the minutes of policy meetings next week, while the central banks of Indonesia and Turkey come together to set interest rates. In front of dice economic, PMI flash surveys for the US, UK, Eurozone, Japan and Australia will give a insight into the state of the global economy. Other important launches to follow include retail sales in the United States and industrial production; Canadian and UK inflation and retail trade data; GDP data from Japan and the euro zone in the fourth quarter; and employment numbers in Australia. You Investors will also be monitoring any signs of progress on the US fiscal stimulus side.

COT report

- ES COT: -36.6k; Total = -71,503 (Previous week: -6,5k; Total = -34,862)

- COT NQ: -3.4k; Total = 25,662 (Previous week: -10.6k; Total = 29,069)

- COT NQ: -3.4k; Total = 25,662 (Previous week: -10.6k; Total = 29,069)

- COT LIBRA: + 11.5k; Total = 21,118 (Previous week: + 1,65k; Total = 9,616)

- COT DXY: +955; Total = -13,875 (Previous week: +111; Total = -14,830)

- GOLD COT: -5.7k; Total = 251.407 (Previous week: -420; Total = 257.126)

Profiles (Friday closing)

- ES: Long distribution in L pattern

- NQ: Long distribution in L pattern

- EURO: Long distribution in P pattern (Selling rejection in “V”)

- LIBRA: Long distribution in P pattern

- GOLD: Simple distribution, with neutral closure, above the POC.

Weekend HEADLINES:

TRUMP IMPEACHMENT IS BARRED IN THE SENATE (THERE WAS NO MAJORITY, THAT IN THIS WOULD NEED 2/3);

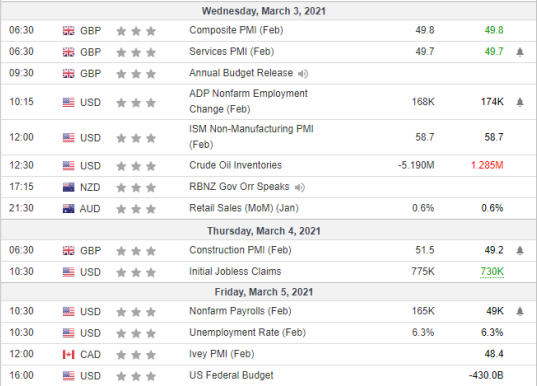

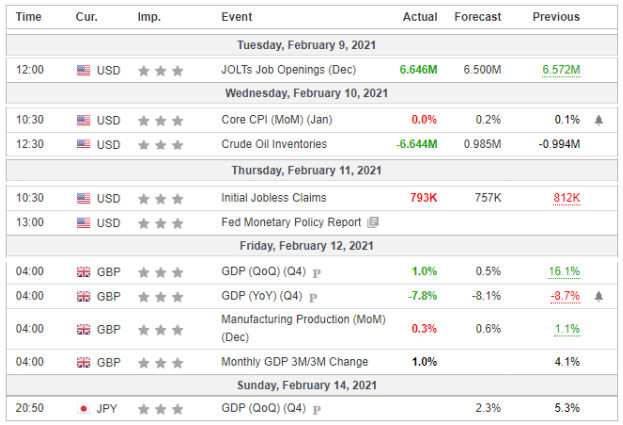

ECONOMIC CALENDAR (KEY EVENTS) – PREVIOUS WEEK

Highlights

- JOLTS: Jolts job vacancies were higher than expected, demonstrating that there are more open positions to be filled.

- US consumer inflation came in below expected on Wednesday, driven by inflation from under and rents, which continue to fall and have the greatest weight in the index. In the fourth, after the release of the data inflation, bonds pulled hard and 10-year yields dropped 2 basis points.

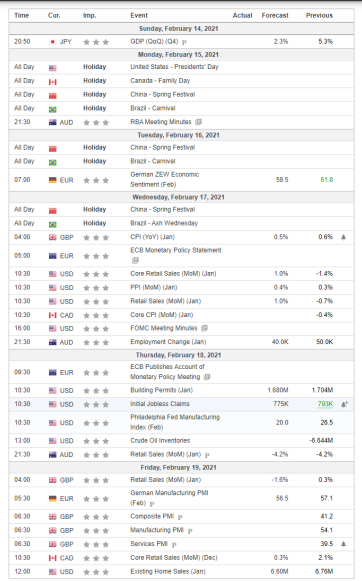

ECONOMIC CALENDAR (KEY EVENTS) – NEXT WEEK

BALANCE SHEET CALENDAR

Economic calendar: In the USA, investors will be waiting for the FOMC minutes, scheduled for Wednesday, for further clarification on the next steps in monetary policy. In your January meeting, the Federal Reserve left monetary policy unchanged and reiterated that it is committed to using its full range of tools to support the economy. Regarding the data economic figures, retail sales and industrial production figures for January point to an recovery in domestic trade and a modest growth in manufacturing activity. The Markit PMI survey February will likely show that the expansion of the manufacturing sector has slowed in relation to January record and the growth in service activity also lost strength, as the recovery from pandemic shock slows amid lack of fiscal support and high levels of unemployment. Other notable publications include building and home permits, home sales existing,

Elsewhere in America, important data to follow includes Canada’s inflation rate, trade retailer, housing data and ADP job change; Business morale in Brazil; and GDP of fourth quarter of Colombia.

Across the Atlantic, the UK’s economic calendar is full of updates important information about Markit PMIs, inflation data, retail sales, consumer confidence Gfk, net public sector debt and the CBI indicator for factory orders. Sector production Britain’s private sector is expected to remain in contraction territory in February for the second month consecutive, as the country was placed in a third national blockade at the beginning of the year.

In Europe, next week will see the publication of the minutes of the ECB policy meeting, a second Eurozone GDP estimate for the fourth quarter and a first analysis of February PMIs for the region. Preliminary Eurostat estimates showed that the bloc’s economy has shrunk 0.7% in the period from October to December due to the containment measures of COVID-19; while the Markit PMI data should point to a more marked contraction in the service sector in the Germany and France, although the reading for the euro area is falling less, while a slowdown in the growth of manufacturing activity should be generalized. Other important data to The following include: Eurozone instant consumer confidence, trade balance, production industrial and construction; Investor morale in Germany and producer prices; Unemployment rate in France; Foreign trade data from Italy and Spain; Industrial production and trade balance of Switzerland; and consumer confidence and Turkey’s budget balance. Turkey’s central bank it will also decide on interest rates, but no change is expected.

Meanwhile, it will be a busy week in Japan with the release of the preliminary GDP reading of the fourth quarter, trade balance, inflation rate, machine orders, Jibun Bank Markit PMIs and the final December reading of industrial production. The world’s third largest economy must grow 2.3 percent in the quarter in October-December, much slower than a 5.3 percent jump percent in the third quarter, as the recovery from the COVID-19 crisis slowed. In a base annualized, the economy probably grew 9.5%, after a 22.9% gain in the previous quarter.

The Reserve Bank of Australia will publish the minutes of its last monetary policy meeting. In front of economic data, major releases in Australia include job numbers, Markit PMIs, new HIA home sales, leading Westpac index and January retail sales reading.

Other important data for the Asia-Pacific region includes the fourth quarter’s GDP figures Thailand and Israel, Indonesia’s trade balance and interest rate decision, unemployment rate Hong Kong and final Indian trade numbers.

10/02/2021 – RELATÓRIO CONSUMER PRICE INDEX – CONSUMER PRICE INDEX REPOR – EUA

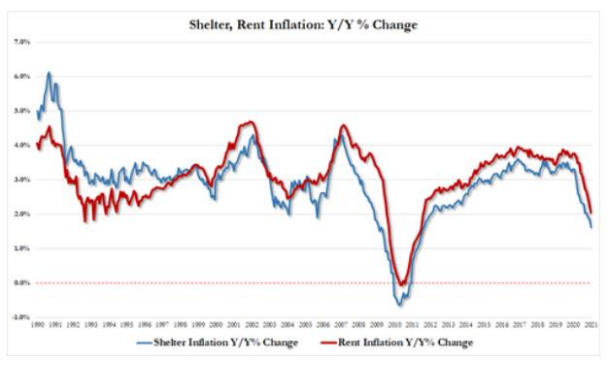

08/02/2021 – Dolar and Yields plummet after CPI release, rental inflation at least 10 years

Dolar and Yields plummet after CPI release, rental inflation at least 10 years

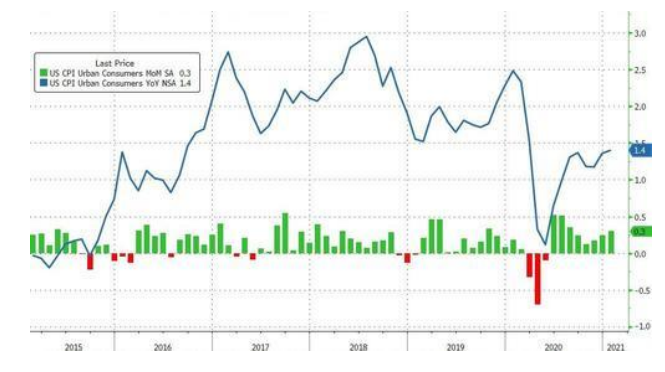

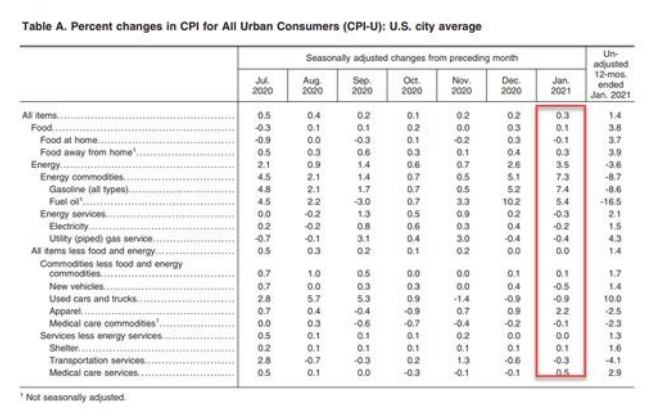

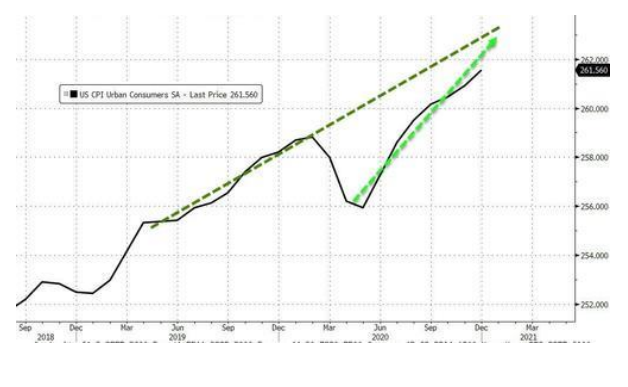

Consumer prices in the US rose for the 8th consecutive month, printing 0.3% MoM as expected, leaving prices year on year rising 1.4%

However, Core CPI (core inflation, which excludes food and energy) lost expectations, unchanged in January, compared to an expected increase 0.2% MoM.

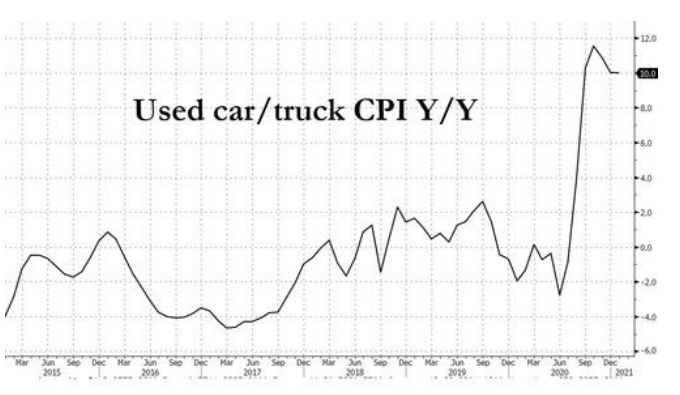

Prices for used cars and food at home fell month, as energy and clothing costs recorded the biggest increases

The acceleration in the price of used cars seems to have peaked

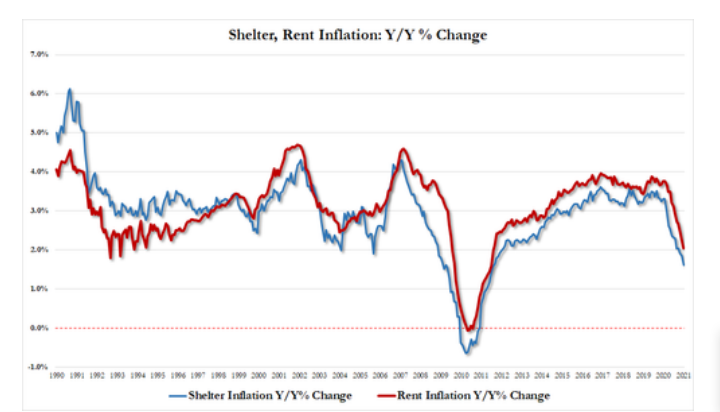

And on the bright side for many, shelter / rent inflation continues to slow (despite record prices?)

- Y / Y rental inflation fell from 1.84% in December to 1.62% in January, the lowest since August 2011

- Y / Y inflation for shelters fell from 2.28% in December to 2.05% in January, also the lowest since August 2011

So, the collapse of rents in NY is why the Fed will continue inflating the biggest asset bubble for years?

The reaction on the calls was instantaneous, with 10Y yields dropping 2 bps.

However, we note that inflation rates are one to two months away of a dramatic increase due to the underlying effects of pandemic blockades

08/02/2021 – ANÁLISE SEMANAL – WEEKLY OUTLOOK

08/02/2021 – Chinese lunar new year holiday begins week, UK reports GDP and week in the US and China.

As in the past week, investors will pay attention to the COVID-19 numbers and to the progress of the new US stimulus package. Lunar New Year Holiday Begins in China, now begins the year of the Metal Ox (year 4719), an extended holiday where population travels to the interior (and even other countries) to visit family members. Disclosures of important data include inflation in the USA and China; GDP figures for the fourth quarter to the United Kingdom; consumer sentiment to the US and Australia and production industrial and foreign trade to Germany. In addition, Mexico’s central banks and Russia will decide on interest rates.

COT report

- COT ES: -6.5k; Total = -34,862 (Previous week: -26.44k; Total = -28.375)

- COT NQ: -10.6k; Total = 29,069 (Previous week: + 8.1k; Total = 39,662)

- EURO COT: -28.3k; Total = 137,003 (Previous week: + 1.9k; Total = 165,344)

- COT LIBRA: + 1.65k; Total = 9,616 (Previous week: -5.74k; Total = 7,965)

- COT DXY: +111; Total = -14,830 (Previous week: -492; Total = -14,719)

- GOLD COT: -420; Total = 257,126 (Previous week: + 10.9k; Total = 257,546)

Profiles (Friday closing)

- ES: Simple Long Distribution

- NQ: Simple Long Distribution

- EURO: Long distribution in L pattern

- LIBRA: Long distribution in P pattern

- GOLD: Long distribution in P pattern

Weekend HEADLINES:

- BIDEN ABOUT CHINA: “I WILL NOT DO THIS THE WAY TRUMP DID”

- VERY LESS EFFECTIVE ASTRAZENECA VACCINE AGAINST THE NEW AFRICAN CEPA

- YELLEN SAYS I WOULD LIKE WORKERS WHO WIN $ 60,000 PER YEAR TO RECEIVE SUPPORT, DETAILS ARE STILL BEING WORKED

- WHITE HOUSE SAYS THAT EUROPEAN COMMERCIAL TARIFF POLICY IS UNDER REVIEW

- BIDEN ABSOLUTELY COMMITTED TO SAFETY REOPENING SCHOOLS

- BERNSTEIN SAYS PRICE OF $ 1.9 TRILLION IN THE BIDEN CORONAVIRUS PLAN IS NOT VERY LARGE

- MERKEL PLANS TO EXTEND THE BLOCKING OF GERMANY FOR TWO WEEKS

- BIDEN SAYS IT IS NOT CUTTING THE SIZE OF STIMULUS CHECKS

- BIDEN SAYS GOP IS NOT WILLING TO GO AS FAR AS HE THINKS IT IS NECESSARY

- BIDEN SAYS IT IS VERY CLEAR THAT OUR ECONOMY IS STILL IN TROUBLE

- PELOSI SAYS HE HOPES THAT CHAMBER CAN SEND STIMULUS PACKAGE TO CORONAVIRUS TO SENATE WITHIN TWO WEEKS

ECONOMIC CALENDAR (KEY EVENTS)

BALANCE SHEET CALENDAR

Economic calendar

In the United States, the January consumer price report likely to show the inflation rate rising further, to 1.5%, its highest level since March last year, but below the Federal Reserve’s target of around 2%. At the same time, preliminary reading of Michigan consumer sentiment for February is likely to show a slight improvement in morale, still remaining well below pre-pandemic levels in the midst of the crisis COVID-19 and the lack of fiscal support. Other important publications include job vacancies at JOLTs, IBD / TIPP Economic Optimism, the monthly government budget report and the final reading of wholesale stocks

The central banks of Mexico and Peru will decide on interest rates on Thursday. Dice Important factors to follow include producer prices in Canada and wholesale sales; Consumer morale Mexico, inflation rate and industrial production; and retail trade in Brazil and consumer prices.

The United Kingdom will publish its preliminary estimate of GDP growth for the fourth quarter, together with with business investment, trade balance, industrial and construction production. At market forecasts anticipate 0.5 percent growth from October to December, avoiding falling back into contraction territory, despite the restrictive measures imposed to contain the spread of COVID-19.

In Europe, Germany will release data on foreign trade, in addition to industrial activity, prices in the wholesale and final inflation reading. Preliminary data indicated that consumer prices in the Europe’s largest economy rose in January for the first time in seven months. Other data important to follow include: industrial production figures from France, Italy and Spain; the fee of Dutch inflation and industrial production; Swiss unemployment rate and consumer prices; GDP the fourth quarter of Norway and Poland; and industrial production in Turkey, retail trade and unemployment data. In addition, the central banks of Russia and Sweden will decide on the policy monetary policy.

In Asia, China will publish inflation data for January, with markets pointing to a new drop in consumer prices and a recovery in producer prices for the first time in a year. Elsewhere, Japan’s main figures include current account, producer prices and Eco Watchers Survey.

Meanwhile, investors in Australia will turn their attention to business confidence NAB and Westpac consumer confidence. On the other side of the Tasmanian Sea, New Zealand must publish Business NZ PMI and monthly food inflation

31/01/2021 – ANÁLISE SEMANAL – WEEKLY OUTLOOK

First week of February brings payroll on Friday, report from giants AMAZON and GOOGLE on Tuesday and PMI’s from manufacturing and services, in addition to the Eurozone Information on Wednesday.

Next week, the US employment report for January will provide an update on the labor market after seven consecutive months of earnings jobs were interrupted in December. ISM PMIs and the trade balance will also be highlighted and investors will also follow the progress of stimulus discussions in Washington. The profit season continues with quarterly results from Alphabet, Amazon, Exxon Mobil and Pfizer. Elsewhere, traders will look to the OPEC + meeting for more clues on the production of short-term oil and monetary policy decisions of the BoE, RBA and RBI, as well as GDP growth figures for the Euro Area.

COT report

- ES COT: -26.44k; Total = -28,375 (Previous week: + 15.67k; Total = -1940)

- COT NQ: + 8.1k; Total = 39,662 (Previous week: + 11.2k; Total = 31,611)

- EURO COT: + 1.9k; Total = 165,344 (Previous week: + 7.6k; Total = 163,466)

- COT LIBRA: -5.74k; Total = 7,965 (Previous week: +763; Total = 13,705)

- COT DXY: -492; Total = -14,719 (Previous week: -320; Total = -14,227)

- GOLD COT: + 10.9k; Total = 257,546 (Previous week: +411; Total = 246,638)

Profiles (Friday closing)

- ES: Short distribution in L pattern

- NQ: Short multiple distribution in P pattern

- EURO: Long distribution in standard P, with rejection.

- LIBRA: Simple distribution

- GOLD: Short multiple distribution in P pattern (“V” rejection)

Weekend HEADLINES:

- VON DER LEYEN, OF THE EUROPEAN UNION, SAYS WE WANT 70% OF VACCINATED ADULTS IN EUROPE UNTIL THE END OF SUMMER

- Melvin Capital Management ended January with a loss of 53%

- Ten Republican senators ask Biden to work with them on the coronavirus

- GOP senators propose more modest relief framework

- GOP proposal includes vaccine distribution funds and more direct checks targeted. No closed “total cost” yet, in the GOP proposal.

- The SEC said it is looking to identify possible misconduct in the recent episode of stock market, with GameStop, and will review brokers’ decisions to restrict purchase of certain shares

ECONOMIC CALENDAR

Sunday

- 10:45 PM CNY Caixin Manufacturing PMI (Jan)

Monday

- 05:55 EUR German Manufacturing PMI (Jan)

- 06:00 EUR Manufacturing PMI

- 06:30 GBP Manufacturing PMI

- 11:45 USD Manufacturing PMI

- 12:00 USD ISM Manufacturing Employment

- 12:00 USD ISM Manufacturing New Orders Index

- 12:00 USD ISM Manufacturing PMI

Tuesday

- 00:30 AUD RBA Interest Rate Decision

- 00:30 AUD RBA Rate Statement

- 18:45 NZD Employment Change (QoQ) (Q4)

- 08:00 BRL BCB Copom Meeting Minutes

- 12:00 USD CB Consumer Confidence (Jan)

- 21:30 AUD CPI (QoQ) (Q4)

Wednesday

- 05:00 EUR ECB Monetary Policy Statement

- 06:00 EUR Markit Composite PMI / Services PMI

- 06:30 GBP Composite PMI / Services PMI (Jan)

- 07:00 EUR CPI / PPI

- 10:15 USD ADP Nonfarm Employment Change

- 11:45 USD Markit Composite PMI (Jan)

- 11:45 USD Services PMI (Jan)

- 12:00 USD ISM Non-Manufacturing PMI

Thursday

- 09:00 GBP BoE Interest Rate Decision (Feb)

- 10:30 USD Initial Jobless Claims

- 12:00 USD Factory Orders (MoM) (Dec)

- 21:30 AUD RBA Monetary Policy Statement

- 21:30 AUD Retail Sales (MoM) (Dec)

Friday

- 10:30 USD Nonfarm Payrolls / Unemployment Rate / Averafe Hourly Earnings / Participation Rate

24/01/2021 – ANÁLISE SEMANAL – WEEKLY OUTLOOK

01/17/2021 – Demonstrations in Russia, New blocks, week balance sheet of Big Techs and interest decision and monetary policy of the EDF.

In the US, it will be a busy week of economic data, including new GDP growth figures, Fed monetary policy decision and gains with reports from Apple, Microsoft, Facebook and Tesla. Investors will continue to focus on the pandemic, especially new and more contagious strains, and will carefully monitor President Biden’s legislative agenda in a Congress divided. Elsewhere, the IMF must disclose its Outlook World Economic Statistics and growth figures for Germany, Mexico and Hong Kong will also be highlighted.

COT report

- COT ES: + 15.67k; Total = -1940 (Previous week: + 17.2k; Total = -17.611)

- COT NQ: + 11.2k; Total = 31,611 (Previous week: -5.4k; Total = 20,413)

- EURO COT: + 7.6k; Total = 163,466 (Previous week: + 12.9k; Total = 155,890)

- COT LIBRA: +763 ; Total= 13.705 (Semana anterior: +9,3k ; Total= 12.942)

- COT DXY: -320; Total = -14,227 (Previous week: + 1,04k; Total = -13,907)

- GOLD COT: +411; Total = 246,638 (Previous week: -33.1k; Total = 246,227)

Profiles (Friday closing)

- ES: Simple Distribution

- NA: Simple Distribution

- EURO: Simple Distribution

- LIBRA: Short distribution in L pattern (with rejection – closing above POC)

- GOLD: Short multiple distribution in L pattern, with minimum rejection.

Weekend HEADLINES:

- Demonstrations in Russia for Navalny’s freedom and Putin’s departure

- Biden will put a new travel ban on the majority of non-American citizens who were in European countries, South Africa and Brazil;

- France will possibly do a new lockdown;

- Health advisor in France says vaccines are less effective compared to the new variation of COVID that came from South Africa

- UK will require negative COVID-19 testing of all travelers arriving in the country (or £ 500 fine plus 10 days quarantine)

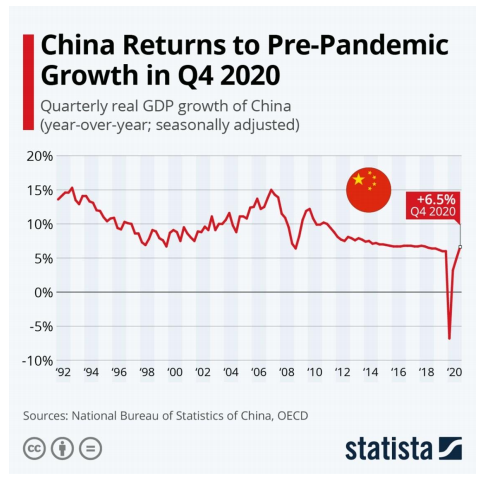

- China’s fourth quarter GDP shows recovery all pandemic decline returning to levels pre-covid. It was the only country that had GDP growth in 2020.

ECONOMIC CALENDAR

Monday

- 06:00 EUR German Ifo Business Climate Index (Jan)

- 13:15 EUR ECB President Lagarde Speaks

- 20:50 JPY Monetary Policy Meeting Minutes

Tuesday

- All Day Holiday Australia – Australia Day

- 04:00 GBP Average Earnings Index +Bonus (Nov)

- 08:00 BRL BCB Copom Meeting Minutes

- 12:00 USD CB Consumer Confidence (Jan)

- 21:30 AUD CPI (QoQ) (Q4)

Wednesday

- 10:30 USD Durable Goods Orders (MoM) (Dec)

- 12:30 USD Crude Oil Inventories

- 16:00 USD FOMC Statement / Fed Interest Rate Decision / FOMC Press Conference

Thursday

- 10:30 USD GDP (QoQ) (Q4)

- 10:30 USD Initial Jobless Claims

- 12:00 USD New Home Sales (Dec)

Friday

- 06:00 EUR German GDP (QoQ) (Q4)

- 06:00 EUR German Unemployment Change (Jan)

- 10:30 USD PCE Price index (YoY) (Dec)

- 10:30 USD Personal Spending (MoM) (Dec)

- 10:30 CAD GDP (MoM) (Nov)

- 12:00 USD Pending Home Sales (MoM) (Dec)

CALENDÁRIO DE BALANÇOS

The US Federal Reserve must keep the target for the federal funds rate stable at 0-0.25 percent at the end of its two-day meeting on Wednesday, with investors focusing on President Jerome Powell’s press conference looking for clues about the next steps in monetary policy. Last month, the central bank reiterated that was committed to using its full range of tools to support the economy of USA, as the uncertainty surrounding the economic outlook remained high.

With respect to economic data, the anticipated estimate of US GDP probably suggest that there has been a sharp slowdown in the economic recovery during the fourth quarter of the year, amid record COVID-19 infections, high levels unemployment and lack of government support. The world’s largest economy is growing at an annualized rate of 4 percent during the period from October to December, decreasing from a record expansion seen in the previous three-month period. Others Notable publications include: personal income and expenses; PCE price index; orders for durable goods; employment cost index in the fourth quarter; Confidence CB consumer; sales of new and pending homes; National Activity Index of

Fed de Chicago; Índice de Fabricação do Fed de Dallas; Preços das casas Case-Shiller; Chicago PMI; as estimativas antecipadas da balança comercial de mercadorias e dos estoques no atacado;

Investors will also be closely monitoring one of the most of the earnings season, with a focus on reporting large companies, including Apple, Microsoft, Facebook, Tesla, 3M, Johnson & Johnson, Caterpillar, American Express, Mastercard, Visa, AT&T, Verizon, McDonald’s, Starbucks, General Electric, Boeing and Chevron.

In other parts of America, important data to follow includes Canada’s monthly GDP, construction licenses and the final reading of producer prices; Fourth quarter GDP Mexico, trade balance, retail sales and economic activity; and unemployment rate and current account in Brazil.

It will be a smooth week on the UK economic calendar, with only the report employment, CBI distributive trades, Nationwide Housing prices and automobiles to be disclosed. ONS numbers should show the highest rate of unemployment in more than 4-1 / 2 years, while wage growth is accelerating to a 9-month high

Elsewhere in Europe, traders await the launch of eurozone businesses, while several countries, including Germany, France and Spain, publish quick readings of fourth quarter GDP. Europe’s largest economy must stagnate in the fourth quarter of 2020, after growing a record 8.5% in the third quarter, as the blocking rules were tightened up again at the end of the year. Other important data includes business in Germany and consumer morale, unemployment and instant consumer prices; Business and consumption research in Italy; Switzerland KOF Main indicators and trade balance; and business confidence and Turkey’s foreign trade.

In the Asia-Pacific region, investors will turn their attention to retail sales Japan, consumer confidence, unemployment rate, industrial production, construction Tokyo housing prices and inflation data. China’s industrial profits will also be highlighted; while in South Korea, the data to be observed includes the anticipated fourth quarter GDP estimate. Australia will publish the figures of the fourth quarter inflation, including consumer, producer and trade prices abroad, as well as business confidence in December. India’s final reading of GDP figures for 2019-20 will also be closely observed, as well as the public sector deficit and infrastructure production. Other highlights include the anticipated GDP estimates for the fourth quarter of Taiwan and Hong Kong.

17/01/2021 – ANÁLISE SEMANAL – WEEKLY OUTLOOK

01/17/2021 – Highlight of the week for Biden ownership and fees interest rates in several countries, such as China, Canada, Eurozone, Brazil and Japan. Worldwide service and manufacturing PMI’s also are delivered this week

The fourth quarter earnings season continues next week, with companies such as IBM, Netflix, Intel, United Health, P&G and others reporting their results. In others places, flash PMI surveys for the US, UK, Eurozone, Japan and Australia will be watched carefully, while euro area central banks, Japan, China, Malaysia, Indonesia, Canada, Brazil and Turkey will be deciding on the monetary policy. Other important data to be followed include: building and starting housing in the USA and selling existing homes; Inflation data UK and retail trade; Consumer confidence in the euro area; Dice China’s fourth quarter GDP; and Japan’s trade balance and inflation.

COT report

- COT ES: + 17.2k; Total = -17,611 (Previous week: -3.9k; Total = -34,805)

- COT NQ: -5.4k; Total = 20,413 (Previous week: + 5.99k; Total = 25,783)

- EURO COT: + 12.9k; Total = 155,890 (Previous week: -85; Total = 142,991)

- COT LIBRA: + 9.3k; Total = 12,942 (Previous week: -1.17k; Total = 3,665)

- GOLD COT: -33.1k; Total = 246,227 (Previous week: + 10.45k; Total = 279,318)

- COT DXY: + 1.04k; Total = -13,907 (Previous week: -395; Total = -14,952)

Profiles

- ES: Short distribution in P pattern

- NQ: Short distribution in P pattern

- EURO: Short distribution in L pattern

- LIBRA: Short distribution in L pattern

- GOLD: Short distribution in P pattern

ECONOMIC CALENDAR

Sunday

- 23:00 CNY GDP (QoQ) (Q4) / Industrial Production (YoY) (Dec) / Chinese Industrial Production YTD (YoY) (Dec) / Retail Sales (YoY) (Dec) / Chinese Retail Sales YTD (YoY) (Dec) 23:00 CNY NBS Press Conference

Monday

- All Day Holiday United States – Martin Luther King, Jr. Day

Tuesday

- 06:00 EUR Current Account (Nov)

- 06:00 EUR Current Account n.s.a. (Nov)

- 06:30 GBP Labor Productivity (Q3)

- 07:00 EUR German ZEW Current Conditions (Jan)

- 07:00 EUR German ZEW Economic Sentiment (Jan)

Wednesday

- 04:00 GBP CPI (YoY) (Dec) / German PPI (MoM) (Dec)

- 07:00 EUR CPI (YoY) (Dec)

- 10:30 CAD CPI (YoY) (Dec)

- 12:00 CAD BoC Monetary Policy Report / BoC Rate Statement / BoC Interest Rate Decision

- 12:30 USD Crude Oil Inventories

- Tentative USD U.S. President Biden Speaks

- Tentative CAD BOC Press Conference

- 20:50 JPY Trade Balance (Dec)

- 21:30 AUD Employment Change (Dec)

Thursday

- Tentative JPY BoJ Monetary Policy Statement / BoJ Outlook Report (YoY) / BoJ Press Conference / BoJ Interest Rate Decision

- 09:45 EUR Deposit Facility Rate (Jan) / ECB Interest Rate Decision (Jan)

- 10:30 USD Building Permits / Housing Starts / Initial Jobless Claims / Philadelphia Fed Manufacturing Index / ECB Press Conference

- 18:45 NZD CPI (QoQ) (Q4)

- 19:00 AUD Manufacturing PMI / Services PMI

- 21:30 AUD Retail Sales (MoM) / Manufacturing PMI (Jan)

- 9:30 PM JPY Services PMI (Jan)

Friday

- 04:00 GBP Retail Sales (MoM) (Dec)

- 05:15 EUR French Manufacturing PMI (Jan) / French Markit Composite PMI (Jan) / French Services PMI (Jan)

- 05:30 EUR PMI Composto Alemão (Jan) / PMI Manufatura Alemã (Jan) / Serviços Alemães PMI (Jan)

- 06:00 EUR PMI de manufatura (janeiro) / PMI Markit Composite (janeiro) / PMI de serviços (janeiro)

- 06:30 GBP PMI composto (janeiro) / PMI de manufatura (janeiro) / PMI de serviços (janeiro)

- 10:30 CAD Core Retail Sales (MoM) (novembro)

- 11:45 USD PMI de manufatura (janeiro) / PMI Markit Composite (janeiro) / PMI de serviços (janeiro)

- 12:00 USD Vendas de Casas Existentes (dezembro)

- 13:00 USD Estoques de petróleo bruto

US investors will turn their attention to the January Markit PMI survey, with suggesting that the expansion of the manufacturing sector slowed in relation to the high December of more than six years and the growth in service activity has gone away even greater than five and a half years in November, as the recovery from the shock pandemic eased amid records of COVID-19 infections. Other publications notable include building permits and start of new construction, home sales existing builders sentiment, Philadelphia Fed Manufacturing Index and flows general net capital.

On the corporate front, the fourth quarter earnings season continues, with reports to follow, including IBM, Netflix, Intel, Procter & Gamble, Bank of America, Goldman Sachs, Morgan Stanley and Schlumberger.

Elsewhere in America, central banks in Canada and Brazil are likely to will keep their interest rates at record low levels when they meet on Wednesday. Important data to be followed includes Canada’s inflation rate, trade retailer, new home prices, home start and ADP job numbers; as well as the unemployment rate in Mexico.

On the other side of the Atlantic, the UK’s economic calendar is full of important updates on inflation data, retail sales, consumer confidence consumer demand, CBI factory orders and business optimism, and net debt from Public sector. In addition, the Markit PMI flash survey is likely to show that the industry Britain’s private sector reentered contraction territory in January, when the country entered a third block.

In Europe, the ECB will issue its latest monetary policy decision, but none change is expected. In front of economic data, the Markit PMI flash survey of the zone of the euro should point to a sharper contraction in the production of the private sector bloc during January, as several bloc countries were forced to impose or extend restrictions due to record increases in coronavirus cases and hospitalizations. To At the same time, consumer morale in the Euro Area is expected to weaken further in January. Other major launches include eurozone construction production and current account; Investor morale in Germany and producer prices; Search of business in France; Spain’s foreign trade; Employment growth in Poland, industrial production and retail trade; and consumer morale in Turkey. In addition, central banks in Turkey and Ukraine will decide on monetary policy.

In Asia, all eyes are on China’s fourth quarter GDP, alongside December industrial production, retail sales, unemployment rate and investment in fixed assets. Markets expect 6.1% growth in the three months to December, faster than the 4.9% in the third quarter, as activity and demand continued to recover. In addition, the People’s Bank of China will provide an update on its new basic interest rate (LPR) on Wednesday, which will remained stable at 3.85% last month.

Meanwhile, the Bank of Japan is expected to maintain its interest rate at -0.1% and the target of Japanese 10-year government bond yields at around zero when performing a meeting on 20 and 21 January. The main economic data includes the survey flash PMI of Jibun Bank, the trade balance and the rate of inflation.

Investors in Australia will follow consumer confidence Westpac, numbers of employment, retail sales and Markit flash PMIs; while New Zealand is promoting the fourth quarter inflation rate, Business NZ PMI and NZIER business confidence. Other highlights for the Asia-Pacific region include: Unemployment rate and inflation in Hong Kong; Taiwan export orders and unemployment rate; Trade balance from Thailand; Domestic non-oil exports from Singapore; and prices Malaysian consumer. The central banks of Malaysia and Indonesia will also decide

03/01/2021 – ANÁLISE SEMANAL – WEEKLY OUTLOOK

03/01/2021 – First week of the year, week and minutes of the FOMC and Payroll, definition of the remaining 2 seats in the Senate and counting of district votes by Congress for Biden to take office.

All eyes are on the minutes of the Federal Reserve meeting this week, as well as for the US jobs report on Friday, which probably point to a slowdown in the recovery of the labor market. Others Important launches include ISM’s PMI surveys and balance commercial; UK monetary indicators; Eurozone retail sales, industrial production and inflation rate; China Caixin PMI surveys; Trust of consumer in Japan; Singapore first quarter GDP data; and PMI surveys of manufacturing and services worldwide

COT report (update tomorrow 17:30)

- COT ES

- COT NQ

- EURO COT

- GOLD COT

- COT DXY

ECONOMIC CALENDAR

Sunday

Mayor election (USA)

22:45 CNY Caixin Manufacturing PMI (Dec)

Monday

Tuesday

Second round elections for Senate (Georgia) – 2 seats remaining

Wednesday

US Congress counts polling station votes

Thursday

Friday

In the US, investors will be waiting for the FOMC minutes, scheduled for Wednesday, for further clarification on the next steps in monetary policy. The Federal Reserve maintained the target for the federal funds rate at 0-0.25 percent during its December meeting, and signaled that there would be no change in interest rates even at least 2023.

The investor’s focus also turns to the December jobs report, which likely to show an increase in payroll of just 100,000, the lowest job gain since the labor market recovery started in May, from a record loss of 20.787 million in April. The unemployment rate is rising to 6.8%, well above pre-pandemic levels of around 3.5%. Meanwhile, the ISM PMI surveys are expected to signal a slowdown in the growth rates of manufacturing and services during December. Other notable publications are the balance of foreign trade, construction costs, factory orders, ADP job change and the final readings of Markit PMIs and wholesale stocks.

Other important data to note in America include job numbers in Canada, trade balance and PMI surveys from Markit and Ivey Business School; Brazilian trade balance, industrial production and Markit PMIs; and morale of consumer and business in Mexico, Markit manufacturing inflation and PMI data. O Central Bank of Mexico is also expected to publish its minutes of monetary policy meetings.

Across the Atlantic, final readings from Markit PMIs should confirm expansion Britain’s private sector output, driven by another increase manufacturing production, while the activity of the services sector has stagnated in the end of 2020. House prices in Halifax, along with the monetary figures from the Bank of England Indicators and Markit Construction PMI are also expected.

Elsewhere, the eurozone, Germany and France will publish their estimates end of Markit PMIs, while many other countries, such as Spain and Italy, will disclose instant readings. In addition, labor market data will be published for the Euro Area, Germany, Italy, Spain and Switzerland. Other important economic data include: Eurozone business research, consumer and producer prices and retail sales; Germany foreign trade, retail, industrial activity and orders for factory and inflation rate; Business and consumer morale Spain; and numbers of inflation in France, Italy, Switzerland and Turkey.

In China, Caixin will publish its manufacturing and services PMI surveys, with forecasts pointing to solid growth in manufacturing activity in December. In Japan, Important launches include consumer sentiment, household spending, a preliminary estimate of the coincident index and the final readings of Jibun Bank PMIs.

01/01/2021 – ANÁLISE SEMANAL – WEEKLY OUTLOOK

01/10/2021 – Week of Inflation Indices of several countries (including USA and Brazil) and ECB monetary policy report.

The coronavirus situation worldwide will continue to dominate the headlines, as that the number of infections continues to increase at a record pace and several countries are returning to the locks. This week the ECB will publish the minutes of its policy meetings monetary; while other important publications include US inflation data, retail sales and industrial production; UK monthly GDP; Inflation data and China’s foreign trade; Germany 2020 annual GDP data; Production data industrial and inflation in India; and Japan’s current account and machine orders.

COT report (update tomorrow 17:30)

- COT ES: -3.9k; Total = -34,805 (Previous week: -6,3k; Total = -30,832)

- COT NQ: + 5.99k; Total = 25,783 (Previous week: -11.4k; Total = 19,976)

- EURO COT: -85; Total 142,991 (Previous week: 0.826k; Total = 143.076)

- COT LIBRA: -1.17k; Total = 3,665 (Previous week: -1.2k; Total = 4,832)

- GOLD COT: + 10.45k; Total = 279,318 (Previous week: -9.3k; Total = 268,872)

- COT DXY: -395; Total = -14,952 (Previous week: 318; Total = -14,557)

ECONOMIC CALENDAR

Sunday

22:30 CNY CPI / PPI

Monday

Holiday Japan

20:50 JPY Bank Lending (YoY) (Dec) / Current Account n.s.a. (Nov)

Tuesday

- 09:00 USD EIA Short-Term Energy Outlook

- 10:55 USD Redbook (MoM)

- 12:00 USD JOLTs Job Openings (Nov)

- 12:30 BRL CPI (MoM) (Dec) Last: 0.78% Exp: 0.89%

Wednesday

- 07:00 EUR Industrial Production (YoY) (Nov)

- 10:30 USD CPI / Core CPI (MoM) (Dec)

- 12:30 USD Crude Oil Inventories (and derivatives)

- 16:00 USD Beige Book / Federal Budget Balance (Dec)

- 20:50 JPY PPI (MoM) (Dec)

Thursday

- 04:00 EUR German GDP (QoQ)

- Tentative CNY M2 Money Stock (YoY) 10.7%

- Tentative CNY New Loans 1,430.0B

- 09:30 EUR ECB Monetary Policy Statement

- 10:30 USD Export Price Index (MoM) (Dec) / Import Price Index (MoM) (Dec) / Initial Jobless Claims

- 14:30 USD Fed Chair Powell Speaks

Friday

- 04:00 GBP GDP (MoM)

- 04:00 GBP Produção Industrial (MoM) (Nov)

- 04:00 GBP Manufacturing production (MoM) (November)

- 04:00 GBP Monthly GDP 3M / 3M Change

- 04:00 GBP Trade Balance (Nov)

- 10:30 USD PPI / Core PPI (MoM) (Dec)

- 10:30 USD Retail Sales / Core Retail Sales (MoM) (Dec)

- 12:00 USD Michigan Inflation Expectations (Jan)

- 17:30 GBP CFTC speculative net positions

It’s a relatively busy week ahead of us in the US when it comes to data economical. The December consumer price report will likely show the inflation rate rising to 1.3%, still remaining well below the Federal target Reserve. At the same time, the preliminary estimate of the consumer’s feeling of Michigan for January is likely to show a slight deterioration in morale amid explosion of COVID-19 case records and hospitalizations and current restrictive measures all over the country. Elsewhere, the figures for retail sales and industrial production in December point to a drop in domestic trade and a modest growth in manufacturing activity. Other publications to be observed are producer prices (PPI) and trade balance, business stocks, job vacancies at JOLTs, IBD / TIPP Economic Optimism, NY Empire State Manufacturing Index and the monthly budget of government.

In other parts of America, the following important data includes industrial production Mexico and gross fixed investment; Brazil’s inflation rate, retail trade and morale business; Inflation rate in Argentina; and Peruvian monthly GDP and unemployment rate.

On the other side of the Atlantic, the United Kingdom will publish monthly GDP data, alongside industrial production, construction and foreign trade. ONS numbers are likely to show that Britain’s economy contracted 4% in November, when England returned to the blockade.

Elsewhere, investors will be waiting for the accounts of the policy meeting monetary policy of the ECB. In December, policymakers expanded the program emergency pandemic purchase from the central bank by another € 500 billion and the extended to last until at least the end of March 2022. In the meantime, main data to follow include industrial production and the trade balance of the euro; Germany GDP data for the whole year in 2020 and wholesale prices; Production industrial in Spain; Retail sales and industrial production in Italy; inflation rates Holland, Sweden and Ireland; and current account of Turkey, industrial production and unemployment. The central banks of Poland and Serbia will decide on interest rates.

In Asia, China will publish inflation data for December, with markets pointing for a recovery in consumer prices from the first drop in 11 years in the previous month, while producer deflation is likely to decrease. In addition, trade figures will provide a vision of the post-pandemic economic recovery, with exports and imports growing sharply in December. The indicators country monetary policy and the housing price index will also be highlighted.

Elsewhere, Japan is releasing data on machinery orders, current account, producer prices and Eco Watchers Survey Outlook. In Australia, investors will return your attention to real estate loans and the final readings of retail sales and building permits.

Other highlights include: consumer and wholesale prices in India and production industrial; Unemployment rate in South Korea; Indonesia’s trade balance and morale consumer; and New Zealand building consent and food inflation. O Bank of Korea to keep interest rates at record low levels when it meets on Friday.